FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:1:14

k

t

aces

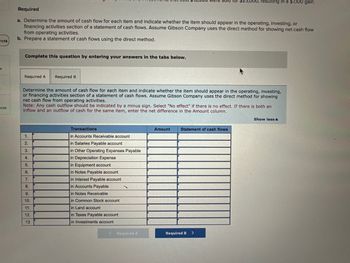

Required

a. Determine the amount of cash flow for each item and indicate whether the item should appear in the operating, investing, or

financing activities section of a statement of cash flows. Assume Gibson Company uses the direct method for showing net cash flow

from operating activities.

b. Prepare a statement of cash flows using the direct method.

Complete this question by entering your answers in the tabs below.

Required A Required B

Determine the amount of cash flow for each item and indicate whether the item should appear in the operating, investing,

or financing activities section of a statement of cash flows. Assume Gibson Company uses the direct method for showing

net cash flow from operating activities.

Note: Any cash outflow should be indicated by a minus sign. Select "No effect" if there is no effect. If there is both an

inflow and an outflow of cash for the same item, enter the net difference in the Amount column.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13

Transactions

in Accounts Receivable account

in Salaries Payable account

in Other Operating Expenses Payable

in Depreciation Expense

in Equipment account

in Notes Payable account

in Interest Payable account

in Accounts Payable

in Notes Receivable

in Common Stock account

in Land account

in Taxes Payable account

in Investments account

.

< Required A

000, resulting in a $7,100 gain.

Amount

Statement of cash flows

Required B >

Show less A

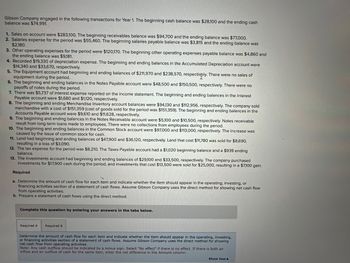

Transcribed Image Text:Gibson Company engaged in the following transactions for Year 1. The beginning cash balance was $28,100 and the ending cash

balance was $74,991.

1. Sales on account were $283,100. The beginning receivables balance was $94,700 and the ending balance was $77,000.

2. Salaries expense for the period was $55,460. The beginning salaries payable balance was $3,815 and the ending balance was

$2,180.

3. Other operating expenses for the period were $120,170. The beginning other operating expenses payable balance was $4,860 and

the ending balance was $9,181.

4. Recorded $19,330 of depreciation expense. The beginning and ending balances in the Accumulated Depreciation account were

$14,340 and $33,670, respectively.

5. The Equipment account had beginning and ending balances of $211,970 and $238,570, respectively. There were no sales of

equipment during the period.

6. The beginning and ending balances in the Notes Payable account were $48,500 and $150,500, respectively. There were no

payoffs of notes during the period.

7. There was $5,737 of interest expense reported on the income statement. The beginning and ending balances in the Interest

Payable account were $1,680 and $1,120, respectively.

8. The beginning and ending Merchandise Inventory account balances were $94,130 and $112,956, respectively. The company sold

merchandise with a cost of $151,359 (cost of goods sold for the period was $151,359). The beginning and ending balances in the

Accounts Payable account were $9,610 and $11,628, respectively.

9. The beginning and ending balances in the Notes Receivable account were $5,100 and $10,500, respectively. Notes receivable

result from long-term loans made to employees. There were no collections from employees during the period.

10. The beginning and ending balances in the Common Stock account were $97,000 and $113,000, respectively. The increase was

caused by the issue of common stock for cash.

11. Land had beginning and ending balances of $47,900 and $36,120, respectively. Land that cost $11,780 was sold for $8,690,

resulting in a loss of $3,090.

12. The tax expense for the period was $8,210. The Taxes Payable account had a $1,020 beginning balance and a $939 ending

balance.

13. The Investments account had beginning and ending balances of $29,100 and $33,500, respectively. The company purchased

investments for $17,900 cash during the period, and investments that cost $13,500 were sold for $25,000, resulting in a $7,100 gain.

Required

a. Determine the amount of cash flow for each item and indicate whether the item should appear in the operating, investing, or

financing activities section of a statement of cash flows. Assume Gibson Company uses the direct method for showing net cash flow

from operating activities.

b. Prepare a statement of cash flows using the direct method.

Complete this question by entering your answers in the tabs below.

Required A

Required B

Determine the amount of cash flow for each item and indicate whether the item should appear in the operating, investing,

or financing activities section of a statement of cash flows. Assume Gibson Company uses the direct method for showing

net cash flow from operating activities.

Note: Any cash outflow should be indicated by a minus sign. Select "No effect" if there is no effect. If there is both an

inflow and an outflow of cash for the same item, enter the net difference in the Amount column.

Show less A

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following sections from the statement of cash flows includes activities that affect current assets and current liabilities on the balance sheet? a. Investing b. None-cash investing and financing. c. Operating d. Financingarrow_forwardOn a statement of cash flows , the net amount of cash provided by (or used for ) items that normally appear on the income statement are : Financing activities Investing activities Operating activitiesarrow_forwardWhich of the following describes the operating activities as shown in the statement of cash flows? a. Includes increases and decreases in long-term assets b. Includes transactions that primarily impact current assets and current liabilities c. Shows the beginning and ending balance of cash d. Includes transactions affecting the capitalization of the businessarrow_forward

- what are the two methods to prepare cash flow statement? Discuss in detail how cash from operating activities is determined in both the methods. Describe the entire processarrow_forwardDetermine cash flows from operating activities by the direct method.arrow_forwardWhen using the indirect method of determining net cash flows from operating activities, how are revenues and expenses reported on the statement of cash flows if their cash effects are identical to the amounts reported in the income statement?arrow_forward

- A measure that helps estimate the amount and timing of cash flows from operating activities is the cash flow on total assets ratio. True or False True Falsearrow_forwardUse ulate the cash flow from operating activities using the indirect method. AA. Statement of Cash Flows (Indirect Method) Use the following information regarding the Surpa Corporation to (a) prepare a statement of cash flows using the indirect method and (b) compute Surpa's operating-cash-flow -to-current-liabilities ratio. Accounts payable increase. . Accounts receivable increase. . . Accrued liabilities decrease . .. Amortization expense. . Cash balance, January 1.. . Cash balance, December 31.. Cash paid as dividends ... Cash paid to purchase land . .. Cash paid to retire bonds payable at par. . Cash received from issuance of common stock... Cash received from sale of equipment . .. Depreciation expense. .. Gain on sale of equipment . . .. Inventory decrease. . . Net income. . .. am . . . $ 13,000 .. 4,000 6,000 7,000 21,000 17,000 31,000 90,000 60,000 40,000 17,000 29,000 7,000 13,000 78,000 3,000 140,000 Prepaid expenses increase ... Average current liabilities. .. A. Cash Flow…arrow_forwardThe statement of cash flows classifies all cash inflows and outflows into one of the three categories shown below and lettered from a through c. In addition, certain transactions that do not involve cash are reported in the statement as noncash investing and financing activities, labeled d. a. Operating activities b. Investing activities c. Financing activities d. Noncash investing and financing activities Required: For each of the following transactions, use the letters above to indicate the appropriate classification category. 1. _____ Purchase of equipment for cash. 2. _____ Payment of employee salaries. 3. _____ Collection of cash from customers. 4. _____ Cash proceeds from a note payable. 5. _____ Purchase of common stock of another corporation for cash 6. _____ Issuance of common stock for cash. 7. _____ Sale of equipment for cash. 8. _____ Payment of interest on note payable. 9. _____ Issuance of bonds payable in exchange for land and building. 10. _____ Payment of cash…arrow_forward

- Please explain how to prepare a statement of cash flows (indirect method) including analyzing tables? Please provide an example. Thank you,arrow_forwardAssuming a statement of cash flows is prepared using the indirect method, indicate the reporting of the transactions and events listed below by major categories on the statement. Use the following code letters to indicate the appropriate category under which the item would appear on the statement of cash flows. Code Cash Flows From Operating Activities Add to Net Income A Deduct from Net Income D Cash Flows From Investing Activities IA Cash Flows From Financing Activities FA Category 1. Common stock is issued for cash at an amount above par value ______ 2. Inventory increased during the period ______ 3. Depreciation expense recorded for the period ______ 4. Building was purchased for cash ______ 5. Bonds payable were acquired and retired at their carrying value ______ 6. Accounts payable decreased during the period ______ 7. Prepaid expenses decreased during the period ______ 8. Treasury stock was acquired for cash ______ 9. Land is sold for cash at an amount equal to book value ______…arrow_forwardSelect the item that matches with the description. Descriptions a. Begins with net income and then lists adjustments to net income in order to arrive at operating cash flows. b. Item included in net income, but excluded from net operating cash flows. c. Net cash flows from operating activities divided by average total assets. d. Cash transactions involving lenders and investors. e. Cash transactions involving net income. f. Cash transactions for the purchase and sale of long-term assets. g. Purchase of long-term assets by issuing stock to seller. h. Shows the cash inflows and outflows from operations such as cash received from customers and cash paid for inventory, salaries, rent, interest, and taxes. Termsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education