EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

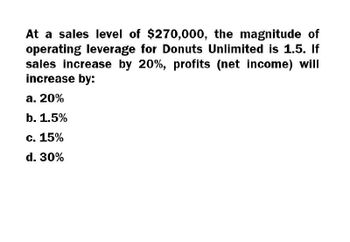

At a sales level of $270,000, the magnitude of operating leverage for Donuts unlimited is 1.5.

Transcribed Image Text:At a sales level of $270,000, the magnitude of

operating leverage for Donuts Unlimited is 1.5. If

sales increase by 20%, profits (net income) will

increase by:

a. 20%

b. 1.5%

c. 15%

d. 30%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- O e. operating income will decrease. XYZ Co. has a contribution margin of $450,000 and profit of $150,000. If sales increase 5%, by how much will profits increase? O a. 15% O b. 90% 30% O d. 60% O e. None of the given answer is correct. NEXT PAGE AGE Poarrow_forwardWhat is the opereting leverage? General accountingarrow_forwardNeed answer the financial accounting questionarrow_forward

- If Sales are $2,000,000 and the Break Even point is $1,500,000. What is the Margin of Safety (ratio)? A. 33% B. 175% C. 25% D. 75%arrow_forwardWhat is the opereting leverage? Accountingarrow_forwardJacob Arrell Corporation has sales revenue of $9,500,000. The company's fixed costs total $5.000.000, its variable costs are 15 percent of sales, and its interest expense is $1,000,000. If the company wants to increase its EPS by 30%, how much will it need to increase its Sales? a. 20.24 percent b. 7.71 percent c. 11.42 percent d. 48.19 percent e. 16.75 percent FOTarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College