Financial And Managerial Accounting

15th Edition

ISBN: 9781337902663

Author: WARREN, Carl S.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Entries for selected corporate transactions

Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Nav-Go Enterprises' stockholders' equity accounts, with balances on January 1, 20Y1, are as follows:

Common Stock, $10 stated value (750,000 shares authorized, 500,000 shares issued)

Paid-In Capital in Excess of Stated Value-Common Stock

Retained Earnings

Treasury Stock (50,000 shares, at cost)

The following selected transactions occurred during the year:

$5,000,000

950,000

11,350,000

750,000

Jan. 15. Paid cash dividends of $0.15 per share on the common stock. The dividend had been properly recorded when declared on December 1

of the preceding fiscal year for $67,500.

Mar. 15. Sold all of the treasury stock for $18 per share.

Apr. 13. Issued 95,000 shares of common stock for $18 per share.

June 14. Declared a 4% stock dividend on common stock, to be capitalized at the market price of the stock, which is $20 per share.

July 16. Issued stock for the stock dividend declared on June 14.

Oct. 30. Purchased 31,000 shares of treasury stock for $20 per share.

Dec. 30. Declared a $0.18-per-share dividend on common stock.

31. Closed the two dividends accounts to Retained Earnings.

Required:

1. The January 1 balances in T accounts for the stockholders' equity accounts have been listed below. T accounts for the following accounts have also been created: Paid-In Capital from Sale of Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash

Dividends. If required, round to one decimal place.

Check My Work

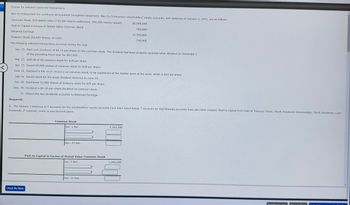

Common Stock

Jan. 1 Bal.

Dec. 31 Bal.

Paid-In Capital in Excess of Stated Value-Common Stock

Jan. 1 Bal.

Dec. 31 Bal.

3,100,000

1,240,000

Email Instructor

Save and Buit

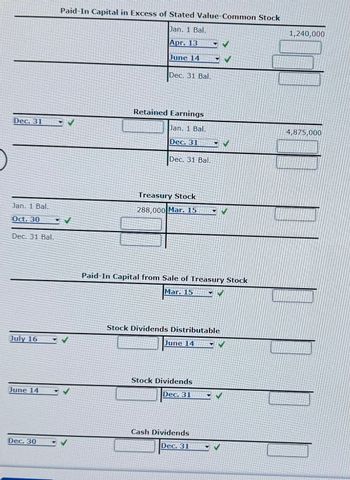

Transcribed Image Text:Dec. 31

Paid-In Capital in Excess of Stated Value-Common Stock

Jan. 1 Bal.

Apr. 13

June 14

Dec. 31 Bal.

Retained Earnings

1,240,000

Jan. 1 Bal.

4,875,000

Dec. 31

Dec. 31 Bal.

Treasury Stock

Jan. 1 Bal.

288,000 Mar. 15

Oct. 30

Dec. 31 Bal.

July 16

June 14

Paid-In Capital from Sale of Treasury Stock

Mar. 15

Stock Dividends Distributable

June 14

Stock Dividends

Dec. 31

Dec. 30

Cash Dividends

Dec. 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following selected accounts appear in the ledger of EJ Construction Inc. at the beginning of the current fiscal year: During the year, the corporation completed a number of transactions affecting the stockholders equity. They are summarized as follows: a. Issued 500,000 shares of common stock at 8, receiving cash. b. Issued 10,000 shares of preferred 1% stock at 60. c. Purchased 50,000 shares of treasury common for 7 per share. d. Sold 20,000 shares of treasury common for 9 per share. e. Sold 5,000 shares of treasury common for 6 per share. f. Declared cash dividends of 0.50 per share on preferred stock and 0.08 per share on common stock. g. Paid the cash dividends. Instructions Journalize the entries to record the transactions. Identify each entry by letter.arrow_forwardEntries for selected corporate transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. The stockholders equity accounts of Nav-Go Enterprises Inc., with balances on January 1, 20Y3, are as follows: The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of 0.06 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for 34,320. Mar. 15. Sold all of the treasury stock for 6.75 per share. Apr. 13. Issued 200,000 shares of common stock for 8 per share. June 14. Declared a 3% stock dividend on common stock, to be capitalized at the market price of the stock, which is 7.50 per share. July 16. Issued the certificates for the dividend declared on June 14. Oct. 30. Purchased 50,000 shares of treasury stock for 6 per share. Dec. 30. Declared a 0.08-per-share dividend on common stock. 31. Closed the two dividends accounts to Retained Earnings. Instructions 1. Enter the January 1 balances in T accounts for the stockholders equity accounts listed. Also prepare T accounts for the following: Paid-In Capital from Sale of Treasury Stock; Stock Dividends Distributable; Stock Dividends; Cash Dividends. 2. Journalize the entries to record the transactions and post to the eight selected accounts. 3. Prepare a retained earnings statement for the year ended December 31, 20Y3. 4. Prepare the Stockholders Equity section of the December 31, 20Y3, balance sheet Using Method 1 of Exhibit 8.arrow_forwardEntries for Selected Corporate Transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Nav-Go Enterprises' stockholders' equity accounts, with balances on January 1, 20Y1, are as follows: Common Stock, $10 stated value (350,000 shares authorized, 240,000 shares issued) Paid-In Capital in Excess of Stated Value-Common Stock Retained Earnings Treasury Stock (24,000 shares, at cost) The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.15 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $32,400. Mar. 15. Sold all of the treasury stock for $17 per share. Apr. 13. Issued 45,000 shares of common stock for $720,000. June 14. Declared a 4% stock dividend on common stock, to be capitalized at the market price of the stock, which is $18 per share. July 16. Issued shares of stock for the stock dividend declared on June 14. Oct. 30. Purchased 15,000…arrow_forward

- Entries for Selected Corporate Transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Navo-Go Enterprises' stockholders' equity accounts, with balances on January 1, 20Y1, are as follows: Common Stock, $5 stated value (900,000 shares authorized, 620,000 shares issued) $3,100,000 Paid-In Capital in Excess of Stated Value—Common Stock 1,240,000 Retained Earnings 4,875,000 Treasury Stock (48,000 shares, at cost) 288,000 The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.06 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $34,320. Mar. 15. Sold all of the treasury stock for $6.75 per share. Apr. 13. Issued 200,000 shares of common stock for $8 per share. June 14. Declared a 3% stock dividend on common stock, to be capitalized at the market price of the stock, which is $7.50 per share. July 16. Issued stock for…arrow_forwardEntries for Selected Corporate Transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Nav-Go Enterprises' stockholders’ equity accounts, with balances on January 1, 20Y1, are as follows: Common Stock, $10 stated value (550,000 shares authorized, 380,000 shares issued) $3,800,000 Paid-In Capital in Excess of Stated Value-Common Stock 700,000 Retained Earnings 8,630,000 Treasury Stock (38,000 shares, at cost) 570,000 The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.15 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $51,300. Mar. 15. Sold all of the treasury stock for $18 per share. Apr. 13. Issued 70,000 shares of common stock for $1,260,000. June 14. Declared a 4% stock dividend on common stock, to be capitalized at the market price of the stock, which is $20 per share. July 16. Issued shares of stock for the…arrow_forwardEntries for Selected Corporate Transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Nav-Go Enterprises' stockholders’ equity accounts, with balances on January 1, 20Y1, are as follows: Common Stock, $10 stated value (550,000 shares authorized, 380,000 shares issued) $3,800,000 Paid-In Capital in Excess of Stated Value-Common Stock 700,000 Retained Earnings 8,630,000 Treasury Stock (38,000 shares, at cost) 532,000 The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.13 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $44,460. Mar. 15. Sold all of the treasury stock for $17 per share. Apr. 13. Issued 70,000 shares of common stock for $1,120,000. June 14. Declared a 4% stock dividend on common stock, to be capitalized at the market price of the stock, which is $18 per share. July 16. Issued shares of stock for the…arrow_forward

- Entries for Selected Corporate Transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. The stockholders' equity accounts of Nav-Go Enterprises Inc., with balances on January 1, 20Y3, are as follows: Common Stock, $5 stated value (900,000 shares authorized, 620,000 shares issued) $3,100,000 Paid-In Capital in Excess of Stated Value—Common Stock 1,240,000 Retained Earnings 4,875,000 Treasury Stock (48,000 shares, at a cost of $6 per share) 288,000 The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.06 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $34,320. Mar. 15. Sold all of the treasury stock for $6.75 per share. Apr. 13. Issued 200,000 shares of common stock for $8 per share. June 14. Declared a 3% stock dividend on common stock, to be capitalized at the market price of the stock, which is $7.50 per share.…arrow_forwardEntries for Selected Corporate Transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Nav-Go Enterprises' stockholders’ equity accounts, with balances on January 1, 20Y1, are as follows: Common Stock, $10 stated value (400,000 shares authorized, 280,000 shares issued) $2,800,000 Paid-In Capital in Excess of Stated Value-Common Stock 550,000 Retained Earnings 6,360,000 Treasury Stock (28,000 shares, at cost) 392,000 The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.14 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $35,280. Mar. 15. Sold all of the treasury stock for $17 per share. Apr. 13. Issued 55,000 shares of common stock for $880,000. June 14. Declared a 5% stock dividend on common stock, to be capitalized at the market price of the stock, which is $18 per share. July 16. Issued shares of stock for the…arrow_forwardEntries for Selected Corporate Transactions Nav-Go Enterprises Inc. produces aeronautical navigation equipment. Nav-Go Enterprises' stockholders’ equity accounts, with balances on January 1, 20Y1, are as follows: Common Stock, $10 stated value (350,000 shares authorized, 240,000 shares issued) $2,400,000 Paid-In Capital in Excess of Stated Value-Common Stock 450,000 Retained Earnings 5,450,000 Treasury Stock (24,000 shares, at cost) 336,000 The following selected transactions occurred during the year: Jan. 15. Paid cash dividends of $0.15 per share on the common stock. The dividend had been properly recorded when declared on December 1 of the preceding fiscal year for $32,400. Mar. 15. Sold all of the treasury stock for $17 per share. Apr. 13. Issued 45,000 shares of common stock for $720,000. June 14. Declared a 4% stock dividend on common stock, to be capitalized at the market price of the stock, which is $18 per share. July 16. Issued shares of stock for the…arrow_forward

- Subject: accountingarrow_forwardTotal stockholders' equity. $11,262.432Entries for selected corporate transactionsNav-Go Enterprises Inc. produces aeronautical navigation equipment. Navo-Go Enterprises' stockholders' equity accounts, with balances on January 1, 20Y1, are as follows: Common Stock, $5 stated value (900,000 shares authorized, 620,000 shares issued)Paid-In Capital in Excess of Stated Value-Common StockRetained EarningsTreasury Stock (48,000 shares, at cost) $3,100,0001,240,0004,875,000288,000 The following selected transactions occurred during the year:Jan 15. Paid cash dividends of $0.06 per share on the common stock. Thedividend had been property recorded when declared on December 1 of the precedingfiscal year for $34,320.Mar. 15. Sold all of the treasury stocks for $6.75 per share. Apr. 13. Issued 200,000 shares of common stock for $8 per share.June 14 Declared a 3% stock dividend on common stock, to be capitalized at the market price of the stock, which is $7.50 per share. July 16 Issued stock…arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning