Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

What profit margin must the firm achieve ?

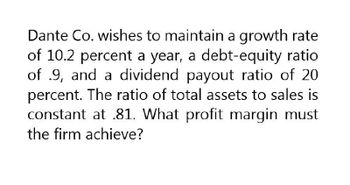

Transcribed Image Text:Dante Co. wishes to maintain a growth rate

of 10.2 percent a year, a debt-equity ratio

of .9, and a dividend payout ratio of 20

percent. The ratio of total assets to sales is

constant at .81. What profit margin must

the firm achieve?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ogier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?arrow_forwardCan you answer this accounting question?arrow_forwardRamble On Co. wishes to maintain a growth rate of 6 percent a year, a debt-equity ratio of 0.49, and a dividend payout ratio of 52 percent. The ratio of total assets to sales is constant at 1.34. What profit margin must the firm achieve?arrow_forward

- McCormack co. Wishes to maintain a growth rate of 6 percent a year, a debt equity ratio of 0.49, and a dividend payout ratio of 58 percent. The ratio of total assets to sales is constant at 1.41. What profit margin must the firm achieve?arrow_forwardLoreto Inc. has the following financial ratios: asset turnover = 2.40; net profit margin (i.e., net income/sales) = 5%; payout ratio = 30%; equity/assets = 0.40. a. What is Loreto's sustainable growth rate? b. What is its internal growth rate?arrow_forwardJasmine Manufacturing wishes to maintain a sustainable growth rate of 10.25 percent a year, a debt-equity ratio of .46, and a dividend payout ratio of 29.5 percent. The ratio of total assets to sales is constant at 1.29. What profit margin must the firm achieve?arrow_forward

- ACME Inc. has the following ratios: A0/S0- 1.3; LO/SO-0.40; profit margin-0.14; and the dividend payout ratio- .32, or 32%. Sales last year were $85 million. Assuming that these ratios will remain constant, use the AFN equation to determine the firm's self-supporting growth rate-in other words, the maximum growth rate ACME can achieve without having to employ non-spontaneous external funds. (Equation 9-2, which is 9-1, solving for g)arrow_forwardNeed help. accountingarrow_forwardGamgee Company wishes to maintain a growth rate of 11 percent per year, a debt-equity ratio of .75, and a dividend payout ratio of 25 percent. The ratio of total assets to sales is constant at .65. What profit margin must the firm achieve?arrow_forward

- The Stieben Company has determined that the following will be true next year: T(ratio of total assets of sales)=1 P(net profit of margin)=5% d(dividend pay out ratio)=50% L(debt equity ratio)=1 a) What is Stieben's sustainable growth rate in sales? b)Can Stieben's actual growth rate in sales be different from its sustainable growth rate? Why or why not? c) How can Stieben change its sustainable growth?arrow_forwardACME Inc. has the following ratios: A0*/S0 = 1.3; LO*/S0 = 0.35; profit margin = 0.12; and the dividend payout ratio = 37, or 37%. Sales last year were $85 million. Assuming that these ratios will remain constant, use the AFN equation to determine the firm's self-supporting growth rate-in other words, the maximum growth rate ACME can achieve without having to employ non-spontaneous external funds. (Equation 9-1)arrow_forwardHi expert. Need helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning