SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

I want to correct answer general accounting

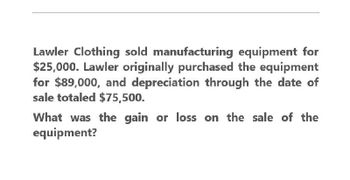

Transcribed Image Text:Lawler Clothing sold manufacturing equipment for

$25,000. Lawler originally purchased the equipment

for $89,000, and depreciation through the date of

sale totaled $75,500.

What was the gain or loss on the sale of the

equipment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- I need help to get answerarrow_forwardPiper’s Pizza sold baking equipment for $25,000. The equipment was originally purchased for $72,000, and depreciation through the date of sale totaled $51,000. What was the gain or loss on the sale of the equipment?arrow_forwardWhat was the gain or loss on the sale of the equipment on this general accounting question?arrow_forward

- Granite Stone Creamery sold ice cream equipment for $16,000. Granite Stone originally purchased the equipment for $90,000, and depreciation through the date of sale totaled $71,000. What was the gain or loss on the sale of the equipment?arrow_forwardWhat was the gain or loss on the sale of the machinery on these accounting question?arrow_forwardThe Bomb Pop Corporation sold ice cream equipment for $18,500. The equipment was originally purchased for $40,000, and depreciation through the date of sale totaled $25,000. 1. What was the gain or loss on the sale of the equipment? on salearrow_forward

- Ngu own equipment that cost 96,500 with accumulated depreciation of 66,000. Ngu asks 35,750 for the equipment but sells it for 33,500. Compute the amount of gains or losses on the salearrow_forwardSolution needarrow_forwardHauswirth Corporation sold (or exchanged) a warehouse in year 0. Hauswirth bought the warehouse several years ago for $72.500. and it has claimed $24,800 of depreciation expense against the building. Required: a. Assuming that Houswirth receives $59,700 in cash for the warehouse, compute the amount and character of Hauswirth's recognized gain or loss on the sale. b. Assuming that Hauswirth exchanges the warehouse in a like-kind exchange for some land with a fair market value of $59,700 compute Houswirth's realized gain or loss, recognized gain or loss, deferred gain or loss, and basis in the new land. c. Assuming that Houswirth receives $26.500 in cash in year 0 and a $57,000 note receivable that is payable in year 1, compute the amount and character of Hauswirth's gain or loss in year 0 and in year 1. Complete this question by entering your answers in the tabs below. Required a Required b Required c Assuming that Hauswirth receives $59,700 in cash for the warehouse, compute the amount…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you