CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

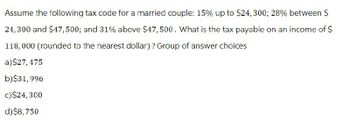

Transcribed Image Text:Assume the following tax code for a married couple: 15% up to $24, 300; 28% between $

24,300 and $47,500; and 31% above $47,500. What is the tax payable on an income of $

118,000 (rounded to the nearest dollar)? Group of answer choices

a)$27,475

b)$31,996

c) $24, 300

d)$8,750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Melodie's taxable income is $39,000 and she pays income tax of $4,489. If Melodie's taxable income increases to $41,000, she would pay income taxes of $4,884. What is Melodie's marginal tax rate? 19.75 22.00 18.50 12.00 Some other amountarrow_forwardLisa records nonrefundable Federal income tax credits of 65,000 for the year. Her regular income tax liability before credits is 190,000, and her TMT is 150,000. a. What is Lisas AMT? b. What is Lisas regular income tax liability after credits?arrow_forwardCompute the 2019 tax liability and the marginal and average tax rates for the following taxpayers (use the 2019 Tax Rate Schedules in Appendix A for this purpose): a. Chandler, who files as a single taxpayer, has taxable income of 94,800. b. Lazare, who files as a head of household, has taxable income of 57,050.arrow_forward

- PERSONAL TAXES Joe and Jane Keller are a married couple who file a joint income tax return, where the tax rates are based on the tax tables presented in the chapter. Assume that their taxable income this year was 165,000. a. What is their federal tax liability? b. What is their marginal tax rate? c. What is their average tax rate?arrow_forwardGiven the following tax structure, Taxpayer Salary Total tax $21,500 $1,032 $46,000 ??? Mae Pedro a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable based on the tax rate paid? (Round your final answer to nearest whole dollar amount.) Minimum tax b. This would result in what type of tax rate structure? Tax rate structurearrow_forwardFor the person below, calculate the FICA tax and income tax to obtain the total tax owed. Then find the overall tax rate on the gross income, including both FICA and income tax. Assume that the individual is single and takes the standard deduction. A womanearned a salary of $27,000 and received $1000 in interest. Tax Rate Single 10% up to $9325 15% up to $37,950 25% up to $91,900 28% up to $191,650 33% up to $416,700 35% up to $418,400 39.6% above $418,400 Standard deduction $6350 Exemption (per person) $4050 Let FICA tax rates be 7.65%on the first $127,200 of income from wages, and 1.45% on any income from wages in excess of $127,200. Her income tax is $_____.arrow_forward

- Using the tax table, determine the amount of federal taxes for the following situations: a. A head of household with taxable income of $66,500. b. A single person with taxable income of $42,700. c. Married taxpayers filing jointly with taxable income of $81,800. Note: For all the requirements, round your intermediate calculations and final answer to the nearest whole dollar. a. Tax amount b. Tax amount c. Tax amountarrow_forwardDetermine the tax liability, marginal tax rate, and average tax rate in each of the following cases. Use the tax tables to determine tax liability. Required: Married taxpayers, taxable income of $97, 463. Married taxpayers, taxable income of $66,829. Note: For all requirements, round "Average tax rate" to 2 decimal places.arrow_forwardFor the person below, calculate the FICA tax and income tax to obtain the total tax owed. Then find the overall tax rate on the gross income, including both FICA and income tax. Assume that the individual is single and takes the standard deduction. A man earned a salary of $27,000 and received $1250 in interest. Tax Rate Single 10% up to $9325 15% up to $37,950 25% up to $91,900 28% up to $191,650 33% up to $416,700 35% up to $418,400 39.6% above $418,400 Standard deduction $6350 Exemption (per person) $4050 Let FICA tax rates be 7.65%on the first $127,200 of income from wages, and 1.45% on any income from wages in excess of $127,200. His total FICA tax is $____.arrow_forward

- Given the following tax structure: Taxpayer Mae Pedro Salary $ 42,000 $ 66,000 Total tax $ 1,680 ??? a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable based on the tax rate paid? (Round your final answer to nearest whole dollar amount.)arrow_forwardUsing the tax table, determine the amount of taxes for the following situations: (Do not round intermediate calculations. Round your answers to 2 decimal places.) a. A head of household with taxable income of $59,500. Tax amount b. A single person with taxable income of $35,800. Tax amount c. Married taxpayers filing jointly with taxable income of $71,100. Tax amountarrow_forwardA married couple are calculating their federal income tax using the tax rate tables: If Taxpayer's Income Is... Then Estimated Taxes Are... Between But Not Over Base Tax + Rate Of the Amount Over $0 $16,700 $0 10% $0 $16,700 $67,900 $1,670.00 15% $16,700 $67,900 $137,050 $9,350.00 25% $67,900 $137,050 $208,850 $26,637.50 28% $137,050 $208,850 $372,950 $46,741.50 33% $208,850 $372,950 - - - - - $100,894.50 35% $372,950 How much tax will they have to pay on their taxable income of $112,000?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT