Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Prblm

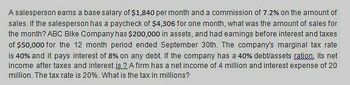

Transcribed Image Text:A salesperson earns a base salary of $1,840 per month and a commission of 7.2% on the amount of

sales. If the salesperson has a paycheck of $4,306 for one month, what was the amount of sales for

the month? ABC Bike Company has $200,000 in assets, and had earnings before interest and taxes

of $50,000 for the 12 month period ended September 30th. The company's marginal tax rate

is 40% and it pays interest of 8% on any debt. If the company has a 40% debt/assets ration, its net

income after taxes and interest is 2A firm has a net income of 4 million and interest expense of 20

million. The tax rate is 20%. What is the tax in millions?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- Helparrow_forwardBed Bug Inn has annual sales of $137,000. Earnings before interest and taxes are equal to 5.8 percent of sales. For the period, the firm paid $4,700 in interest. What is the profit margin if the tax rate is 34 percent? Can you provide the formula?arrow_forwardThe annual sales of a company are $235,000 including sales tax at 17.5%. Half of the sales are on credit terms, half are cash sales. The receivables in the statement of financial position are $23,500. What is the output tax?arrow_forward

- b. How much SUTA and FUTA tax did Universal pay in the second quarter of the year? Amount under wage limit subject to FUTA and SUTA Abner Clark Corbin Total = SUTA tax, second quarter = FUTA tax, second quarter =arrow_forwardThe following information relates to Eva Co's sales tax for the month of March 20X3:$Sales (including sales tax) 109,250Purchases (net of sales tax) 64,000Sales tax is charged at a flat rate of 15%. Eva Co's sales tax account showed an opening credit balanceof $4,540 at the beginning of the month and a closing debit balance of $2,720 at the end of themonth.What was the total sales tax paid to regulatory authorities during the month of March 20X3?arrow_forwardThe following information relates to Eva Co's sales tax for the month of March 20X3: $ 109,250 Sales (including sales tax) Purchases (net of sales tax) 64,000 Sales tax is charged at a flat rate of 15%. Eva Co's sales tax account showed an opening credit balance of $4,540 at the beginning of the month and a closing debit balance of $2,720 at the end of the month. What was the total sales tax paid to regulatory authorities during the month of March 20X3?arrow_forward

- An employee earns $44 per hour and 1.75 times that rate for all hours in excess of 40 hours per week. Assume that the employee worked 55 hours during the week. Assume that the FICA tax rate is 7.5% and that federal income tax of $670 was withheld. a. Determine the gross pay for the week. p. Determine the net pay for the week. Round intermediate calculations and your final answer to the nearest cent, if rounding is required.arrow_forwardAn employee earns $36 per hour and 1.75 times that rate for all hours in excess of 40 hours per week. Assume that the employee worked 60 hours during the week. Assume that the FICA tax rate is 7.5% and that federal income tax of $621 was withheld. a. Determine the gross pay for the week. b. Determine the net pay for the week. Round intermediate calculations and your final answer to the nearest cent, if rounding is required. $arrow_forwardAn appliance company has three installers. Larry earns $395 per week, Curly earns $490 per week, and Moe earns $595 per week. The company's SUTA rate is 5.4%, and the FUTA rate is 6.0% minus the SUTA. As usual, these taxes are paid on the first $7,000 of each employee's earnings. (a) How much SUTA and FUTA tax (in $) does the company owe for the first quarter of the year? total SUTA tax $ 1134 total FUTA tax $126 X Xarrow_forward

- The SUTA rate for LARVA Corporation is 5.4% and its FUTA rate is 6.0% less the 5.4% SUTA credit. If its semimonthly GROSS payroll is $254,400 and none was for payments to employees in excess of the $7,000 wage base, then what are the total FUTA and SUTA taxes for the payroll? O $15,264.00 O $17,844.00 O$28,203.60 O $29,001.60arrow_forward[The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay through August 31 Gross Pay for September a. $ 6,000 $ 1,500 b. 2,000 2,100 c. 132,900 9,500 Exercise 11-9 (Algo) Payroll-related journal entries LO P3 Assuming situation (a), prepare the employer’s September 30 journal entry to record the employer’s payroll taxes expense and its related liabilities. Record the employer's September 30 payroll taxes expense and its related liabilities. Note: Enter debits before credits. Date General Journal Debit Credit September 30 Payroll taxes expense FICA—Social security taxes payable FICA—Medicare taxes payable Federal…arrow_forward[The following information applies to the questions displayed below.] BMX Company has one employee. FICA Social Security taxes are 6.2% of the first $137,700 paid to its employee, and FICA Medicare taxes are 1.45% of gross pay. For BMX, its FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay through August 31 Gross Pay for September a. $ 5,700 $ 1,800 b. 3,200 3,300 c. 132,600 9,200 Compute BMX’s amounts for each of these four taxes as applied to the employee’s gross earnings for September under each of three separate situations (a), (b), and (c). Note: Round your answers to 2 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College