International Financial Management

14th Edition

ISBN: 9780357130698

Author: Madura

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

???

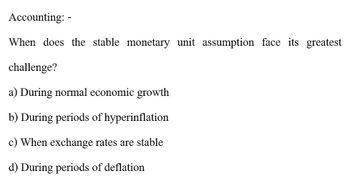

Transcribed Image Text:Accounting: -

When does the stable monetary unit assumption face its greatest

challenge?

a) During normal economic growth

b) During periods of hyperinflation

c) When exchange rates are stable

d) During periods of deflation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the basic accounting problem created by the monetary unit assumption when there is significant inflation? What appears to be the IASB position on a stable monetary unit?arrow_forwardThe stable dollar assumption assumes that: the monetary unit is the functional currency of any country in which a company operates. inflationary effects should be recognized in the financial statements economic wealth is not measurable. the monetary unit is stable across time.arrow_forwardThe principal of the time value of money is probably the single most important concept in financial management. One of the most frequently encountered applications involves the calculation of a future value. The process for converting present values into future values is called four time-value-of-money variables. Which of the following is not one of these variables? O The present value (PV) of the amount invested O The inflation rate indicating the change in average prices O The duration of the investment (N) O The interest rate (I) that could be earned by invested funds This process requires knowledge of the values of three of All other things being equal, the numerical difference between a present and a future value corresponds to the amount of interest earned during the deposit or investment period. Each line on the following graph corresponds to an interest rate: 0%, 8%, or 16%. Identify the interest rate that corresponds with each line.arrow_forward

- Why is it true, in general, that a failure to adjust expected cash flows forexpected inflation biases the calculated NPV downward?arrow_forward1. The valuation of an MNC should fall when an event causes the expected cash outflow from foreign currencies to and when home currencies denominating these cash flows are expected to a. decrease; appreciate b. increase; appreciate C. decrease; depreciate d. e. increase; depreciate No Answerarrow_forwardSuppose interest rates in the economy increase. How would such a change affect the costs of both debt and common equity based on the CAPM?arrow_forward

- The focus of the short-run macro model is on the role of a. spending in explaining economic fluctuations b. output in explaining economic fluctuations c. labor in explaining economic fluctuations d. financial markets in explaining economic fluctuationsarrow_forward3. Future value The principal of the time value of money is probably the single most important concept in financial management. One of the most frequently encountered applications involves the calculation of a future value. The process for converting present values into future values is called four time-value-of-money variables. Which of the following is not one of these variables? The trend between the present and future values of an investment The duration of the deposit (N) The interest rate (t) that could be earned by deposited funds The present value (PV) of the amount deposited This process requires knowledge of the values of three of 4arrow_forwardChoose the correct Optionarrow_forward

- Under hyperinflationary accounting, monetary items are: a) Restated using price indices b) Left at their nominal values c) Converted to foreign currency d) Written off immediatelyarrow_forwardWhich of the following is not an example of sovereign risk? a. Changes in tax rates b. Changes in currency denominations c. Changes in exchange rates d. Changes in regulationsarrow_forwardChoose the correct answer 1.) Which of the following is/are the possible effects of introducing fresh currency?[S1] Increase in money supply with the public [S2] The rise in the nominal income of public [S3] The fall in the general price level A.) Statement 1 only. B.) Statements 1 and 2 only. C.) Statement 2 only. D.) Statements 1, 2, and 3. 2.) If the quantity of money demanded exceeds the quantity of money supplied, then the interest rate will A.) fall B.) remain constant C.) rise D.) change in an uncertain direction 3.) [Case 1] Mortgagor A earns P50,000 a month while Mortgagor B earns P80,000 per month. [Case 2] Mortgagor C is willing to make a down payment of P3,000,000 while Mortgagor D will make a down payment of P5,000,000. Assuming everything else is held constant, who will have a better credit rating A.) A and C B.) A and D C.) B and C D.) B and Darrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning