FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Questiona

ttatached in screenshot

thanx for the help

1l3tp13tp1rkgopxv

vv

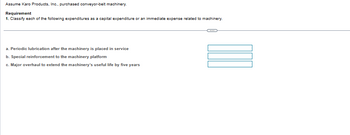

Transcribed Image Text:Assume Karo Products, Inc., purchased conveyor-belt machinery.

Requirement

1. Classify each of the following expenditures as a capital expenditure or an immediate expense related to machinery.

a. Periodic lubrication after the machinery is placed in service

b. Special reinforcement to the machinery platform

c. Major overhaul to extend the machinery's useful life by five years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- gle Chrome File Edit View History Bookmarks Profiles Tabl Window Help X M Inbox (231)- abigailof X M Verify Your Email Addra × The following unadjus! X iConnect - Home × M Question 5 - Chap C bis- Google Search ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Chapter 4 Homework 5 Saved Help Save & Ex 12.89 points eBook Ask Print References Problem 4-6AA (Algo) Preparing reversing entries LO P3 The Unadjusted Trial Balance for Hawkeye Ranges as of December 31 is presented in requirement 1. The following additional information relates to the required year-end adjustments. a. As of December 31, employees had earned $855 of unpaid and unrecorded salaries. The next payday is January 4, at which time $1,522 of salaries will be paid. b. Cost of supplies still available at December 31 total is $2,575. c. An interest payment is made every three months. The amount of unrecorded accrued interest at December 31 is $1,450. The…arrow_forwardhrome File Edit View History Objs - Google Search Bookmarks Profiles Tab x QuickLaunchSSO :: Single Sic x Window Help M Question 3- Chapter 3 Home .X + ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... 一口 Chapter 3 Homework i 3 Saved Help Save Check my work mode: This shows what is correct or incorrect for the work you have completed so far. It does not indicate completion. Exercise 3-6 (Algo) Preparing adjusting entries LO P1, P2, P3 Return 8.54 points a. Depreciation on the company's equipment for the year is computed to be $14,000. b. The Prepaid Insurance account had a $6,000 debit balance at December 31 before adjusting for the costs of any expired coverage. An analysis of the company's insurance policies showed that $550 of unexpired insurance coverage remains. c. The Supplies account had a $480 debit balance at the beginning of the year, and $2,680 of supplies were purchased during the year. The December 31…arrow_forwardomework x ezto.mheducation.com/ext/map/index.html?_con3con&external_browser%3D0&launchUrl=https%253A%252F%252Ffaytechcc.blackboard.co.. Q E User Management,. H https://outlook.offi. FES Protection Plan System 7 - North C... ework Exercises Saved Help Bushard Company (buyer) and Schmidt, Inc. (seller), engaged in the following transactions during February 20X1: Bushard Company DATE TRANSACTIONS 20X1 Feb. 10 Purchased merchandise for $6,800 from Schmidt, Inc., Invoice 1980, terms 1/10, n/30. 13 Received Credit Memorandum 230 from Schmidt, Inc., for damaged merchandise totaling $380 that was returned; the goods were purchased on Invoice 1980, dated February 10. 19 Paid amount due to Schmidt, Inc., for Invoice 1980 of February 10, less the return of February 13 and less the cash discount, Check 2010. Schmidt, Inc. DATE TRANSACTIONS 20X1 Feb. 10 Sold merchandise for $6,800 on account to Bushard Company, Invoice 1980, terms 1/10, n/30. The cost of merchandise sold was $3,900. 13 Issued…arrow_forward

- Fill in the missing amounts from the following T accounts.arrow_forwardgle Chrome File Edit View History Bookmarks Profiles Tab Window Help Inbox (229) - abigailof X MGmail x iConnect - Home x Question 5 Mid-Term x Connect Getting to K wiL47988 xapp ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252Fwe... Mid-Term Exam Saved 5 Part 4 of 4 Required information [The following information applies to the questions displayed below.] On December 1, Jasmin Ernst organized Ernst Consulting. On December 3, the owner contributed $83,660 in assets to launch the business. On December 31, the company's records show the following items and amounts. Cash Accounts receivable Office supplies Ask Land Office equipment Accounts payable Owner investments $ 12,040 Cash withdrawals by owner 13,720 Consulting revenue 2,990 Rent expense 45,940 Salaries expense 17,710 Telephone expense 8,230 Miscellaneous expenses. 83,660 $ 1,760 13,720 3,210 6,690 870 680 Mc Graw Hill 一口 Help Save & E Also assume the following: a.…arrow_forwardAutoSave Normal 因 Document1 - Word Search badiya aldujaili ff BА EN File Home Insert Draw Design Layout References Mailings Review View Help A Share O Comments X Cut Calibri (Body) v 11 - A^ A Aav A E E O Find - AaBbCcDc AaBbCcDc AABBCC AABBCCC AaB AABBCCC AaBbCcDa 自Copy Paste S Replace В IUvab х, х* А 1 Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em.. A Select v Dictate Editor Format Painter Clipboard Font Paragraph Styles Editing Voice Editor 2 3 4 Winter Company reported the following for the most recent month: Physical Units 700 Beginning work in process (60% complete) Units transferred in (started) during month Ending work in process 4,800 950 Materials are added at the end of the process and conversion costs are added evenly throughout the process. If equivalent whole units of production for conversion using the weighted average were 4,816, what percent complete was ending work in process at the end of the month? (Round to the nearest whole percent.) а. 20% b. 16%…arrow_forward

- How would I calculate this problem? I just guessed on which answer made sense to me. Please help. thank you in advance.arrow_forwardQuestion 3arrow_forwardLutoSave 日 Off UnitlILabAssignment_Question1 O Search (Alt-Q) Protected View Home Insert Draw Page Layout Formulas Data Review View Help PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing fx Formula: Multiply, Subtract; Cell Referencing A D E F G H. K Formula: Multiply, Subtract; Cell Referencing Using Excel to Record Stock Entries Student Work Area PROBLEM Required: Provide input into cells shaded in yellow in this template. Select account names from the drop-down lists. Use cell references to the data area. Use mathematical formulas to calculate any amounts not given. On May 10, Jack Corporation issues common stock for cash. Shares of stock issued Par value per share 2,000 24 %24 10.00 Amount at which stock issued 18.00 Journalize the issuance of the stock. 10 11 Date Debit Credit 12 May 10 13 14 15 16 17 18 19 20 21 22 23 25 26 27 28 29 30 31 32 33 Enter Answer Ready 24arrow_forward

- Help Save & Exit ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Flms.mheducation.com%252Fmghmiddleware%252... 3-RA1 - Princi x M Question 2 - CV 12.5 - Conne x + Fube Maps Translate News 2.5 i 2 Required information Saved t2 of 3 ts Knowledge Check 01 J. Morgan and M. Halsted are partners who share income and loss in a 3:1 ratio. After several unprofitable periods, the two partners decided to liquidate their partnership. The current period's income or loss is closed to the partners' capital accounts according to the sharing agreement. Immediately before liquidation, the partnership balance sheet shows: land, $100,000; accounts payable, $80,000; J. Morgan, Capital, $15,000; and M. Halsted, Capital, $5,000. On January 15, the land was sold for $110,000 cash. On January 16, the partnership settled its liabilities. On January 31, the remaining cash was distributed to the partners. Prepare the January 15 journal entry for the partnership to…arrow_forwardAutoSave a Ch13Homework_Question5 OFF Home Insert Draw Page Layout Formulas Data Review View Tell me A Share Comments A^ A KA Insert v Liberation Sans 12 22 Wrap Text v Custom Delete v В I U A $ v % 9 .00 Conditional Format Cell Find & Select Analyze Data Paste Merge & Center v Sort & Sensitivity 00 Formatting as Table Styles Format v Filter С32 fx K L 0 P A В C D E G H J M N R S U V W X Formula: Divide; Cell Referencing 1 2 3 Using Excel to Perform Vertical Analysis PROBLEM Student Work Area Required: Provide input into cells shaded in yellow in this template. Use mathematical formulas with cell references to this work area. 4 5 Data from the comparative balance sheets of Rollaird Company is 6 presented here. 7 December 31, December 31, Using these data from the comparative balance sheets of Rollaird Company, perform vertical analysis. 8. 9. 2022 2021 Accounts receivable (net) $ 460,000 $ 780,000 400,000 650,000 10 11 Inventory December 31, 2022 December 31, 2021 12 Total assets…arrow_forwarde File Edit View History Bookmarks Profiles Tab Window Help C Netflix MInbox (228 X MACC101 Pr X Accounting X Accounting X M Question 1 X M Question 1 xb Answered: ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fbb.mwcc.edu%252... Chapter 9 Homework 13 30.12 points Saved Note: Use 360 days a year. Year 1 December 16 Accepted a(n) $12,800, 60-day, 8% note in granting Danny Todd a time extension on his past-due account receivable. December 31 Made an adjusting entry to record the accrued interest on the Todd note. Year 2 eBook Ask Print References February 14 Received Todd's payment of principal and interest on the note dated December 16. March 2 Accepted a(n) $6,400, 8%, 90-day note in granting a time extension on the past-due account receivable from Midnight Company. March 17 Accepted a $3,900, 30-day, 7% note in granting Ava Privet a time extension on her past-due account receivable. April 16 Privet dishonored her note. May 31 Midnight…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education