FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

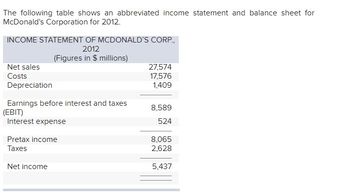

Transcribed Image Text:The following table shows an abbreviated income statement and balance sheet for

McDonald's Corporation for 2012.

INCOME STATEMENT OF MCDONALD'S CORP.,

2012

(Figures in $ millions)

Net sales

Costs

Depreciation

Earnings before interest and taxes

(EBIT)

Interest expense

Pretax income

Taxes

Net income

27,574

17,576

1,409

8,589

524

8,065

2,628

5,437

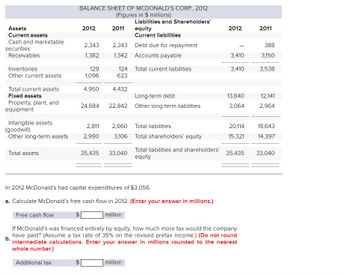

Transcribed Image Text:Assets

Current assets

Cash and marketable

securities

Receivables

Inventories

Other current assets

Total current assets

Fixed assets

Property, plant, and

equipment

Intangible assets

(goodwill)

Other long-term assets

Total assets

BALANCE SHEET OF MCDONALD'S CORP., 2012

(Figures in $ millions)

Liabilities and Shareholders'

Free cash flow

2012

2,343

1,382

129

1,096

4,950

24,684

2,811

2,990

35,435

2011

2,343

1,342 Accounts payable

124

623

4,432

2,660

3,106

equity

Current liabilities

Debt due for repayment

Long-term debt

22,842 Other long-term liabilities

33,040

Total current liabilities

million

Total liabilities

Total shareholders' equity

In 2012 McDonald's had capital expenditures of $3,056.

a. Calculate McDonald's free cash flow in 2012. (Enter your answer in millions.)

million

Total liabilities and shareholders'

equity

2012

-

3,410

3,410

13,640

3,064

b.

If McDonald's was financed entirely by equity, how much more tax would the company

have paid? (Assume a tax rate of 35% on the revised pretax income.) (Do not round

intermediate calculations. Enter your answer in millions rounded to the nearest

whole number.)

Additional tax

2011

388

3,150

3,538

12,141

2,964

20,114 18,643

15,321 14,397

35,435 33,040

Expert Solution

arrow_forward

Concept Introduction:

Free cash flows are those cash flows in the business which can be used freely in business. This means operating cash flows after making net capital expenditures and also after contribution to net working capital. Interest is only being paid on debt funds, no interest expense will be incurred on equity funds.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Some recent financial statements for Smolira Golf Corporation follow. Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation Taxable income Taxes (22%) Earnings before interest and taxes Interest paid Net income Dividends Retained earnings 2020 $35,585 $38,940 28,846 43,112 18,401 3,970 SMOLIRA GOLF CORPORATION 2021 Income Statement a. Price-earnings ratio b. Dividends per share c. Market-to-book ratio d. PEG ratio SMOLIRA GOLF CORPORATION 2020 and 2021 Balance Sheets 2021 Liabilities and Owners' Equity Current liabilities $57,956 $110,898 $ 465,585 $ 27,000 37,022 Accounts payable Notes payable Other $ 521,433 Total $ 523,541 $ 632,331 Total liabilities and owners' equity Long-term debt times Owners' equity Common stock and paid-in surplus Accumulated retained earnings times times Total $ 512,454 363,528 45,963 $102,963 20,883 $ 82,080 18,058 $ 64,022 Smolira Golf Corporation has 52,000…arrow_forward4arrow_forwardSuppose the following items were taken from the 2022 financial statements of Texas Instruments, Inc. (All dollars are in millions.) Common stock Prepaid rent Equipment Stock investments (long-term) Debt Investments (short-term) Income taxes payable Cash $2.826 164 6,705 637 1,743 128 1,182 Accumulated depreciation-equipment Accounts payable Patents Notes payable (long-term) Retained earnings Accounts receivable V Inventory TEXAS INSTRUMENTS, INC. Balance Sheet (in millions) Assets $3.547 1,459 2,210 Prepare a classified balance sheet in good form as of December 31, 2022. (List Current Assets in order of liquidity) $ 810 6,896 1,823 1,202 Liabilities and Stockholders' Equity $ $ $ $arrow_forward

- Give answer with explanationarrow_forwardHere are simplified financial statements for Phone Corporation in 2020: Net sales Cost of goods sold Other expenses INCOME STATEMENT (Figures in $ millions) Depreciation Earnings before interest and taxes (EBIT) Interest expense Income before tax Taxes (at 21%) Net income Dividends Assets Cash and marketable securities Receivables Inventories Other current assets BALANCE SHEET (Figures in $ millions) Total current assets Net property, plant, and equipment Other long-term assets. Total assets Liabilities and shareholders' equity Payables Short-term debt Other current liabilities Total current liabilities Long-term debt and leases Other long-term liabilities Shareholders' equity Total liabilities and shareholders' equity $ 13,600 4,310 4,162 2,668 $2,460 718 $1,750 368 a. Return on equity (use average balance sheet figures) b. Return on assets (use average balance sheet figures) c. Return on capital (use average balance sheet figures) d. Days in inventory (use start-of-year balance sheet…arrow_forwardRevenues Expenses Cost of goods sold Selling expenses General and administrative expenses Interest expense Income tax expense Total expenses Net income Assets Current assets Cash Marketable securities Accounts receivable Inventories Prepaid expenses Total current assets Plant and equipment (net) Intangibles Total assets Liabilities and Stockholders' Equity Liabilities Current liabilities Accounts payable Other Total current liabilities Bonds payable Total liabilities Year 2 $219,100 Total liabilities and stockholders' equity 124, 400 19,700 10,000 1,700 20, 100 175,900 $ 43,200 $ 38,500 15,800 54,300 64,300 118,600 Stockholders' equity Common stock (43,000 shares) Retained earnings Total stockholders' equity 159,000 $277,600 $ 4,800 $ 7,200 2,800 2,800 36,600 31, 100 101,600 94, 100 3,900 2,900 149,700 138, 100 106,400 106,400 21,500 0 $277,600 $244,500 Year 1 $182,800 114,900 44, 100 101, 100 17,700 9,000 1,700 16,900 146,400 $36,400 $ 34,200 16, 200 50,400 65,300 115,700 114,900…arrow_forward

- The balance sheets for Dual Monitors Corporation and additional information are provided below. DUAL MONITORS CORPORATION Balance Sheets December 31, 2024 and 2023 Assets Current assets: Cash Accounts receivable Inventory Investments Long-term assets: Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity Additional Information for 2024: 1. Net Income is $150,600. 2. Sales on account are $1,215,500. (All sales are credit sales.) 3. Cost of goods sold is $973,400. Complete this question by entering your answers in the tabs below. a. Gross profit ratio b. Return on assets c. Profit margin d. Asset turnover e. Return on equity 2024 19.9 % 13.9 % %6 $208,600 60,000 86,000 3,100 times %6 390,000 390,000 700,000 580,000 (338,000) (178,000)…arrow_forwardNonearrow_forwardSunland Company reported the following information for 2025: Sales revenue Cost of goods sold Operating expenses Unrealized holding gain on available-for-sale debt securities Cash dividends received on the securities O $490300. O $404600. $480700. $2420000 O $85700. 1754000 271000 85700 For 2025, Sunland would report comprehensive income (ignoring tax effects) of 9600arrow_forward

- The following information (in $ millions) comes from the Annual Report of Saratoga Springs Company for the year ending 12/31/2024: Year ended 12/31/2024 $ 8,139 4,957 2,099 Net sales Cost of goods sold Selling and administrative expense Interest expense Income before taxes Net income Cash and cash equivalents Receivables, net Inventories Land, buildings and equipment at cost, net Total assets Total current liabilities Long-term debt Total liabilities Total stockholders' equity 606 477 648 Profit margin on sales 12/31/2024 $ 1,165 1,200. 1,245 13,690 $ 17,300 $ 5,937 5,781 $ 11,718 $5,582 Required: Compute the profit margin on sales for 2024. Note: Round your answer to 1 decimal place, e.g., 0.1234 as 12.3%. 12/31/2023 $ 83 854 709 4,034 $ 5,680 $ 2,399 2,411 $ 4,810 $ 870arrow_forwardcash flow statment Assets Long term investments long-term assets Brand name & Goodwell The comparative statements of financial position of Lopez Inc. at the beginning and the end of the year 2022 appear as follows. Inventory Accounts receivable Cash Total J Equity and Liabilities Share capital ordinary Retained earnings Accounts payable Income Tax payable Total Ć Lopez Inc. Statements of Financial Position Dec.31, 2022 $ 56,000 115,000 50,000 100,000 65,000 12,000 $398,000 $250,000 61,000 53,000 34,000 $398,000 Jan. 1, 2022 $ 40,000 150,000 43,000 60,000 40,000 43,000 $376,000 $ 200,000 91,000 75,000 10,000 $376,000 Additional information Net income $90,000 Deprecation on long term assets $25,000 dividends of $15,000 were paid in 2022 a long-term asset with a net book value of $10,000 were sold at a gain of $17,000 Instructions From the information given above, prepare a Cash Flow Statement for Lopez Inc. for the period ending 31st Dec., 2022 (Using indirect method). Show very clearly…arrow_forwardCurrent assets: Cash and marketable securities Accounts receivable Inventory Total Assets Fixed assets: Gross plant and equipment Less: Accumulated depreciation Net plant and equipment Other long-term assets Total Total assets Net sales Less: Cost of goods sold Gross profits Less: Other operating expenses 2024 VALIUM'S MEDICAL SUPPLY CORPORATION Balance Sheet as of December 31, 2024 and 2023 (in millions of dollars) $ 72 187 312 $ 571 Earnings per share (EPS) Dividends per share (DPS) Book value per share (BVPS) Market value (price) per share (MVPS) 2023 $ 71 181 291 $ 543 $ 1,073 146 $ 927 134 $ 1,061 $ 1,632 $ 1,446 $ 882 113 $ 769 134 $ 903 Liabilities and Equity Current liabilities: Accrued wages and taxes Accounts payable Notes payable Total Long-term debt Stockholders' equity: Preferred stock (6 thousand shares) Common stock and paid-in surplus (100 thousand shares) Retained earnings Total VALIUM'S MEDICAL SUPPLY CORPORATION Income Statement for Years Ending December 31, 2024 and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education