Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Bhupatbhai

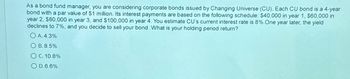

Transcribed Image Text:As a bond fund manager, you are considering corporate bonds issued by Changing Universe (CU). Each CU bond is a 4-year

bond with a par value of $1 million. Its interest payments are based on the following schedule: $40,000 in year 1, $60,000 in

year 2, $80,000 in year 3, and $100,000 in year 4. You estimate CU's current interest rate is 8%. One year later, the yield

declines to 7%, and you decide to sell your bond. What is your holding period return?

OA. 4.3%

OB. 8.5%

OC. 10.8%

OD.6.6%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- As a bond fund manager, you are considering corporate bonds issued by Super Buy (SB). Each SB bond is a 4-year bond with a par value of $1 million. Its interest payments are based on the following schedule: $50,000 in year 1, $60,000 in year 2, $70,000 in year 3, and $80,000 in year 4. You estimate SB's current interest rate is 6%. What is the actual bond price change if the YTM increases by 100 basis points? OA.-3.49% OB.3.42% O C.3.49% O D.-3.42%arrow_forwardAs a bond fund manager, you are considering 10-year corporate bonds issued by Mellon Bank (MB). Each MB bond has a $1,000 par value with 8% annual coupon rate. The coupons are paid semi-annually. The estimated rate of return on MB bond is 10%. What is the price of the bond? • A. $831.31 • B. $1,010.29 • C. $875.38 • D. $946.32 You purchase a 5-year corporate bond. The coupon rate of the bond is 6%, paid annually, and its par value is $1,000. The YTM is 4%. If you sell the bond one year later, what is your holding period return? • A. 3.5% • B. 0.5% • C. 1.7% • D. 4.0%arrow_forwardThe Wildhorse Department of Transportation has issued 25-year bonds that make semiannual coupon payments at a rate of 10.375 percent. The current market rate for similar securities is 10.50 percent. Assume that the face value of the bond is $1.000. Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) Problem 8.29 a-d (Excel Video)(a) What is the current market value of one of these bonds? (Round answer to 2 decimal places, eg. 15.25) Current market valuearrow_forward

- The Pharoah Department of Transportation has issued 25-year bonds that make semiannual coupon payments at a rate of 10.425 percent. The current market rate for similar securities is 10.30 percent. Assume that the face value of the bond is $1,000. Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) Problem 8.29 a-d (Excel Video)(a) Your answer is incorrect. What is the current market value of one of these bonds? (Round answer to 2 decimal places, e.g. 15.25.) Current market value $arrow_forwardThe Pharoah Department of Transportation has issued 25-year bonds that make semiannual coupon payments at a rate of 10.425 percent. The current market rate for similar securities is 10.30 percent. Assume that the face value of the bond is $1,000. Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) Problem 8.29 a-d (Excel Video)(a) ✓ Your answer is correct. What is the current market value of one of these bonds? (Round answer to 2 decimal places, e.g. 15.25.) Current market value $ eTextbook and Media Using multiple attempts will impact your score. 50% score reduction after attempt 2 Problem 8.29 a-d (Excel Video)(b) ✓ Your answer…arrow_forwardCalculate Bond Interest Rates. Fill in the correct answers. Please show your work A municipal bond that matures in one year has a $5,000 face value and is currently at an interest rate of 11.11%. The initial price for this bond is $______ Suppose that inflation is exactly 1.00%. The real interest rate for the bond is _____.%arrow_forward

- Energetic Engines is trying to estimate its cost bonds that pay $20 interest every six months. Each bond, which has a $1,000 face value and matures in six years, is currently selling for $900. Estimate Energetic’s cost of retained earnings using the bond-plus-risk-premium approach.arrow_forwardYour company is planning to issue new bonds soon. Your boss gives you the following informationand asks you to calculate the interest rate at which to issue the bonds. Given this information, whatinterest rate do you recommend? Expected Inflation Rate: 3% Interest rate of similar corporations' (AAA rated) 30-year bonds: 6.5% Interest rate of 30 - Year Treasury Bonds: 5.38% Interest rate of 3 -month treasury bills: 4.89% Liquidity - risk premium: 0.03 Instruction: Type ONLY your numericalanswer in the unit of dollars, NO $ sign, NO comma, and round to two decimal places. E.g., if youranswer is $7, 001.56, should type ONLY the number 7001.56, NEITHER 7,001.6, $7001.6, $7,001.6,NOR 7002. Otherwise, Blackboard will treat it as a wrong answer.arrow_forwardUnion Local School District has a bond outstanding with a coupon rate of 3.4 percent paid semiannually and 19 years to maturity. The yield to maturity on this bond is 3.6 percent, and the bond has a par value of $5,000. What is the price of the bond?arrow_forward

- Cardinal Mania is financing a new investment project by issuing five-year bonds. Each bond has the face value of $1,000, and each bond pays out a $25 coupon each year (annual coupon.) Cardinal Mania plans to issue 1000 such bonds to raise the required funding of $870,000. Please answer the following questions: A. Calculate the yield to maturity and the current yield of this bond. B. Your tax rate is 20%, and the bond from Cardinal Mania is not tax-exempt. Suppose you can also invest in a five-year tax-exempt municipal bond with a yield of 3%. Would you buy the Cardinal Mania bond or the municipal bond? C. What would the holding period return rate be if you hold the Cardinal Mania bond for two years before selling it at par?arrow_forwardUnion Local School District has a bond outstanding with a coupon rate of 2.9 percent paid semiannually and 24 years to maturity. The yield to maturity on this bond is 2.5 percent, and the bond has a par value of $10,000. What is the dollar price of the bond?arrow_forwardPlease view the following video before answering this question. Click here to watch the video Ten bonds are purchased for $8.568.37 and are kept for 5 years. The bond coupon rate is 7% per year, payable annually. Immediately following the owner's receipt of the last coupon payment, the owner sells each bond for $50 less than its par value (price discount). The owner will invest in the bonds if the effective annual yield is at least 9% What is the face value of the the ten bonds?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education