Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

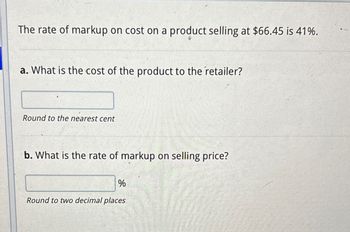

Transcribed Image Text:The rate of markup on cost on a product selling at $66.45 is 41%.

a. What is the cost of the product to the retailer?

Round to the nearest cent

b. What is the rate of markup on selling price?

%

Round to two decimal places

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Calculate the missing values and express your answers rounded to two decimal places. Cost Amount ofMarkup SellingPrice Rate of Markupon Cost Rate of Markupon Selling Price a. $260.00 25.00% % b. $60.00 % 30.00%arrow_forwardThe rate of markup on cost on a product selling at $64.50 is 45%. What is the cost of the product to the retailer? What is the rate of markup on selling price?arrow_forwardAssume that markup is based on cost. Calculate the cost and selling price. Note: Round your answers to the nearest cent. Cost Selling price Dollar markup $ 6.00 Percent markup on cost 101.69 %arrow_forward

- Question: The cost of goods sold as a percentage of net sales revenue is (round your answer to two decimal places). Sales Revenue $420,000 Sales Returns and Allowances 1,400 Sales Discounts Net Sales Revenue Cost of Good Sold a) 62.45% b) 62.58% c) 61.90% d) 62.24% 850 417,750 260,000arrow_forwardCalculate the missing values and express your answers rounded to two decimal places. Cost Amount of MK Selling Price Rate of MK on Cost Rate of MK on Selling Price A $300.00 25.00% B $54.00 26.00%arrow_forwardGeneral Accountingarrow_forward

- An item has a 29% markup based on selling price. The markup is $400. a. Find the selling price. b. Find the cost. Round to the nearest cent. a. The selling price is $ (Round to the nearest cent as needed.) b. The cost is Sarrow_forwardWhat is the wholesale price of an item, if the retail price is $104.37 and the amount of markup is $33.37? The wholesale price is $arrow_forwardCalculate the missing values and express your answers rounded to two decimal places. a. b. Cost $0.00 $56.00 Amount of Markup Selling Price $350.00 Rate of Markup on Cost 25.00% % Rate of Markup on Selling Price 28.00% %arrow_forward

- Ans.arrow_forwardCalculate the net price factor and net price (in dollars). For convenience, round the net price factor to five decimal places and the net price to the nearest cent, when necessary. List Price Trade Discount Rate Net Price Factor $435.60 22/15/5 $ Net Pricearrow_forwardCalculate the missing information. Round dollars to the nearest cent and percents to the nearest tenth of a percent.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning