FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

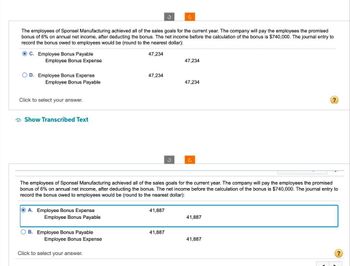

Transcribed Image Text:The employees of Sponsel Manufacturing achieved all of the sales goals for the current year. The company will pay the employees the promised

bonus of 6% on annual net income, after deducting the bonus. The net income before the calculation of the bonus is $740,000. The journal entry to

record the bonus owed to employees would be (round to the nearest dollar):

C. Employee Bonus Payable

Employee Bonus Expense

47,234

47,234

OD. Employee Bonus Expense

Employee Bonus Payable

47,234

47,234

Click to select your answer.

Show Transcribed Text

?

The employees of Sponsel Manufacturing achieved all of the sales goals for the current year. The company will pay the employees the promised

bonus of 6% on annual net income, after deducting the bonus. The net income before the calculation of the bonus is $740,000. The journal entry to

record the bonus owed to employees would be (round to the nearest dollar):

A. Employee Bonus Expense

Employee Bonus Payable

41,887

41,887

B. Employee Bonus Payable

Employee Bonus Expense

41,887

41,887

Click to select your answer.

?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Peyton Company's payroll for the year is$737,910. Of this amount, 472,120 is for wages paid in excess of of 7,000 to each individual employee. The SUTA rate in Peyton Company's state is 2.9% on the first 7,000 of each employees earnings.. Computte a. Net FUTA tax b. Net SUTA tax c. Total Unemployment taxesarrow_forwardHelp me selecting the right answer. Thank youarrow_forwardPART A:Silver Records has 4 employees who are paid on the 1st and 15th of each month for the work they performed in the preceding half-month. At November 30, each employee is owed gross pay of $2,250, but each one must have 10% of their pay withheld for income taxes. Each must also make CPP contributions of 5.1% of their gross pay and pay EI premiums of 1.62% of their gross pay. Required: Prepare a single journal entry required to record the accrual of payroll on November 30 Prepare the journal entry to record the related employer’s liability on November 30 PART B:Superb Industries borrowed money by issuing a $30,000, 6%, 10-year bond. The Assume that Superb Industries issued the bond on April 1, 2021 at a price of $27,868. The market interest rate on April 1 was 7%. Superb’s accounting year ends on September 30. Required:Journalize the following transactions for Superb Industries: Issuance of the bonds on April 1, 2021 Accrual of interest expense and amortization of bonds on September…arrow_forward

- A company has one employee. All wages for September are subject to 6.2% FICA Social Security taxes and 1.45% FICA Medicare taxes. The company's FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to its employee. Gross Pay through August Gross Pay for September 31 $6,500 $ 1,900 Prepare the employer's September 30 journal entry to record the employer's payroll taxes expense and its related liabilities. Enter answers in the tabs below. Payroll Taxes General Expense Journal Prepare the employer's September 30 journal entry to record the employer's payroll taxes expense and its related liabilities. Note: Round answers to 2 decimals. No 1 Date X Answer is not complete. September 30 General Journal Salaries expense FICA-Social security taxes payable FICA-Medicare taxes payable Salaries payable < Payroll Taxes Expense X General Journal Debit 1,900.00 Credit 117.80 27.55 1,754.65arrow_forwardP4-3 Roppongi Company incurred payroll for the week of P100,000, which consists of P70,000 also estimated that annual bonus of P432,000 will be paid at year end. All employees are earned by 20 production workers and P30,000 earned by 10 sales workers. Roppongi Required: Prepare the journal entries to: (a) distribute the weekly payroll and to (b) accrue CHAPTER 4 Accountir Sawed wth Canseaner entitled to 4-week paid vacation and 10 paid holidays. the bonus, vacation and holiday pay. for Innuary shows the following informationarrow_forwardMest Company has nine employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. FUTA taxes are 0.6% and SUTA taxes are 5.4% of the first $7,000 paid to each employee. Cumulative pay for the current year for each of its employees follows. Employee Cumulative Pay Employee Cumulative Pay Employee Cumulative Pay Ken S $ 5,000 Julie W $ 146, 500 Christina S $ 140, 800 Tim V 43, 400 Michael M 109,900 Kitty O 39,900 Steve S 90,000 Zach R 137,700 John W 6, 600 Compute the amounts in this table for each employee. For the company, compute each total for FICA Social Security taxes, FICA Medicare taxes, FUTA taxes, and SUTA taxes. Hint: Remember to include in those totals any employee share of taxes that the company must collect.arrow_forward

- Selected information from the payroll register of Barbara's Stables for the week ended September 28, 20--, is as follows: Social Security tax is 6.2% on the first $128,400 of earnings for each employee. Medicare tax is 1.45% of gross earnings, FUTA tax is 0.8%, and SUTA tax is 5.4% each on the first $7,000 of earnings. Cumulative Pay Current Taxable Earnings Employee Name Before CurrentEarnings GrossPay UnemploymentCompensation SocialSecurity Carlosi, Peggy $ 84,240 $2,350 Sanchez, Carmela 81,900 2,100 Delaney, Roger 109,800 3,320 Weitz, Alana 6,300 1,100 Dunhill, Craig 6,800 1,000 Bella, Stephen 42,330 1,850arrow_forwardSubject:arrow_forwardCalculate Payroll An employee earns $44 per hour and 1.5 times that rate for all hours in excess of 40 hours per week. If the employee worked 50 hours during the week. Assume that the social security tax rate is 6.0%, the Medicare tax rate is 1.5%, and the employee's federal income tax withheld is $557. a. Determine the gross pay for the week. 2,750 x If applicable, round your final answer to two decimal places. b. Determine the net pay for the week. 1,911 X Feedback Check My Work Gross pay represents the total earnings of an employee for a specific pay period, prior to taxes and deductions. Net pay is also known as take-home pay.arrow_forward

- Swifty Hardware has four employees who are paid on an hourly basis plus time-and-a-half for all hours worked in excess of 40 a week. Payroll data for the week ended March 15, 2022, are presented below. Employee Hours Worked Hourly Rate Federal Income Tax Withholdings United Fund Ben Abel 40 $14.00 $59.00 $5.00 Rita Hager 41 16.00 64.00 5.00 Jack Never 44 13.00 60.00 8.00 Sue Perez 46 13.00 62.00 5.00 Abel and Hager are married. They claim 0 and 4 withholding allowances, respectively. The following tax rates are applicable: FICA 7.65%, state income taxes 3%, state unemployment taxes 5.4%, and federal unemployment 0.6%. 1. Prepare a payroll register for the weekly payroll. No employee has reached the Social Security limit of $132,900 or the FUTA/SUTA limit of $7,000 2. Journalize the payroll on March 15, 2022, and the accrual of employer payroll taxes. 3. Journalize the payment of the payroll on March 16,…arrow_forwardFor the current year ended December 31, a company has implemented an employee bonus program based on its net income, which employees share equally. Its bonus expense is $40,000. (a) Prepare the journal entry at December 31 of the current year to record the bonus due. (b) Prepare the journal entry at January 20 of the following year to record payment of that bonus to employees.arrow_forwardQuestion 2 With the following data, compute the NET FUTA Tax. $6,750 Gross FUTA Tax DUE Credit against FUTA (assume $3,100 applicable) O $3,650 O $7,000 O $3,100 $6,750 MacBook Air 80 F3 F2 F4 F5 F6 F7 FB F9 3 4. 5 7 8 9. E T Y D G < 6 F.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education