FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

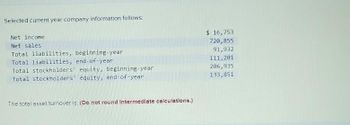

Transcribed Image Text:Selected current year company information follows:

Net income.

Net sales

Total liabilities, beginning-year

Total liabilities, end-of-year

Total stockholders' equity, beginning-year

Total stockholders' equity, end-of-year

The total asset turnover is: (Do not round Intermediate calculations.)

$ 16,753

720,855

91,932

111, 201

206,935

133,851

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Horizontal Analysis The comparative temporary investments and inventory balances of a company follow. Current Year Previous Year Accounts payable $59,409 $48,300 Long-term debt 44,795 52,700 Based on this information, what is the amount and percentage of increase or decrease that would be shown on a balance sheet with horizontal analysis? Amount of Change Increase/Decrease Percentage Accounts payable $ % Long-term debt $ %arrow_forwardCompare the Solvency, Liquidity and Profitability for the two companiesarrow_forwarda. Efficiency ratios. b. Asset turnover ratios. c. Leverage ratios. d. Coverage ratios. Efficiency Ratios Inventory turnover ratio enter Inventory turnover ratio in times times Days sales in inventory enter Days sales in inventory days Accounts receivables turnover enter Accounts receivables turnover in times times DSO enter days sales outstanding days Asset Turnover Ratios Total asset turnover enter Total asset turnover in times times Fixed assets turnover enter Fixed assets turnover in times times Leverage Ratios Total debt ratio enter Total debt ratio in times times Debt to equity ratio enter Debt to equity ratio in times times Equity multiplier enter Equity multiplier in times times Coverage Ratios Times interest earned enter Times interest earned times Cash coverage enter Cash coverage in times timesarrow_forward

- What are three of the benefits of common-sized analysis using the inverse operating asset turnover (ATO) ratios? a) provides insight into the age of the assets b) the item is expressed as a percentage of current year sales c) is more comparable year-to-year than other methods d) negates the issue with small denominators e) it provides a common denominator for all accountsarrow_forwardHorizontal Analysis The comparative temporary investments and inventory balances of a company follow: Current Year Previous Year Accounts payable $51,212 $43,400 Long-term debt 57,597 78,900 Based on this information, what is the amount and percentage of increase or decrease that would be shown on a balance sheet with horizontal analysis? Amount of Change Increase/Decrease Percentage Accounts payable $fill in the blank fill in the blank fill in the blank Long-term debt $fill in the blank fill in the blank fill in the blankarrow_forwardReturn on Assets Ratio and Asset Turnover Ratio Northern Systems reported the following financial data (in millions) in its annual report: Previous Year Current Year Net Income $9,050 $7,500 Net Sales 52,350 37,200 Total Assets 58,734 68,128 If the company’s total assets are $55,676 at the beginning of the previous year, calculate the company’s: (a) return on assets (round answers to one decimal place - ex: 10.7%) (b) asset turnover for both years (round answers to two decimal places) Previous Year Current Year a. Return on Assets Ratio Answer Answer b. Asset Turnover Ratio Answer Answerarrow_forward

- Asset turnover ratio Financial statement data for years ended December 31, 20Y3 and 20Y2, for Edison Company follow: 20Y3 20Y2 Sales $1,950,000 $1,564,000 Total assets: Beginning of year 740,000 620,000 End of year 820,000 740,000 a. Determine the asset turnover ratio for 20Y3 and 20Y2. Round answers to one decimal place. 20Y3 20Y2 Asset turnover fill in the blank 1 fill in the blank 2 b. Is the change in the asset turnover ratio from 20Y2 to 20Y3 favorable or unfavorable?arrow_forwardHorizontal Analysis The comparative temporary investments and inventory balances of a company follow. Current Year Previous Year Accounts payable $55,200 $46,000 Long-term debt 46,716 68,700 Based on this information, what is the amount and percentage of increase or decrease that would be shown on a balance sheet with horizontal analysis? Amount of Change Increase/Decrease Percentage Accounts payable $fill in the blank 1 fill in the blank 3% Long-term debt $fill in the blank 4 fill in the blank 6%arrow_forwardFixed Asset Turnover Ratio Financial statement data for years ending December 31 for Dennis Company follow: Year 2 Year 1 Sales $4,521,000 $3,960,000 Fixed assets: Beginning of year 1,140,000 1,060,000 End of year 1,600,000 1,140,000 a, Determine the fixed asset turnover ratio for Year 1 and Year 2. Round your answers to one decimal place. Fixed asset turnover Year 1 Year 2 b. Does the change in the fixed asset turnover ratio from Year 1 to Year 2 indicate a favorable or an unfavorable change? Check My Work Save an 31 tv MacBook Air DII DD F7 F2 F3 F4 F5 F6 F8 F9 F10 #3 2$ 3 8. W R Y U < cOarrow_forward

- Asset turnover A company reports the following: Sales $724,200 Average total assets 426,000 Determine the asset turnover ratio. If required, round your answer to one decimal place.fill in the blank 1arrow_forwardfill out the missing blank Billy’s BBQ reported sales of $750,000 and net income of $29,500. Billy’s also reported ending total assets of $497,000 and beginning total assets of $390,000. Required: Calculate the return on assets, the profit margin, and the asset turnover ratio for Billy's BBQ.arrow_forwardComprehensive Ratio Analysis Data for Lozano Chip Company and its industry averages follow. Lozano Chip Company: Balance Sheet as of December 31, 2019 (Thousands of Dollars) Cash $ 240,000 Accounts payable $ 600,000 Receivables 1,575,000 Notes payable 100,000 Inventories 1,135,000 Other current liabilities 560,000 Total current assets $2,950,000 Total current liabilities $1,260,000 Net fixed assets 1,315,000 Long-term debt 400,000 Common equity 2,605,000 Total assets $4,265,000 Total liabilities and equity $4,265,000 Lozano Chip Company: Income Statement for Year Ended December 31, 2019 (Thousands of Dollars) Sales $7,500,000 Cost of goods sold 6,375,000 Selling, general, and administrative expenses 943,000 Earnings before interest and taxes (EBIT) $ 182,000 Interest expense 40,000 Earnings before taxes (EBT) $ 142,000 Federal and state income taxes (25%) 35,500 Net income $ 106,500 a. Calculate the indicated ratios for Lozano. Do not round intermediate calculations. Round your answers…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education