EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

General Accounting

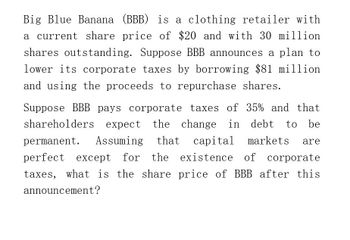

Transcribed Image Text:Big Blue Banana (BBB) is a clothing retailer with

a current share price of $20 and with 30 million

shares outstanding. Suppose BBB announces a plan to

lower its corporate taxes by borrowing $81 million

and using the proceeds to repurchase shares.

Suppose BBB pays corporate taxes of 35% and that

shareholders expect the change in debt to be

permanent. Assuming that

that capital markets are

perfect except for the

the existence of corporate

taxes, what is the share price of BBB after this

announcement?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- General accounting. Solve this questionarrow_forwardHawar International is a shipping firm with a current share price of $4.94 and 9.8 million shares outstanding. Suppose that Hawar announces plans to lower its corporate taxes by borrowing $8.7 million and repurchasing shares, that Hawar pays a corporate tax rate of 25%, and that shareholders expect the change in debt to be permanent. a. If the only imperfection is corporate taxes, what will be the share price after this announcement? b. Suppose the only imperfections are corporate taxes and financial distress costs. If the share price rises to $4.99 after this announcement, what is the PV of financial distress costs Hawar will incur as the result of this new debt? a. If the only imperfection is corporate taxes, what will be the share price after this announcement? The share price after this announcement will be $ per share. (Round to the nearest cent.) b. Suppose the only imperfections are corporate taxes and financial distress costs. If the share price rises to $4.99 after this…arrow_forwardHawar International is a shipping firm with a current share price of $4.50 and 10 million shares outstanding. Suppose Hawar announces plans to lower its corporate taxes by borrowing $10 million and repurchasing shares. a. With perfect capital markets, what will the share price be after this announcement? b. Suppose that Hawar pays a corporate tax rate of 40%, and that shareholders expect the change in debt to be permanent. If the only imperfection is corporate taxes, what will the share price be after this announcement? c. Suppose the only imperfections are corporate taxes and financial distress costs. If the share price rises to $4.55 after this announcement, what is the PV of financial distress costs Hawar will incur as the result of this new debt? Question content area bottom Part 1 a. With perfect capital markets, what will the share price be after this announcement? With perfect capital markets, the share price will be $enter your response here per sharearrow_forward

- Hawar International is a shipping firm with a current share price of $5.05 and 10.4 million shares outstanding. Suppose that Hawar announces plans to lower its corporate taxes by borrowing $9.5 million and repurchasing shares, that Hawar pays a corporate tax rate of 21%, and that shareholders expect the change in debt to be permanent. a. If the only imperfection is corporate taxes, what will be the share price after this announcement? b. Suppose the only imperfections are corporate taxes and financial distress costs. If the share price rises to $5.10 after this announcement, what is the PV of financial distress costs Hawar will incur as the result of this new debt?arrow_forwardBig Blue Banana (BBB) is a clothing retailer with a current share price of $10.00. It has no debt and 25 million shares outstanding. Now suppose that BBB announces plans to increase its leverage by borrowing $250 million and using the proceeds to repurchase shares. Assuming perfect capital markets, what is the firm value for BBB after this announcement? Suppose that BBB pays corporate taxes of 35% and that shareholders expects the change in debt to be permanent. Assume that capital markets are perfect except for the existence of corporate taxes. What is the value of BBB after this announcement? Suppose that BBB pays corporate taxes of 35% and that shareholders expects the change in debt to be permanent. Assume that capital markets are perfect except for the existence of corporate taxes and financial distress costs. If the price of BBB's stock decreases to $8 per share following the announcement, then what is the present value of BBB's financial distress costs?arrow_forwardProvide this question solutionarrow_forward

- Please help with this financial accounting questionarrow_forwardThe Rivoli Company has no debt outstanding, and its financial position is given by the following data: What is Rivoli’s intrinsic value of operations (i.e., its unlevered value)? What is its intrinsic stock price? Its earnings per share? Rivoli is considering selling bonds and simultaneously repurchasing some of its stock. If it moves to a capital structure with 30% debt based on market values, its cost of equity, rs, will increase to 12% to reflect the increased risk. Bonds can be sold at a cost, rd, of 7%. Based on the new capital structure, what is the new weighted average cost of capital? What is the levered value of the firm? What is the amount of debt? Based on the new capital structure, what is the new stock price? What is the remaining number of shares? What is the new earnings per share?arrow_forwardAs a financial analyst at JPMorgan Chase, you are analyzing the impact of debt on the value of the firm. Suppose BAC Company has no debt in its capital structure. The company is valued at $300 million. Assume the corporate tax rate is 20%. a. What would be the value of tax shield if it issued $100 million in perpetual debt and repurchased the equity? (sample answer: 200.40) b. What would be the value of the firm if it issued $100 million in perpetual debt and repurchased the equity? ( sample answer: 200.40)arrow_forward

- Qlink ltd is involved in manufacturing of fast -moving consumer goods.The firm is currently an all -equity firm with 30 million shares outstanding and stock price of Kshs.10 per share.The firm plans to announce that it will borrow Ksshs.400 million and use the funds to repurchase shares. The firm will pay interest only on this debt and has no plans to change its debt holding in future. The prevailing corporate tax rate is 30%.(i)What is the market value of the firm's existing existing assets before the announcement?(ii)What is the market value of the firm's assets(including tax shields) just after the debt is issued but before the shares are repurchased?(iii)What is the firm's share price just before the share repurchase?However many shares will Qlink Ltd repurchased?(iv) What are Qlink Ltd's market value balance sheet and share price after share repurchase?arrow_forwardProvide correct calculation for this accounting questionarrow_forwardSolve it correctly please.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT