CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

I need assistance with this question.

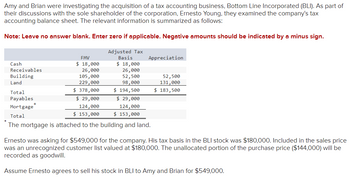

Transcribed Image Text:Amy and Brian were investigating the acquisition of a tax accounting business, Bottom Line Incorporated (BLI). As part of

their discussions with the sole shareholder of the corporation, Ernesto Young, they examined the company's tax

accounting balance sheet. The relevant information is summarized as follows:

Note: Leave no answer blank. Enter zero if applicable. Negative amounts should be indicated by a minus sign.

Cash

Receivables

Building

Land

Total

Payables

FMV

$ 18,000

26,000

105,000

229,000

$ 378,000

Adjusted Tax

Basis

$ 18,000

26,000

52,500

98,000

Appreciation

$ 194,500

52,500

131,000

$ 183,500

$ 29,000

124,000

$ 153,000

Mortgage

Total

$ 29,000

124,000

$ 153,000

The mortgage is attached to the building and land.

Ernesto was asking for $549,000 for the company. His tax basis in the BLI stock was $180,000. Included in the sales price

was an unrecognized customer list valued at $180,000. The unallocated portion of the purchase price ($144,000) will be

recorded as goodwill.

Assume Ernesto agrees to sell his stock in BLI to Amy and Brian for $549,000.

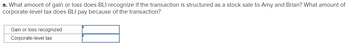

Transcribed Image Text:a. What amount of gain or loss does BLI recognize if the transaction is structured as a stock sale to Amy and Brian? What amount of

corporate-level tax does BLI pay because of the transaction?

Gain or loss recognized

Corporate-level tax

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- I need assistance with finding the answers.arrow_forwardKk.218.arrow_forwardAmy and Brian were investigating the acquisition of a tax accounting business, Bottom Line Inc. (BLI). As part of their discussions with the sole shareholder of the corporation, Ernesto Young, they examined the company's tax accounting balance sheet. The relevant information is summarized as follows: Cash Receivables Building Land Total Payables Mortgage* Total FMV $ 14,000 21,000 94,000 204,000 $333,000 $ 25,000 $ 25,000 108,000 108,000 $133,000 $133,000 Adjusted Basis $ 14,000 Gain or loss recognized Corporate-level tax 21,000 47,000 74,000 $156,000 Show Transcribed Text The mortgage is attached to the building and land. Ernesto was asking for $470,000 for the company. His tax basis in the BLI stock was $150,000. Included in the sales price was an unrecognized customer list valued at $150,000. The unallocated portion of the purchase price ($120,000) will be recorded as goodwill. (Leave no answer blank. Enter zero if applicable.) Assume Ernesto agrees to sell his stock in BLI to Amy…arrow_forward

- Can you please answer this accounting question do fast? Ouirky inc.....arrow_forwardWhich of these businesses would NOT be required to file a balance sheet with the tax return? ORB, a C corporation, with $245,000 in gross receipts and $50,000 in assets. DBS, a partnership, with $275,000 in gross receipts and $150,000 in assets. JAS, an S corporation, with $175,000 in gross receipts and $260,000 in assets. BLA, a C corporation, with $240,000 in gross receipts and $290,000 in assets.arrow_forwardQuestion 1 Nana John is a self-employed as a hairdresser and lives in the UK. She has the following information available for the year ended 2021/22 Trading profit for the year ended 30 June 2021 Nana's statement of profit or loss for the year ended 30th June 2021 is as follows: Income Expenses Depreciation Motor Vehicle Professional fees Property expenses Purchases Other expenses Net profit Note 1 2 3 4 5 £ 2,635 2,200 1,650 12,900 4,700 16,550 £ 63,635 (40,635) 23,000 1. Nana John charges all the running expenses for her motor car to the business. During the year ended 30 June 2021 Nana drove a total of 8,000 miles of which 7,000 were for private journeys. 2. The figure for professional fees includes £1,260 for legal fees in connection with the grant of a new five-year lease of parking spaces for customers' motor cars. 3. Nana lives in a flat that is situated above her hairdressing studio and one-third of the total property expenses of £12,900 relate to this flat. 4. During the year…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College