FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

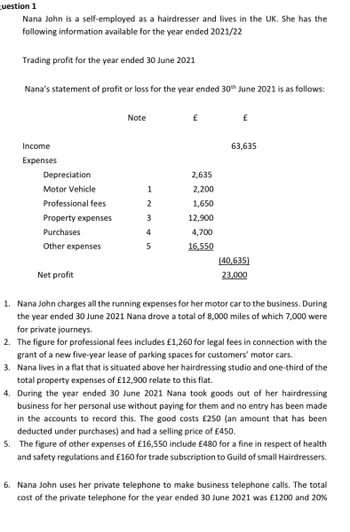

Transcribed Image Text:Question 1

Nana John is a self-employed as a hairdresser and lives in the UK. She has the

following information available for the year ended 2021/22

Trading profit for the year ended 30 June 2021

Nana's statement of profit or loss for the year ended 30th June 2021 is as follows:

Income

Expenses

Depreciation

Motor Vehicle

Professional fees

Property expenses

Purchases

Other expenses

Net profit

Note

1

2

3

4

5

£

2,635

2,200

1,650

12,900

4,700

16,550

£

63,635

(40,635)

23,000

1. Nana John charges all the running expenses for her motor car to the business. During

the year ended 30 June 2021 Nana drove a total of 8,000 miles of which 7,000 were

for private journeys.

2. The figure for professional fees includes £1,260 for legal fees in connection with the

grant of a new five-year lease of parking spaces for customers' motor cars.

3. Nana lives in a flat that is situated above her hairdressing studio and one-third of the

total property expenses of £12,900 relate to this flat.

4. During the year ended 30 June 2021 Nana took goods out of her hairdressing

business for her personal use without paying for them and no entry has been made

in the accounts to record this. The good costs £250 (an amount that has been

deducted under purchases) and had a selling price of £450.

5. The figure of other expenses of £16,550 include £480 for a fine in respect of health

and safety regulations and £160 for trade subscription to Guild of small Hairdressers.

6. Nana John uses her private telephone to make business telephone calls. The total

cost of the private telephone for the year ended 30 June 2021 was £1200 and 20%

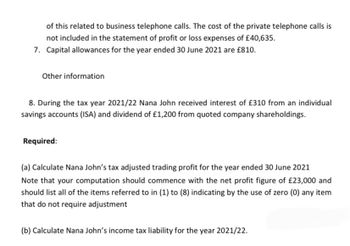

Transcribed Image Text:of this related to business telephone calls. The cost of the private telephone calls is

not included in the statement of profit or loss expenses of £40,635.

7. Capital allowances for the year ended 30 June 2021 are £810.

Other information

8. During the tax year 2021/22 Nana John received interest of £310 from an individual

savings accounts (ISA) and dividend of £1,200 from quoted company shareholdings.

Required:

(a) Calculate Nana John's tax adjusted trading profit for the year ended 30 June 2021

Note that your computation should commence with the net profit figure of £23,000 and

should list all of the items referred to in (1) to (8) indicating by the use of zero (0) any item

that do not require adjustment

(b) Calculate Nana John's income tax liability for the year 2021/22.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Renee operates a proprietorship selling collectibles over the Web. This year, Renee's business reported revenue of $95.5 million and deducted $88.6 million in expenses and loss carryovers. Her business deductions included cost of goods sold of $48.5 million, sales commissions paid of $16.9 million, $10.5 million of interest paid on a mortgage, $10.7 million of depreciation, and $2 million deduction for a net operating loss carryover. a. What is Renee's adjusted taxable income for purposes of calculating the limitation on business interest expense? Note: Do not round intermediate calculations. Enter your answer in millions of dollars rounded to 1 decimal place. Answer is complete but not entirely correct. $ 26.1 million Adjusted Taxable Incomearrow_forwardCameron D., a sole proprietor has the following data in 2021 for the first year of merchandising:Gross sales – P300,000; Cost of Sales – P150,000; Other Income – P50,000; Selling expenses – P20,000; Depreciation expense – P4,000. How much is Cameron’s gross income?arrow_forwardPendleton had the following partial income statement. What is Pendleton's net income if the tax rate is 21%? b Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. $22,500 d $15,775 C $17,775 Sales Cost of goods sold Gross profit Salary expense Rent expense Entertainment $16,275 Business meal with clients Federal income tax Net income $97,000 ($28,000) $69,000 ($41,000) ($5,000) ($2,000) ($1,000) ? ?arrow_forward

- Nanjiarrow_forward[The following information applies to the questions displayed below.] Renee operates a proprietorship selling collectibles over the Web. This year, Renee's business reported revenue of $95.5 million and deducted $88.6 million in expenses and loss carryovers. Her business deductions included cost of goods sold of $48.5 million, sales commissions paid of $16.9 million, $10.5 million of interest paid on a mortgage, $10.7 million of depreciation, and $2 million deduction for a net operating loss carryover. Required: b-1. What is the maximum amount of business interest expense that Renee can deduct this year? b-2. How is the disallowed interest expense (if any) treated? Interest disallowed would be: Complete this question by entering your answers in the tabs below. Required B1 Required B2 What is the maximum amount of business interest expense that Renee can deduct this year? Note: Do not round intermediate calculations. Enter your answer in millions of dollars rounded to 2 decimal places.…arrow_forwardRita owns a sole proprietorship in which she works as a management consultant. She maintains an office in her home (500 square feet) where she meets with clients, prepares bills, and performs other work-related tasks. Her business expenses, other than home office expenses, total $5,720. The following home-related expenses have been allocated to her home office under the actual expense method for calculating home office expenses. Real property taxes $ 1,660 Interest on home mortgage 5,190 Operating expenses of home 830 Depreciation 1,636 Also, assume that, not counting the sole proprietorship, Rita's AGI is $61,200. Rita itemizes deductions, and her itemized deduction for non-home business taxes is less than $10,000 by more than the real property taxes allocated to business use of the home. Assume Rita's consulting business generated $15,300 in gross income. Note: Leave no answer blank. Enter zero if applicable. Required: What is Rita's home office deduction for the current…arrow_forward

- during 2017, Regina, a sole proprietor, had the following income and expenses from herhome jewelry business. Regina is also employed as an office assistant at a local business. W-2 wages from employer$28,000 Proceeds from jewelry sales15,000 Supplies for jewelry5,000 Travel for jewelry1,400 Charitable contributions to church3,000 a.What income or loss should be reported on Schedule C? b.What is Regina's AGI?arrow_forwardManjiarrow_forwardLast year, lana purchased a $100,000 account receivable for $90,000. During the current year, Lucy collected $97,000 on the account. What are the tax consequences to Lucy associated with the collection of the account receivable? No subsequent collections are expected. a.$7,000 gain b.$3,000 loss c.$13,000 loss d.$2,000 gainarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education