EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Need help with this question

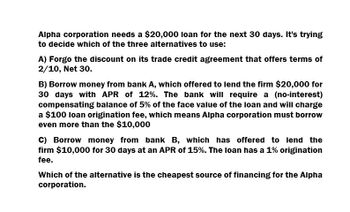

Transcribed Image Text:Alpha corporation needs a $20,000 loan for the next 30 days. It's trying

to decide which of the three alternatives to use:

A) Forgo the discount on its trade credit agreement that offers terms of

2/10, Net 30.

B) Borrow money from bank A, which offered to lend the firm $20,000 for

30 days with APR of 12%. The bank will require a (no-interest)

compensating balance of 5% of the face value of the loan and will charge

a $100 loan origination fee, which means Alpha corporation must borrow

even more than the $10,000

C) Borrow money from bank B, which has offered to lend the

firm $10,000 for 30 days at an APR of 15%. The loan has a 1% origination

fee.

Which of the alternative is the cheapest source of financing for the Alpha

corporation.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Solve this problemarrow_forwardCompany A is currently cash-constrained, and must make a decision about whether to delay paying one of its suppliers, or taking out a loan. They owe the supplier $23345, and they can borrow the money from Bank A, which has offered to lend the firm $23345 for 2 month(s) at an APR (compounded) of 15%. The bank will require a (no-interest) compensating balance of 7% of the face value of the loan and will charge a $216 loan origination fee, which means Hand-to-Mouth must borrow even more than the $23345. Compute the EAR of the loan. Give typing answer with explanation and conclusionarrow_forwardNeed helparrow_forward

- National Co. needs to borrow P300,000 for the next 6 months. The company has a line of credit with a bank that allows the company to borrow funds with a 10% interest rate subject to a 20% of loan compensating balance. Currently, National Co. has no funds on deposit with the bank and will need the loan to cover the compensating balance as well as their other financing needs. How much will National Co. need to borrow?arrow_forwardWrexham Corp. (WC) purchases computer parts from its suppliers 1/15, net 30. However, to take advantage of the discount WC needs to get a bank loan. The bank charges 8% interest (APR) and a one percent origination fee for the loan (assume the loan is for 1 year and is renewed yearly). What is the effective annual cost of not taking the trade discount? What is the effective cost of the bank loan? Should WC take out the bank loan to take advantage of the trade credit?arrow_forwardNonearrow_forward

- NTA Co. needs to borrow P300,000 for the next 6 months. The company has a line of credit with a bank that allows the company to borrow funds with a 10% interest rate subject to a 20% of loan compensating balance. Currently, NTA Co. has no funds on deposit with the bank and will need the loan to cover the compensating balance as well as their other financing needs. How much will NTA Co. need to borrow?arrow_forwardSlingshot Machine Tool Co. owes $40,000 to one of its suppliers. The supplier has offered a trade discount of 2/10 net 30. Slingshot can borrow the funds from either of two banks: First City Bank will loan the funds for 20 days at a cost of $400; Upstart Bank offers a discounted loan for 20 days at a cost of $320. -What is the cost of failing to take the discount? -What is the effective interest rate on each of the loans? -Should Slingshot take the cash discount?-Which bank loan should Slingshot use?arrow_forwardGab Company expects that it will need P600,000 cash for March 2022. Possible means of financing are: (A) Establish a 1-year credit line for P600,000. The bank requires a 2 percent commitment fee. The interest rate is 21 percent. Funds are needed for 30 days. (B) Fail to take a 2/10, net/40 discount on a P600,000 credit purchase. (C) Issue P600,000, 20 percent commercial paper for 30 days. Which financing strategy should be selected? Provide solution a. Strategy Ab. Strategy Bc. Strategy Cd. Strategy A and Be. Strategy B and Carrow_forward

- State Federal Bank (SFB) offers two borrowing options to businesses: (1) a simple interest loan with a 7 percent interest rate and no compensating balance and (2) a discount interest loan with a quoted rate equal to 5 percent that requires a 20 percent compensating balance. If a firm needs a nine-month loan, which option should it choose based on rEAR? Assume the firm normally maintains a negligible checking account balance at the bank. Assume there are 360 days in a year. Do not round intermediate calculations. Round your answers to two decimal places. Option 1, rEAR: % Option 2, rEAR: % Based on rEAR, should be chosen.arrow_forwardAssume the credit terms offered to your firm by your suppliers are 2/10, net 50. Calculate the cost of the trade credit if your firm does not take the discount and pays on day 50. (Hint: Use a 365-day year.)The main reason that your firm has to pass on the discount and pay on the last allowed day (day 40), is lack of liquidity. The CFO is debating whether to borrow from a local bank, so that your firm has the cash sooner to take advantage of the trade credit. The best interest rate your firm can get from the local bank is 20% EAR. Should your firm borrow from the bank to take advantage of the trade credit? I got the correct answer to be 20.25% i need help on the steps to get this answer.arrow_forwardSolve this onearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning