Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Provide solution for this question

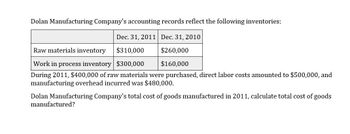

Transcribed Image Text:Dolan Manufacturing Company's accounting records reflect the following inventories:

Dec. 31, 2011 Dec. 31, 2010

Raw materials inventory

$310,000

$260,000

Work in process inventory $300,000

$160,000

During 2011, $400,000 of raw materials were purchased, direct labor costs amounted to $500,000, and

manufacturing overhead incurred was $480,000.

Dolan Manufacturing Company's total cost of goods manufactured in 2011, calculate total cost of goods

manufactured?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Glasson Manufacturing Co. produces only one product. You have obtained the following information from the corporations books and records for the current year ended December 31, 2016: a. Total manufacturing cost during the year was 1,000,000, including direct materials, direct labor, and factory overhead. b. Cost of goods manufactured during the year was 970,000. c. Factory Overhead charged to Work in Process was 75% of direct labor cost and 27% of the total manufacturing cost. d. The beginning Work in Process inventory, on January 1, was 40% of the ending Work in Process inventory, on December 31. e. Material purchases were 400,000 and the ending balance in Materials inventory was 60,000. No indirect materials were used in production. Required: Prepare a statement of cost of goods manufactured for the year ended December 31 for Glasson Manufacturing. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information.)arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 2.70 is direct materials and 5.30 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardOrinder Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 275,800, direct labor cost was 153,000, and overhead cost was 267,300. There were 25,000 units produced. Unit manufacturing cost (rounded to the nearest cent) is a. 28.40 b. 27.98 c. 34.95 d. 27.55arrow_forward

- Wyandotte Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 256,900, direct labor cost was 176,000, and overhead cost was 308,400. There were 40,000 units produced. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 6.62 is direct materials and 7.71 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forwardPrepare a cost of goods sold budget for MacLaren Manufacturing Inc. for the year ended December 31, 2016, from the following estimates. Inventories of production units: Direct materials purchased during the year, 548,000; beginning inventory of direct materials, 36,000; and ending inventory of direct materials, 23,000. Totals from other budgets included:arrow_forwardDuring the year, a company purchased raw materials of $77,321, and incurred direct labor costs of $125,900. Overhead is applied at the rate of 75% of the direct labor cost. These are the inventory balances: Compute the cost of materials used in production, the cost of goods manufactured, and the cost of goods sold.arrow_forward

- The following data were taken from the records of a Company: Raw Materials Inventory, 09/30/2011 - $50,000 Work in Progress, 08/31/2011 - $80,000 Work in Progress, 09/30/2011 - $95,000 Finished Goods, 08/31/2011 - $60,000 Finished Goods, 09/30/2011 - $78,000 Raw materials purchases, $46,000 Factory overhead, 75% of direct labor cost, $63,000 Selling and administrative expenses, 12.5% of sales, $25,000 Net income for September 2011, $25,000 What is the cost of raw materials inventory on August 31, 2011?arrow_forwardOgleby Inc's accounting records reflect the following inventories: Dec. 31. 2016 T Dec 31, 2017 Raw materials inventory $120,000 $96.000 Work in process inventory 156,000 174,000 Finished goods inventory 138.000 150,000 During 2017, Ogleby purchased $890,000 of raw materials, incurred direct labor costs of $175,000, and incurred manufacturing overhead totaling $224,000. How much is total manufacturing costs incurred during 2017 for Ogleby? $1,403,000 $1,313,000 $1,385,000 $1,379,000arrow_forwardBenson Inc.'s accounting records reflect the following inventories: Dec. 31, 2016 Dec. 31, 2017 Raw materials inventory $ 80,000 $ 64,000 Work in process inventory 104,000 116,000 Finished goods inventory 100,000 92,000 During 2017, Benson purchased $1,450,000 of raw materials, incurred direct labor costs of $250,000, and incurred manufacturing overhead totaling $160,000.How much raw materials were transferred to production during 2017 for Benson? Select one: A. $1,386,000 B. $1,450,000 C. $1,466,000 D. $1,434,000arrow_forward

- Benson Inc.'s accounting records reflect the following inventories: Dec. 31, 2016 $ 80,000 Dec. 31, 2017 $ 64,000 Raw materials inventory Work in process 104,000 116,000 inventory Finished goods inventory 100,000 92,000 During 2017, Benson purchased $1,450,000 of raw materials, incurred direct labor costs of $250,000, and incurred manufacturing overhead totaling $160,000. Assume Benson's cost of goods manufactured for 2017 amounted to $1,660,000. How much would it report as cost of goods sold for the year? O a) $1,760,000 b) $1,668,000 c) $1,568,000 d) $1,652,000arrow_forward. Pan Company's accounting records reflect the following inventories: Dec. 31, 2016 $260,000 160,000 150,000 Raw materials inventory Work in process inventory Finished goods inventory Dec. 31, 2017 $310,000 300,000 190,000 During 2017, $800,000 of raw materials were purchased, direct labor costs amounted to $670,000, and manufacturing overhead incurred was $640,000. The total raw materials available for use during 2017 for Pan Company isarrow_forwardThe following information was obtained from the records of Martinez Corporation during 2018. 1. Manufacturing overhead was applied at a rate of 175 percent of direct labor dollars. 2. Beginning value of inventory follows: a. Beginning Work in Process Inventory, $32,000. b. Beginning Finished Goods Inventory, $15,000. 3. During the period, Work in Process Inventory decreased by 25 percent and Finished Goods Inventory increased by 30 percent. 4. Actual manufacturing overhead costs were $105,000. 5. Sales were $750,000. 6. Adjusted Cost of Goods Sold was $325,000. Required: Use the preceding information to find the missing values in the following table: Item Direct Materials Used Direct Labor Manufacturing Overhead Applied Current Manufacturing Costs Plus: Beginning Work in Process Inventory Less: Ending Work in Process Inventory Cost of Goods Manufactured Plus: Beginning Finished Goods Inventory Less: Ending Finished Goods Inventory Unadjusted Cost of Goods Sold Overhead Adjustment…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College