Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Given correct answer general Accounting

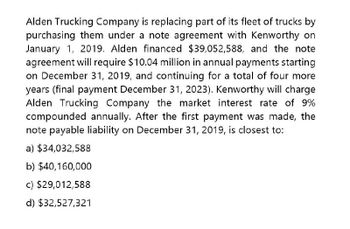

Transcribed Image Text:Alden Trucking Company is replacing part of its fleet of trucks by

purchasing them under a note agreement with Kenworthy on

January 1, 2019. Alden financed $39,052,588, and the note

agreement will require $10.04 million in annual payments starting

on December 31, 2019, and continuing for a total of four more

years (final payment December 31, 2023). Kenworthy will charge

Alden Trucking Company the market interest rate of 9%

compounded annually. After the first payment was made, the

note payable liability on December 31, 2019, is closest to:

a) $34,032,588

b) $40,160,000

c) $29,012,588

d) $32,527,321

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2019, Mopps Corp. agrees to provide Conklin Company 3 years of cleaning and janitorial services. The contract sets the price at 12,000 per year, which is the normal standalone price that Mopps charges. On December 31, 2020, Mopps and Conklin agree to modify the contract. Mopps reduces the fee for the third year to 10,000, and Conklin agrees to a 4-year extension that will extend services through December 31, 2024, at a price of 15,000 per year. At the time that the contract is modified, Mopps is charging other customers 13,500 for the cleaning and janitorial service. Required: Should Mopps and Conklin treat the modification as a separate contract? If so how should Mopps account for the contract modification on December 31, 2020? Support your opinion by discussing the application to this case of the factors that need to be considered for determining the accounting for contract modifications.arrow_forwardSpath Company borrows 75,000 by issuing a 4-year, noninterest-bearing note to a customer on January 1, 2019. In addition, Spath agrees to sell inventory to the customer at reduced prices over a 5-year period. Spaths incremental borrowing rate is 12%. The customer agrees to purchase an equal amount of inventory each year over the 5-year period so that a straight-line method of revenue recognition is appropriate. Required: Prepare the journal entries on Spaths books for 2019 and 2020. (Round answers to 2 decimal places.)arrow_forwardOn March 1, 2019, Elkhart enters into a new contract to build a specialized warehouse for 7 million. The promise to transfer the warehouse is determined to be a performance obligation. The contract states that if the warehouse is usable by November 30, 2019, Elkhart will receive a bonus of 600,000. For every week after November 30 that the warehouse is not usable, the bonus will decrease by 150,000. Elkhart provides the following completion schedule: Required: 1. Assume that Elkhart uses the expected value approach. What amount should Elkhart use for the transaction price? 2. Assume that Elkhart uses the most likely amount approach. What amount should Elkhart use for the transaction price? 3. Next Level What is the purpose of assessing whether a constraint on the variable consideration exists?arrow_forward

- The Moustache Company is replacing most of the windows in its Alden factory by purchasing them under a note agreement with the Blattner Window Design Company on January 1, 2019. Moustache financed $37,908,000, and the note agreement will require $10 million in annual payments starting on December 31, 2019 and continuing for a total of four more years(final payment December 31, 2023). Blattner will charge Moustache the market interest rate of 10% compounded annually. What is the amount of the 2020 interest expense? A. $3,290,800 B. $2,790,800 C. $4,000,000 D. $3,169,880arrow_forwardDBC Company has received a confirmation letter from the First National Bank of Miami (FNBM) about a line of credit for $12,000,000 on January 2, 2020. According to the terms of this short-term loan, DBC Company will be charged the following: A. ABC will be charged for 50 basis points interest (on an annual basis) for any unused amount of credit from the commencement of this agreement. B. Upon usage of any funds, the interest charge will be Prime rate plus 75 basis points. Prime rate at the commencement of this loan on January 2, 2020, was 5.25%. C. The following events took place in 2020: 1) On February 1, 2020; DBC Co., used $4,000,000 against its line of credit for its working capital purposes. 2) On May 1, 2020; DBC Co., used an additional $2,400,000 to purchase fixed assets. 3) On June 1, 2020, upon the meeting of F.O.M.C., the Fed announced its "Quantitative Easiness" policy and reduced the discount rate by 0.50 basis points. Immediately FNBM bank reflected the same reduction to…arrow_forwardUse the following information for the next two questions. Funan Industries purchases new specialized manufacturing equipment on July 1, 2019. The equipment cash price is P79,000. Funan signs a deferred payment contract that provides for a down payment of P10,000 and an 8-year note for P103,472. The note is to be paid in 8 equal annual payments of P12,934. The payments include 10% interest and are made on June 30 of each year, beginning June 30, 2020. (1) The carrying amount of the note payable on December 31, 2020 is a. P66,115 b. P62,966 c. P59,818 d. P56,329 (2) The total interest expense for the year ended December 31, 2020 is a. P6,900 b. P6,612 c. P6,599 d. P5,982arrow_forward

- On January 1, 2020, Coleman Auto sold a Tracktor to Southern Energy in exchange for a 5-year zero-interest-bearing note with a face amount of $135,000, due January 1, 2025. Coleman’s credit rating makes it eligible to borrow money at 3% interest. Southern Energy’s credit rating makes it eligible to borrow money at 5% interest compounded annually from local banks. Coleman’s inventory records show the truck’s original cost at $80,000. Instructions: Record all business transactions for 2020 related to the Sale and Coleman’s accounting records, assuming Colemans has a December 31, 2020 year-end.arrow_forwardOn December 31, 2021, Park Company sold used equipment with carrying amount of 2,000,000 in exchange for noninterest-bearing note of 5,000,000 requiring ten annual payments of 500,000. The first payment was made on December 31, 2022. The market interest for similar note was 12%. What is the carrying amount of the note receivable on December 31, 2021?arrow_forwardWhat is the carrying amount of the loan receivable on December 31, 2022? Beach Bank loaned Boracay Company P7,500,000 on January 1, 2019. The terms of the loan were payment in full on January 1, 2023 plus annual interest payment at 11%. The interest payment was made as scheduled on January 1, 2020. However, due to financial setbacks, Boracay Company was unable to make the 2021 interest payment. Beach Company considered the loan impaired and projected the cash flows from the loan on December 31, 2021. The bank accrued the interest on December 31, 2020, but did not continue to accrue interest for 2021 due to the impairment of the loan. The projected cash flows are: Date of cash flow Amount projected on December 31, 2021 December 31, 2022 500,000 1,000,000 December 31, 2023 December 31, 2024 December 31, 2025 2,000,000 4,000,000 The PV of 1 at 11% is 0.90 for one period, 0.81 for two periods, 0.73 for three periods, and 0.66 for four periods. a. 7,000,000 b. 5,449,600 c. 4,860,000 d.…arrow_forward

- On January 1, 2019, Fulton Inc. enters into a contract with Gibson to deliver goods. Gibson pays $100,000 at the time the contract is signed, at which time the goods are transferred and Fulton’s performance obligation is complete. In addition, Gibson agrees to pay Fulton $100,000 on December 31, 2019, and December 31, 2020. If Fulton entered into a financing arrangement with Gibson it would charge an interest rate of 9%. Please assist with the journal entries. Thank you! There are 8 journal entries in all.arrow_forwardPharoah Inc. has decided to purchase equipment from Central Michigan Industries on January 2, 2020, to expand its production capacity to meet customers' demand for its product. Pharoah issues a(n) $1,520,000, 5-year, zero-interest- bearing note to Central Michigan for the new equipment when the prevailing market rate of interest for obligations of this nature is 12%. The company will pay off the note in five $304,000 installments due at the end of each year over the life of the note. Prepare the journal entry at the date of purchase.arrow_forwardNovak Inc. has decided to purchase equipment from Central Michigan Industries on January 2, 2020, to expand its production capacity to meet customers’ demand for its product. Novak issues a(n) $560,000, 5-year, zero-interest-bearing note to Central Michigan for the new equipment when the prevailing market rate of interest for obligations of this nature is 12%. The company will pay off the note in five $112,000 installments due at the end of each year over the life of the note.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning