Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

thumb_up100%

Chapter 17, Problem 13E

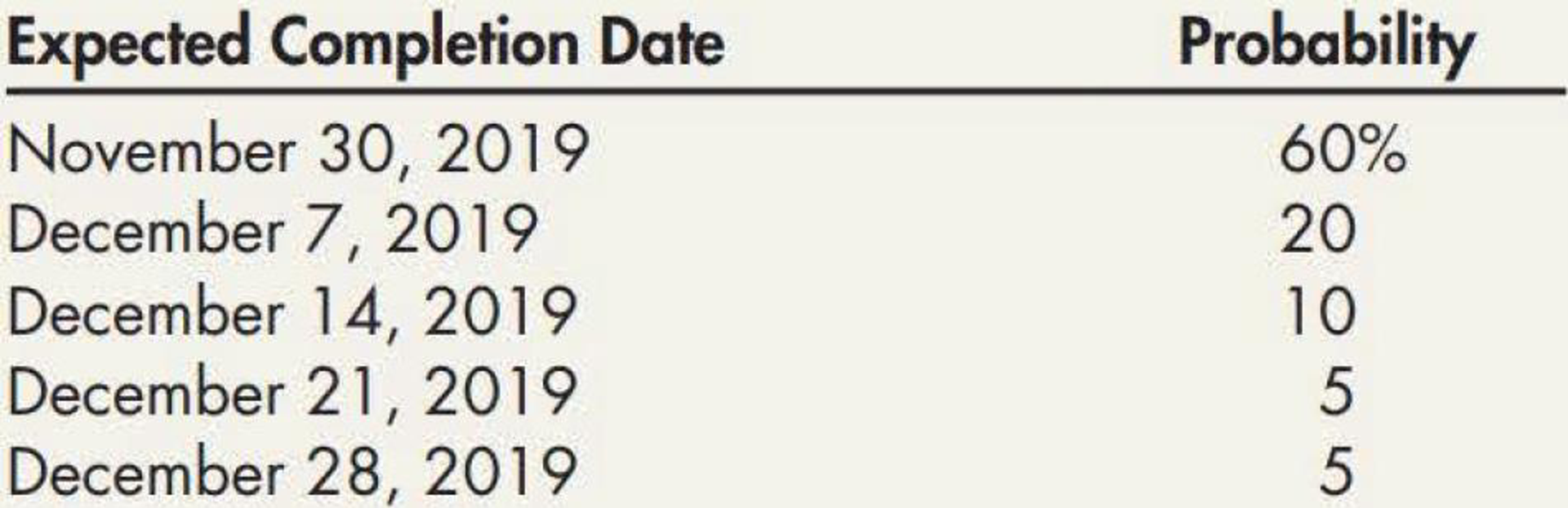

On March 1, 2019, Elkhart enters into a new contract to build a specialized warehouse for $7 million. The promise to transfer the warehouse is determined to be a performance obligation. The contract states that if the warehouse is usable by November 30, 2019, Elkhart will receive a bonus of $600,000. For every week after November 30 that the warehouse is not usable, the bonus will decrease by $150,000. Elkhart provides the following completion schedule:

Required:

- 1. Assume that Elkhart uses the expected value approach. What amount should Elkhart use for the transaction price?

- 2. Assume that Elkhart uses the most likely amount approach. What amount should Elkhart use for the transaction price?

- 3. Next Level What is the purpose of assessing whether a constraint on the variable consideration exists?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

General Accounting

Solve this question

Given answer general Accounting

Chapter 17 Solutions

Intermediate Accounting: Reporting And Analysis

Ch. 17 - Prob. 1GICh. 17 - Prob. 2GICh. 17 - When a company recognizes revenue during a period,...Ch. 17 - Prob. 4GICh. 17 - Prob. 5GICh. 17 - What is the proper accounting for a wholly...Ch. 17 - If a seller enters into more than one contract...Ch. 17 - Prob. 8GICh. 17 - Prob. 9GICh. 17 - Prob. 10GI

Ch. 17 - Prob. 11GICh. 17 - Prob. 12GICh. 17 - Prob. 13GICh. 17 - Prob. 14GICh. 17 - Prob. 15GICh. 17 - Prob. 16GICh. 17 - If the standalone selling price of a good or...Ch. 17 - Prob. 18GICh. 17 - Prob. 19GICh. 17 - If the sellers performance creates on asset (e.g.,...Ch. 17 - Describe input and output methods used to measure...Ch. 17 - Prob. 22GICh. 17 - Prob. 23GICh. 17 - Prob. 24GICh. 17 - Prob. 25GICh. 17 - A company should recognize revenue when a. the...Ch. 17 - A contract between one or more parties creates: a....Ch. 17 - Morgan Company and its customer agree to modify...Ch. 17 - Chlorine Corp. has a contract to deliver pool...Ch. 17 - Prob. 5MCCh. 17 - Prob. 6MCCh. 17 - In accounting for a long-term construction...Ch. 17 - Prob. 9MCCh. 17 - Prob. 10MCCh. 17 - CustomTee Inc. contracts with various customers to...Ch. 17 - Yankee Corp. agrees to provide Albany Company 24...Ch. 17 - Prob. 3RECh. 17 - Prob. 4RECh. 17 - LongDrive sells a specialized golf club that has...Ch. 17 - Prob. 6RECh. 17 - VolleyElite runs a volleyball program consisting...Ch. 17 - Enterprise Solutions Inc. licenses its...Ch. 17 - Prob. 9RECh. 17 - Magical Memories sells Florida theme park vacation...Ch. 17 - Prob. 11RECh. 17 - Robotics Inc. contracts with a customer to build a...Ch. 17 - CoolShoes sells its elite tennis shoes to sports...Ch. 17 - Using the information in RE17-13, what journal...Ch. 17 - GameDay sells recreational vehicles along with...Ch. 17 - Prob. 16RECh. 17 - Using the information provided in RE17-16, prepare...Ch. 17 - Prob. 18RECh. 17 - Prob. 19RECh. 17 - Company enters into a contract with Dearborn Inc....Ch. 17 - Consider each of the following scenarios: a. A...Ch. 17 - On August 1, 2019, Aiken Corp. enters into a...Ch. 17 - On January 1, 2019, Spring Fashions Inc. enters...Ch. 17 - On January 1, 2019, Loud Company enters into a...Ch. 17 - Assume the same facts as in El7-5. On July 1,...Ch. 17 - Assume the same facts as in E17-5 and ignore...Ch. 17 - Prob. 8ECh. 17 - GrillMaster Inc. sells an industry-leading line of...Ch. 17 - WaterWorld Inc. operates an aquarium and water...Ch. 17 - Prob. 11ECh. 17 - Jonas Consulting enters into a contract to provide...Ch. 17 - On March 1, 2019, Elkhart enters into a new...Ch. 17 - On January 5, 2019, ShoeKing Corp. sells for cash...Ch. 17 - On January 1, 2019, Piper Company entered into an...Ch. 17 - On January 1, 2019, Fulton Inc. enters into a...Ch. 17 - Prob. 17ECh. 17 - On December 1, 2019, AwakcAllNight Inc. sells...Ch. 17 - Rix Company sells home appliances and provides...Ch. 17 - Assume the same facts as in E17-19, except that...Ch. 17 - Crazy Computer Store sells a back-to-school bundle...Ch. 17 - Each of the following is an independent situation...Ch. 17 - Prob. 23ECh. 17 - Prob. 24ECh. 17 - Koolman Construction Company began work on a...Ch. 17 - Prob. 26ECh. 17 - Each of the following independent situations...Ch. 17 - JustKitchens Inc. provides services to restaurants...Ch. 17 - On January 1, 2019, ForeRunner Inc. enters into a...Ch. 17 - January 2, 2019, TI enters into a contract with...Ch. 17 - Prob. 5PCh. 17 - Prob. 6PCh. 17 - Fender Construction Company receives a contract to...Ch. 17 - SoccerHawk Merchandise Inc. enters into a 6-month...Ch. 17 - Prob. 9PCh. 17 - Prob. 10PCh. 17 - Blackmon Company provides locator services to the...Ch. 17 - Prior to ASU 2014-09 changing the principles...Ch. 17 - The first step in the revenue recognition process...Ch. 17 - Prob. 3CCh. 17 - One of the more difficult issues that companies...Ch. 17 - Prob. 5CCh. 17 - On October 1, 2019, Grahams WeedFeed Inc. signs a...Ch. 17 - On January 1, 2019, Mopps Corp. agrees to provide...Ch. 17 - Prob. 8CCh. 17 - Revenue for a company is recognized for accounting...Ch. 17 - Prob. 10C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Revenue recognition explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=816Q6pOaGv4;License: Standard Youtube License