Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

What is the PE ratio of this financial accounting question?

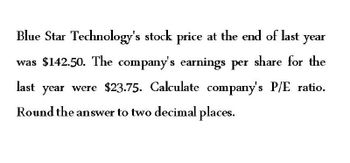

Transcribed Image Text:Blue Star Technology's stock price at the end of last year

was $142.50. The company's earnings per share for the

last year were $23.75. Calculate company's P/E ratio.

Round the answer to two decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the market price per share for Rebert is 51.50. Required: 1. Compute the dollar amount of preferred dividends. 2. Compute the number of common shares. 3. Compute earnings per share. (Note: Round to two decimals.) 4. Compute the price-earnings ratio. (Note: Round to the nearest whole number.)arrow_forwardCrane Jewelers management announced that the company had net earnings of $4,356,000 for this year. The company has 1,613,000 shares outstanding, and the year-end stock price is $68.91. What are Crane’s earnings per share and P/E ratio? (Round answers to 2 decimal places, e.g. 12.25)arrow_forwardSong Corp's stock price at the end of last year was $27.75 and its earnings per share for the year were $1.30. What was its P/E ratio?arrow_forward

- You have found the following historical information for the Daniela Company: Stock price EPS Year 1 Year 2 Year 3 Year 4 $49.24 2.59 $67.43 $61.19 $67.07 2.65 2.82 2.81 Earnings are expected to grow at 8 percent for the next year. What is the PE ratio for each year? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) Year 1 Year 2 Year 3 Year 4 What is the average PE ratio over this period? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Average PE Using the company's historical average PE as a benchmark, what is the target stock price in one year? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Target pricearrow_forwardSong Corp's stock price at the end of last year was $28.75 and its earnings per share for the year were $1.30. What was its P/E ratio? a. 27.64 b. 22.12 c. 17.69 d. 23.00 e. 18.80arrow_forwardA company expects EPS to be $2.52 next year. The industry average P/E ratio is 23.99 and Enterprise multiple is 7.57. The EBITDA for the company is $22.97 million. What is an estimate of the stock price using the method of comparables for P/E multiples? Round your answer to two (2) decimal places.arrow_forward

- PQR Co. has earnings of $2.65 per share. The benchmark PE for company is 22. What stock price (to two decimals) would you consider appropriate?arrow_forwardSmith Inc. has announced net earnings of $877,500 for this year. The company has 325,660 shares outstanding, and the year-end stock price is $50.48. What are the company’s earnings per share and P/E ratio? a. EPS: $2.69; P/E: 18.77 times b. EPS: $0.37; P/E: 18.77 times c. EPS: $0.37; P/E: 10.55 times d. EPS: $2.69; P/E: 10.55 timesarrow_forwardLast year, Big W Company reported earnings per share of $3.50 when its stock was selling for $87.50. If its earnings this year increase by 10 percent and the P/E ratio remains constant, what will be the price of its stock? (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Stock Pricearrow_forward

- I need answer of this question solution accountingarrow_forwardAt the beginning of the year, you purchased a share of stock for $51.64. Over the year the dividends paid on the stock were $3.26 per share. Calculate the return if the price of the stock at the end of the year is $50.24. (Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places. (e.g., 32.16))arrow_forwardFedEx Corp. stock ended the previous year at $120.19 per share. It paid a $1.50 per share dividend last year. It ended last year at $123.49. If you owned 440 shares of FedEx, what was your dollar return and percent return? (Round "Percent return" to 2 decimal places.) Dollar return Percent returnarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College