Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

PLEASE HELPPPPP

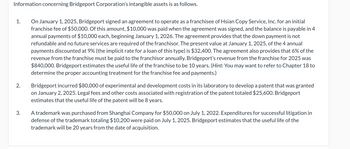

Transcribed Image Text:Information concerning Bridgeport Corporation's intangible assets is as follows.

1.

2.

3.

On January 1, 2025, Bridgeport signed an agreement to operate as a franchisee of Hsian Copy Service, Inc. for an initial

franchise fee of $50,000. Of this amount, $10,000 was paid when the agreement was signed, and the balance is payable in 4

annual payments of $10,000 each, beginning January 1, 2026. The agreement provides that the down payment is not

refundable and no future services are required of the franchisor. The present value at January 1, 2025, of the 4 annual

payments discounted at 9% (the implicit rate for a loan of this type) is $32,400. The agreement also provides that 6% of the

revenue from the franchise must be paid to the franchisor annually. Bridgeport's revenue from the franchise for 2025 was

$840,000. Bridgeport estimates the useful life of the franchise to be 10 years. (Hint: You may want to refer to Chapter 18 to

determine the proper accounting treatment for the franchise fee and payments.)

Bridgeport incurred $80,000 of experimental and development costs in its laboratory to develop a patent that was granted

on January 2, 2025. Legal fees and other costs associated with registration of the patent totaled $25,600. Bridgeport

estimates that the useful life of the patent will be 8 years.

A trademark was purchased from Shanghai Company for $50,000 on July 1, 2022. Expenditures for successful litigation in

defense of the trademark totaling $10,200 were paid on July 1, 2025. Bridgeport estimates that the useful life of the

trademark will be 20 years from the date of acquisition.

Transcribed Image Text:(a)

Your answer is partially correct.

Prepare a schedule showing the intangible assets section of Bridgeport's balance sheet at December 31, 2025.

Franchise

Patent

Trademark

BRIDGEPORT CORPORATION

Intangible Assets

December 31, 2025

Total Intangible Assets

+A

+A

$

38160

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Prepare a schedule showing all expenses resulting from the transactions that would appear on Concord's income statement for the year ended December 31, 2025. CONCORD CORPORATION Expenses Resulting from Selected Intangible Assets Transactions $arrow_forwardPrepare a schedule showing the intangible assets section of Cheyenne's balance sheet at December 31, 2020. CHEYENNE CORPORATION Intangible Assets Prepare a schedule showing all expenses resulting from the transactions that would appear on Cheyenne's income statement for the year ended December 31, 2020. CHEYENNE CORPORATION Expenses Resulting from Selected Intangible Assets Transactions < <arrow_forwardInformation concerning Blue Corporation's intangible assets is as follows. On January 1, 2025, Blue signed an agreement to operate as a franchisee of Hsian Copy Service, Inc. for an initial franchise fee of $100,000. Of this amount, $20,000 was paid when the agreement was signed, and the balance is payable in 4 annual payments of $20,000 each, beginning January 1, 2026. The agreement provides that the down payment is not refundable and no future services are required f the franchisor. The present value at January 1, 2025, of the 4 annual payments discounted at 15% (the implicit rate for a loan of this type) is $57,100. The agreement also provides that 5% of the revenue from the franchise must be paid to the franchisor annually. Blue's revenue from the franchise for 2025 was $870,000. Blue estimates the useful life of the franchise to be 10 years. (Hint: You may want to refer to Chapter 18 to determine the proper accounting treatment for the franchise fee and payments.) Blue incurred…arrow_forward

- Information concerning Cheyenne Corporation’s intangible assets is as follows. 1. On January 1, 2020, Cheyenne signed an agreement to operate as a franchisee of Hsian Copy Service, Inc. for an initial franchise fee of $50,000. Of this amount, $10,000 was paid when the agreement was signed, and the balance is payable in 4 annual payments of $10,000 each, beginning January 1, 2021. The agreement provides that the down payment is not refundable and no future services are required of the franchisor. The present value at January 1, 2020, of the 4 annual payments discounted at 10% (the implicit rate for a loan of this type) is $31,700. The agreement also provides that 4% of the revenue from the franchise must be paid to the franchisor annually. Cheyenne’s revenue from the franchise for 2020 was $900,000. Cheyenne estimates the useful life of the franchise to be 10 years. (Hint:You may want to refer to Chapter 18 to determine the proper accounting treatment for the franchise fee and…arrow_forwardInformation concerning Blue Corporation’s intangible assets is as follows. 1. On January 1, 2020, Blue signed an agreement to operate as a franchisee of Hsian Copy Service, Inc. for an initial franchise fee of $57,500. Of this amount, $11,500 was paid when the agreement was signed, and the balance is payable in 4 annual payments of $11,500 each, beginning January 1, 2021. The agreement provides that the down payment is not refundable, and no future services are required of the franchisor. The present value at January 1, 2020, of the 4 annual payments discounted at 10% (the implicit rate for a loan of this type) is $36,450. The agreement also provides that 5% of the revenue from the franchise must be paid to the franchisor annually. Blue’s revenue from the franchise for 2020 was $840,000. Blue estimates the useful life of the franchise to be 10 years. (Hint: You may want to refer to Chapter 18 to determine the proper accounting treatment for the franchise fee and payments.)…arrow_forwardInformation concerning Sandro Corporation's intangible assets is as follows. 1. On January 1, 2020, Sandro signed an agreement to operate as a franchisee of Hsian Copy Service, Inc. for an initial franchise fee of $75,000. Of this amount, $15,000 was paid when the agreement was signed, and the balance is payable in 4 annual payments of $15,000 each, beginning January 1, 2021. The agreement provides that the down payment is not refundable and no future services are required of the franchisor. The present value at January 1, 2020, of the 4 annual payments discounted at 14% (the implicit rate for a loan of this type) is $43,700. The agreement also provides that 5% of the revenue from the franchise must be paid to the franchisor annually. Sandro's revenue from the franchise for 2020 was $900,000. Sandro estimates the useful life of the franchise to be 10 years. (Hint: You may want to refer to Chapter 18 to determine the proper accounting treatment for the franchise fee and payments.) 2.…arrow_forward

- Information concerning Adnan Corporation’s intangible assets is as follows. (a) On January 1, 2019, Adnan signed an agreement to operate as a franchisee of Hamed Copy Service, Inc. for an initial franchise fee of R$95,000. Of this amount, R$19,000 was paid when the agreement was signed, and the balance is payable in 4 annual payments of R$19,000 each, beginning January 1, 2020. The agreement provides that the down payment is not refundable and no future services are required of the franchisor. The present value at January 1, 2019, of the 4 annual payments discounted at 14% (the implicit rate for a loan of this type) is R$55,350. The agreement also provides that 5% of the revenue from the franchise must be paid to the franchisor annually. Adnan estimates the useful life of the franchise to be 10 years. (b) Adnan incurred R$85,000 of experimental and development costs in its laboratory to develop a patent that was granted on January 2, 2019. Legal fees and other costs associated with…arrow_forwardInformation concerning Haengbok's intangible assets is as follows. 1. On January 1, 2019, Haengbok signed an agreement to operate as a franchisee of CHIR DAK for an initial franchise fee of $150,000. Of this amount, $30,000 was paid when the agreement was signed, and the balance is payable in annual payments of $30,000 each, beginning January 1, 2020. The agreement provides that the down payment is not refundable and no future services are required of the franchisor. The present value at January 1, 2019, of the four annual payments discounted at 14% (the implicit rate for a loan of this type) is $87,400. Haengbok estimates the useful life of the franchise to be 10 years. 2. Haengbok incurred $130,000 of experimental and development costs in its laboratory to develop a patent that was granted on January 2, 2019. Legal fees and other costs associated with registration of the patent totaled $35,200. Haengbok estimates that the useful life of the patent will be 8 years. The patent has yet…arrow_forwardInformation concerning Tully Corporation's intangible assets is asfollows:a. On January 1, 2019, Tully signed an agreement to operate as afranchisee of Rapid Copy Service Inc. for an initial franchise fee of$85,000. Of this amount, $25,000 was paid when the agreement was signed, and the balance is payable in 4 annual payments of $15,000each beginning January 1, 2020. The agreement provides that thedown payment is not refundable and no future services arerequired of the franchisor. The present value at January 2, 2019, ofthe 4 annual payments discounted at 14% (the implicit rate for a loan of this type) is $43,700. The agreement also provides that 5%of the revenue from the franchise must be paid to the franchisorannually. Tully's revenue from the franchise for 2019 was $900,000.Tully estimates the useful life of the franchise to be 10 years. b. Tully incurred $78,000 of experimental and development costs inits laboratory to develop a patent, which was granted on January 2, 2019. Legal…arrow_forward

- You noted the following items relative to the company's intangibles assets of Pete Corporation at December 31, 2022. On January 2021, Pete signed an agreement to operate as franchisee of Clear Copy Service, Inc., for an initial franchise of P680,000. Of this amount, P200,000 was paid when the agreement was signed and the balance was payable in four annual payment of P120,000 each beginning on January 1, 2022. The agreement provides that the down payment is not refundable and no future services are required in the franchisor. The implicit rate for loan of this type is 14%. Discount factors of 14% for four years for ordinary annuity and annuity due are 2.9137 and 3.3216, respectively. The agreement also provides that 5% of the revenue from the franchise must be paid to the franchisor annually. Pete's revenue from the franchise for 2022 was P8,000,000. Pete estimates the useful life of the franchise to be ten years. Pete incurred P624,000 of experimental development costs in its…arrow_forwardDo not give answer in imagearrow_forward. The following information pertains to Best Food (BF) Company’s intangible assets: a. On January 1, 2020, BF signed an agreement to operate as a franchisee of Macky’s Food Chain for an initial franchise fee of P1,500,000. Of this amount, P300,000 was paid when the agreement was signed and the balance is payable in 4 annual payments of P300,000 each, beginning January 1, 2021. The agreement provides that the down payment is not refundable and no future services are required of the franchisor. The present value at January 1, 2020 of the 4 annual payments discounted at 14% (the implicit rate for a loan of this type) is P874,000. The agreement also provides that 5% of the revenue from the franchise must be paid to the franchisor annually. BF’s revenue from the franchise for 2020was P19 million. BF estimates the useful life of the franchise to be 10 years. b. BF incurred P1,300,000 of experimental and developmental costs in its laboratory to develop a patent which was granted on January 2,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning