FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

I don't need ai answer accounting questions

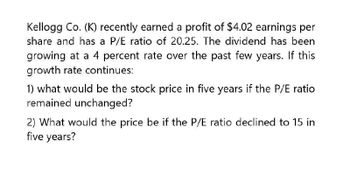

Transcribed Image Text:Kellogg Co. (K) recently earned a profit of $4.02 earnings per

share and has a P/E ratio of 20.25. The dividend has been

growing at a 4 percent rate over the past few years. If this

growth rate continues:

1) what would be the stock price in five years if the P/E ratio

remained unchanged?

2) What would the price be if the P/E ratio declined to 15 in

five years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- New York Times Co. (NYT) recently earned a profit of $1.61 per share and has a P/E ratio of 19.40. The dividend has been growing at a 9.25 percent rate over the past six years. If this growth rate continues, what would be the stock price in five years if the P/E ratio remained unchanged? What would the price be if the P/E ratio increased to 26 in five years? (Round your answers to 2 decimal places.) Stock price Stock price with new P/E SSarrow_forwardIf the last dividend paid by Chemical Brothers Inc. was $1.25 and analysts expect these payments to increase 4% per year, what will the stock price be next year if the required return is 15%? Select one: O a. $12.29 O b. $11.82 O c. $31.25 O d. $12.78 O e. $23.11arrow_forwardNew York Times Co. (NYT) recently earned a profit of $2.81 per share and has a P/E ratio of 20.00. The dividend has been growing at an 8.25 percent rate over the past six years. If this growth rate continues, what would be the stock price in five years if the P/E ratio remained unchanged? What would the price be if the P/E ratio increased to 23 in five years? (Round your answers to 2 decimal places.) Stock price Stock price with new P/Earrow_forward

- If Target Corp. (TGT) recently earned a profit of $6.07 earnings per share and has a P/E ratio of 16.5. The dividend has been growing at a 10 percent rate over the past few years. If this growth continues, what would be the stock price in five years if the P/E ratio remained unchanged?arrow_forwardVijay shiyalarrow_forwardKrell Industries has a share price of $21.55 today. If Krell is expected to pay a dividend of $1.08 this year and its stock price is expected to grow to $24.57 at the end of the year. The dividend yeild is? (Round to one decimal place)The capital rate gain is? (Round to one decimal place)The total return is? (Round to one decimal place)arrow_forward

- Whizcom Inc. is expected to pay a dividend of $1 next period. Dividends are expected to grow at 2% per year and the investors require a return of 12%. i) Compute the current stock price for Whizcom Inc.ii) What would be the likely stock price in year 5?iii) What would be per annum rate of return implied by a change in prices from time 0 to time 5?arrow_forwardWhat did I set up incorrectly on this problem?arrow_forwardSuppose a company just paid dividnd of $2.19.The dividend is expected to grow at 5.99% each year. If the stock is currently selling for $102.09, what is the requird rate of return o the stock?arrow_forward

- Orwell Building Supplies' last dividend was $1.75. Its dividend growth rate is expected to be constant at 25% for 2 years, after which dividends are expected to grow at a rate of 6% forever. Its required return (rs) is 12%. What is the best estimate of the current stock price? a. $41.58 b. $42.64 c. $43.71 d. $44.80 e. $45.92 What is the capital gains yield in the first year for Orwell Building Supplies using the information from the previous question? a. 8.33%. b. 6.87%. c. 12.00%. d. 6.00%. e. 8.00%.arrow_forwardThe future earnings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow 6% per year. Callahan's common stock currently sells for $25.75 per share; its last dividend was $2.00; and it will pay a $2.12 dividend at the end of the current year. Using the DCF approach, what is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % If the firm's beta is 1.1, the risk-free rate is 3%, and the average return on the market is 14%, what will be the firm's cost of common equity using the CAPM approach? Round your answer to two decimal places. % If the firm's bonds earn a return of 12%, based on the bond-yield-plus-risk-premium approach, what will be rs? Use the judgmental risk premium of 4% in your calculations. Round your answer to two decimal places. % If you have equal confidence in the inputs used for the three approaches, what is your estimate of Callahan's cost of common equity? Do not round…arrow_forwardThe future earnings, dividends, and common stock price of Callahan Technologies Inc. are expected to grow 7% per year. Callahan's common stock currently sells for $25.25 per share; its last dividend was $2.00; and it will pay a $2.14 dividend at the end of the current year. Using the DCF approach, what is its cost of common equity? Do not round intermediate calculations. Round your answer to two decimal places. % If the firm's beta is 2.0, the risk-free rate is 6%, and the average return on the market is 13%, what will be the firm's cost of common equity using the CAPM approach? Round your answer to two decimal places. % If the firm's bonds earn a return of 11%, based on the bond-yield-plus-risk-premium approach, what will be rs? Use the midpoint of the risk premium range discussed in Section 10-5 in your calculations. Round your answer to two decimal places. % If you have equal confidence in the inputs used for the three approaches, what is your estimate of Callahan's cost…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education