Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

None

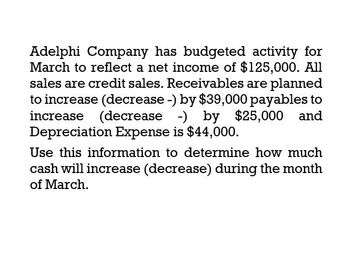

Transcribed Image Text:Adelphi Company has budgeted activity for

March to reflect a net income of $125,000. All

sales are credit sales. Receivables are planned

to increase (decrease -) by $39,000 payables to

increase (decrease -) by $25,000

Depreciation Expense is $44,000.

and

Use this information to determine how much

cash will increase (decrease) during the month

of March.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following data were obtained from the financial records of Sonicbrush, Inc., for March: Sales are expected to increase each month by 15%. Prepare a budgeted income statement.arrow_forwardCarmichael Corporation is in the process of preparing next years budget. The pro forma income statement for the current year is as follows: Required: 1. What is the break-even sales revenue (rounded to the nearest dollar) for Carmichael Corporation for the current year? 2. For the coming year, the management of Carmichael Corporation anticipates an 8 percent increase in variable costs and a 60,000 increase in fixed expenses. What is the break-even point in dollars for next year? (CMA adapted)arrow_forwardThe data shown were obtained from the financial records of Italian Exports, Inc., for March: Sales are expected to increase each month by 10%. Prepare a budgeted income statement.arrow_forward

- Relevant data from the operating budget of The Framers are: Other data: Capital assets were sold in quarter 1 and $8,000 was collected in quarter 1 and $500 collected in quarter 2. Dividends of $500 will be paid in May The beginning cash balance was $50,000 and a required minimum cash balance is $10,000. Prepare a cash budget for the first two quarters of the year.arrow_forwardRelevant data from the Poster Companys operating budgets are: Additional data: Capital assets were sold in January for $10,000 and $4,500 in May. Dividends of $4,500 were paid in February. The beginning cash balance was $60,359 and a required minimum cash balance is $59,000. Use this information to prepare a cash budget for the first two quarters of the yeararrow_forwardHaresharrow_forward

- Kayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. Cash Receipts Cash payments January $ 520,000 $ 467,900 February 402,500 350,400 March 466,000 531,000 Kayak requires a minimum cash balance of $50,000 at each month-end. Loans taken to meet this requirement charge 1%, interest per month, paid at each month-end. The interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $50,000 is used to repay loans at month-end. The company has a cash balance of $50,000 and a loan balance of $100,000 at January 1. Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.)arrow_forwardIn September, the capital expenditure budget of ABC Corp. Indicates a P140,000 purchase of equipment. The ending September cash balance from operations is budgeted at P20,000. The company wants to maintain a minimum cash balance of P10,000. What is the minimum cash loan that must be planned by ABC Corp borrowed from the bank in September?arrow_forwardKayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments excluding cash payments for loan principal and interest payments) for the first three months of next year. January February March Cash Receipts $ 521,000 410,500 480,000 Cash payments $ 467,800 357,300 528,000 Kayak requires a minimum cash balance of $30,000 at each month-end. Loans taken to meet this requirement charge 1%, interest per month, paid at each month-end. The interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $30,000 is used to repay loans at month-end. The company has a cash balance of $30,000 and a loan balance of $60,000 at January 1. Prepare monthly cash budgets for January, February, and March. Note: Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Beginning cash balance Add: Cash receipts Total cash available KAYAK COMPANY Cash Budget January $ 30,000…arrow_forward

- Vishuarrow_forwardKayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for lo principal and interest payments) for the first three months of next year. January February March Cash Receipts Cash payments $518,000 $ 461,500 352,000 523,000 408,500 464,000 Kayak requires a minimum cash balance of $40,000 at each month-end. Loans taken to meet this requirement charge 1%, interest per month, paid at each month-end. The interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $40,000 is used to repay loans at month-end. The company has a cash balance of $40,000 and a loan balance of $80,000 at January 1. Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.) Beginning cash balance Add: Cash receipts Total cash available Less: Cash payments for All items excluding…arrow_forwardKayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. January February March Cash Receipts Cash payments $ 519,000 $ 468,000 404,000 452,000 353,000 521,000 Kayak requires a minimum cash balance of $40,000 at each month end. Loans taken to meet this requirement charge 1%, interest per month, paid at each month-end. The interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $40,000 is used to repay loans at month-end. The company has a cash balance of $40,000 and a loan balance of $80,000 at January 1 Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College