Concept explainers

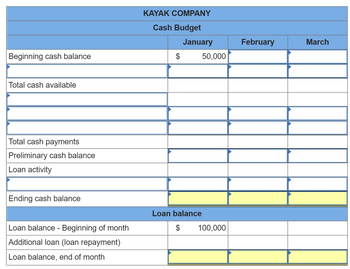

Kayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year.

| Cash Receipts | Cash payments | |

|---|---|---|

| January | $ 520,000 | $ 467,900 |

| February | 402,500 | 350,400 |

| March | 466,000 | 531,000 |

Kayak requires a minimum cash balance of $50,000 at each month-end. Loans taken to meet this requirement charge 1%, interest per month, paid at each month-end. The interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $50,000 is used to repay loans at month-end. The company has a cash balance of $50,000 and a loan balance of $100,000 at January 1.

Prepare monthly

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

- Todd Enterprises is preparing a cash budget for the second quarter of the coming year. The following data have been forecasted: Sales. Merchandise purchases Operating expenses: Payroll.. Advertising Rent. Depreciation End of April balances: Cash Bank loan payable. May April $150,000 $157,500 107,000 112,400 13,600 5,400 2,500 7,500 30,000 26,000 14,280 5,700 2,500 7,500 Additional data: (1) Sales are 40% cash and 60% credit. The collection pattern for credit sales is 50% in the month following the sale and 50% in the month thereafter. Total sales in March were $125,000. (2) Purchases are all on credit, with 40% paid in the month of purchase and 60% paid in the following month. (3) Operating expenses are paid in the month they are incurred. (4) A minimum cash balance of $25,000 is required at the end of each month. (5) Loans are used to maintain the minimum cash balance. At the end of each month, interest of 1% per month is paid on the outstanding loan balance as of the beginning of the…arrow_forwardplease give me answer in excel.arrow_forwardNonearrow_forward

- Kayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for lo principal and interest payments) for the first three months of next year. January February March Cash Receipts Cash payments $518,000 $ 461,500 352,000 523,000 408,500 464,000 Kayak requires a minimum cash balance of $40,000 at each month-end. Loans taken to meet this requirement charge 1%, interest per month, paid at each month-end. The interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $40,000 is used to repay loans at month-end. The company has a cash balance of $40,000 and a loan balance of $80,000 at January 1. Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.) Beginning cash balance Add: Cash receipts Total cash available Less: Cash payments for All items excluding…arrow_forwardABC buys insurance for its fleet of delivery trucks. The cost is $18,000 per year and is paid in two instalments, on January 1 and July 1 of each year. The amount of cash disbursement that will appear on the February cash budget is: O$1,500 $9,000 $18,000arrow_forwardi do not understand why the loan payment amount is wrongarrow_forward

- Karim Corporation requires a minimum $8,800 cash balance. Loans taken to meet this requirement cost 1% interest per month (paid at the end of each month). Any preliminary cash balance above $8,800 is used to repay loans at month-end. The cash balance on July 1 is $9,200, and the company has no outstanding loans. Budgeted cash receipts (other than for loans received) and budgeted cash payments (other than for loan or interest payments) follow. Cash receipts Cash payments Beginning cash balance Add: Cash receipts Total cash available Less: Cash payments for Interest on loan Interest revenue Prepare a cash budget for July, August, and September. Note: Negative balances and Loan repayment amounts (If any) should be Indicated with minus sign. Round your final answers to the nearest whole dollar. Total cash payments Preliminary cash balance Loan activity July $ 24,800 29,208 Ending cash balance August $ 32,800 30,800 Loan balance Beginning of month Additional loan (loan repayment) Loan…arrow_forwardHanshabenarrow_forwardKayak Company budgeted the following cash receipts (excluding cash receipts from loans received) and cash payments (excluding cash payments for loan principal and interest payments) for the first three months of next year. January February March Cash Receipts 523,000 $ Beginning cash balance Total cash available Kayak requires a minimum cash balance of $40,000 at each month-end. Loans taken to meet this requirement charge 1%, Interest per month, paid at each month-end. The Interest is computed based on the beginning balance of the loan for the month. Any preliminary cash balance above $40,000 is used to repay loans at month-end. The company has a cash balance of $40,000 and a loan balance of $80,000 at January 1. 408,500 476,000 Prepare monthly cash budgets for January, February, and March. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign.) Total cash payments Preliminary cash balance Loan activity Ending cash balance Cash payments $ 469,800…arrow_forward

- Garden Depot is a retailer that provided the following budgeted cash flows for next year: 3rd Quarter $ 220,000 $ 227,000 Total cash receipts Total cash disbursements 1st Quarter 2nd Quarter $ 190,000 $ 340,000 $ 267,000 $ 237,000 The company's beginning cash balance for next year will be $22,000. The company requires a minimum cash balance of $10,000 and may borrow money at the beginning of any quarter and may repay any part of its loans at the end of any quarter. Interest payments, based on a quarterly interest rate of 3%, are due on any principal at the time it is repaid. For simplicity, assume interest is not compounded. Required: Prepare the company's cash budget for next year. Note: Repayments, interest, and cash deficiencies should be indicated by a minus sign. Beginning cash balance Total cash receipts Total cash available Total cash disbursements Excess (deficiency) of cash available over disbursements Financing: Borrowings Repayments Interest Total financing Ending cash…arrow_forwardFoyert Corporation requires a minimum $6,300 cash balance. Loans taken to meet this requirement cost 2% interest per month (paid at the end of each month). Any preliminary cash balance above $6,300 is used to repay loans at month-end. The cash balance on October 1 is $6,300, and the company has an outstanding loan of $2,300. Budgeted cash receipts (other than for loans received) and budgeted cash payments (other than for loan or interest payments) follow. Cash receipts Cash payments October $ 22,300 24,450 November $ 16,300 15,300 December $ 20,300 15,700 Prepare a cash budget for October, November, and December. (Negative balances and Loan repayment amounts (if any) should be indicated with minus sign. Round your final answers to the nearest whole dollar.) FOYERT CORPORATION es Beginning cash balance Add: Cash receipts Total cash available Add: Cash payments for Interest on loan Total cash payments Preliminary cash balance Loan activity Additional loan (loan repayment) Ending cash…arrow_forwardDineshbhaiarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education