Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Don't use Ai and chatgpt.

Answer in step by step with explanation

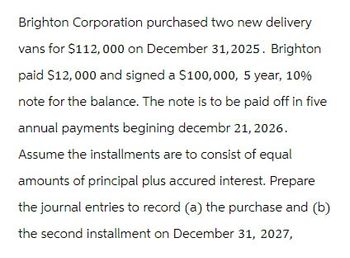

Transcribed Image Text:Brighton Corporation purchased two new delivery

vans for $112,000 on December 31, 2025. Brighton

paid $12,000 and signed a $100,000, 5 year, 10%

note for the balance. The note is to be paid off in five

annual payments begining decembr 21, 2026.

Assume the installments are to consist of equal

amounts of principal plus accured interest. Prepare

the journal entries to record (a) the purchase and (b)

the second installment on December 31, 2027,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2019, Park Company accepted a 36,000, non-interest-bearing, 3-year note from a major customer in exchange for used equipment. The equipment had originally cost Park 200,000 and had a book value of 20,000 on the date of the sale. At the 12% imputed interest rate for this type of loan, the present value of the note is 25,500 on January 1, 2019. Park uses the effective interest rate. What is the carrying value of the note receivable on Parks December 31, 2019, balance sheet? a. 28,560 b. 29,000 c. 32,500 d. 36,000arrow_forwardOn January 1, 2019, Boater Company issues a 20,000 non-interest-bearing, 5-year note for equipment. Neither the fair value of the note nor the equipment is determinable. Boaters incremental borrowing rate is 9%. The asset has a useful life of 7 years. Prepare the journal entry for Boater to record the issuance of the note on January 1.arrow_forwardOn July 1, 2019, Aldrich Company purchased as an available-for-sale security 200,000 face value, 9% U.S. Treasury notes for 194,000. The notes mature July 1, 2020, and pay interest semiannually on January 1 and July 1. The notes were sold on December 1, 2019, for 199,000. Aldrich normally uses straight-line amortization on all of its notes. In its income statement for the year ended December 31, 2019, what amount should Aldrich report as a gain on the sale of the available-for-sale security? a. 2,500 b. 3,500 c. 5,000 d. 6,000arrow_forward

- Spath Company borrows 75,000 by issuing a 4-year, noninterest-bearing note to a customer on January 1, 2019. In addition, Spath agrees to sell inventory to the customer at reduced prices over a 5-year period. Spaths incremental borrowing rate is 12%. The customer agrees to purchase an equal amount of inventory each year over the 5-year period so that a straight-line method of revenue recognition is appropriate. Required: Prepare the journal entries on Spaths books for 2019 and 2020. (Round answers to 2 decimal places.)arrow_forwardFinanceCo lent $8.7 million to Corbin Construction on January 1, 2024, to construct a playground. Corbin signed a three-year, 8% installment note to be paid in three equal payments at the end of each year. Required: Prepare the journal entry for FinanceCo’s lending the funds on January 1, 2024. Prepare an amortization schedule for the three-year term of the installment note. Prepare the journal entry for the first installment payment on December 31, 2024. Prepare the journal entry for the third installment payment on December 31, 2026. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)arrow_forwardFinanceCo lent $8 million to Corbin Construction on January 1, 2018, to construct a playground. Corbin signed athree-year, 6% installment note to be paid in three equal payments at the end of each year.Required:1. Prepare the journal entry for FinanceCo’s lending the funds on January 1, 2018.2. Prepare an amortization schedule for the three-year term of the installment note.3. Prepare the journal entry for the first installment payment on December 31, 2018.4. Prepare the journal entry for the third installment payment on December 31, 2020.arrow_forward

- On 1/1/X1, Caldwell Corp. borrowed $450,000 by agreeing to a 9%, 9-year installment note with the bank. The note's proceeds will eventually be used to purchase a building. The journal entry to record the note is already shown in the journal below. The note will be paid back in nine equal annual installment payments of $ 75,059 on December 31 of each year beginning December 31, 20X1. Required: Using the above information, prepare the journal entries to record the first and second installment payments due on 12/31/X1 and 12/31/X2, respectively. Note: Round all calculations to the nearest whole dollar. Do not use currency symbols, commas or decimal points in your responses. Date Account Name Debit Credit 1/1/X1 Cash 450,000 Note Payable 450,000 12/31/X1 12/31/X2arrow_forwardOn January 1, 2025, Turner Corporation signed a $180,000, eight-year, 8% note. The loan required Turner Corporation to make payments annually on December 31 of $22,500 principal plus interest. 1. Journalize the issuance of the note on January 1, 2025. 2. Journalize the first payment on December 31, 2025. (Record debits first, then credits. Select explanations on the last line of the journal entry.) 1. Journalize the issuance of the note on January 1, 2025. Date Jan. 1 Accounts and Explanation Debit Credit ...arrow_forwardOn January 1, 2021, Strato Corporation borrowed $2 million from a local bank to construct a new building over the next three years. The loan will be paid back in three equal installments of $776,067 on December 31 of each year. The payments include interest at a rate of 8%.Required:1. Record the cash received when the note is issued.2. Prepare an amortization schedule over the three-year life of the installment note. Round answers to the nearest dollar.3. Use amounts from the amortization schedule to record each installment payment.arrow_forward

- Edward purchased a new piece of equipment to be used in its new facility. The $445,000 piece of equipment was purchased with a $66,750 down payment and with cash received through the issuance of a $378,250, 9%, 5-year mortgage payable issued on January 1, 2022. The terms provide for annual installment payments of $97,245 on December 31. 1. Prepare an installment payments schedule for the first five payments of the notes payable 2. Prepare the journal entry related to the notes payable for December 31, 2022. 3. Show the balance sheet presentation for this obligation for December 31, 2022. (Hint: Be sure to distinguish between the current and long-term portions of the note.)arrow_forwardJernigan Co. receives $240,000 when it issues a $240,000, 6%, mortgage note payable to finance the construction of a building at December 31, 2020. The terms provide for annual installment payments of $33,264 on December 31. Instruction: Prepare the journal entries to record the the first and second installment payments.arrow_forwardOn January 1, 2021, Monster Corporation borrowed $9 million from a local bank to construct a new highway over the next four years. The loan will be paid back in four equal installments of $2,657,053 on December 31 of each year. The payments include interest at a rate of 7%. Required: 1. Record the cash received when the note is issued. 2. Prepare an amortization schedule over the four-year life of the installment note. Round answers to the nearest dollar. 3. Use amounts from the amortization schedule to record each installment payment.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning