Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Give true answer

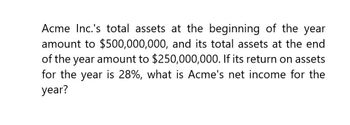

Transcribed Image Text:Acme Inc.'s total assets at the beginning of the year

amount to $500,000,000, and its total assets at the end

of the year amount to $250,000,000. If its return on assets

for the year is 28%, what is Acme's net income for the

year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Reynolds Corp's total assets at the end of last year were $300,000 and its net income after taxes was $25,000. What was its return on total assets?arrow_forwardHello expart need help pleasearrow_forwardRollins Corp's total assets at the end of last year were $300,000 and its EBIT was $75,000. What was its basic earning power (BEP)?arrow_forward

- Helo Company has provided the following data: Sales, P5,000,000; Interest expense, P30,000; Total assets, beginning of the year, P185,000; Total assets, end of the year, P215,000; Return on assets, 15.5%; Tax rate, 30%. What is the net income of Helo Co.? show solutionsarrow_forwardNational Company's net income last year was P65,000 and its interest expense was P15,000. Total assets at the beginning of the year were P630,000 and total assets at the end of the year were P650,000. The company's income tax rate was 25%. The company's return on total assets (based on adjusted net income) for the year was closest to?arrow_forwardFrezia Corp.'s total assets at the end of last year were P315,000 and its net income after taxes was P22,750. What was Frezia’s return on total assets? * Choices: 7.58% 8.78% 7.22% 7.96% 8.36%arrow_forward

- If for the most recent year, a firm's RNOA is 12.0%, its sales were $2,400,000, its asset turnover is 1.5, its net financial obligations (NFO) balance is $550,000, and its net financial expenses after tax are $16,500, what is its ROCE? 1.16.7% 2.29.2% 3.18.3% 4.25.1%arrow_forwardThe following year-end data pertain to Adan Corporation: Earnings before interest and taxes 800,000 Current assets 800,000 Non-Current assets 3,200,000 Current Liabilities 400,000 Non-current liabilities 1,000,000 Adan corporation pays an income tax rate of 30%. Its weighted average cost of capital is 10%. What is Adan corporations Economic value added (EVA)?arrow_forwardUsing the AFN formula approach, calculate the total assets of Harmon Photo Company given the following information: Sales this year = $3,000; increase in sales projected for next year = 20%; net income this year = $250; dividend payout ratio = 40%; projected excess funds available next year = $100; accounts payable = $600; notes payable = $100; and accrued wages and taxes = $200. Except for the accounts noted, there were no other current liabilities. Assume that the firm’s profit margin remains constant and that the firm is operating at full capacity. $3,000 $2,200 $2,000 $1,200 $1,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning