EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

I want correct solution

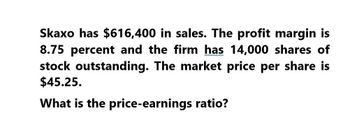

Transcribed Image Text:Skaxo has $616,400 in sales. The profit margin is

8.75 percent and the firm has 14,000 shares of

stock outstanding. The market price per share is

$45.25.

What is the price-earnings ratio?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- ??arrow_forwardZENITH INDUSTRIES HAS $1,235,800 IN SALES. THE PROFIT MARGIN IS 6.5 PERCENT AND THE FIRM HAS 22,000 SHARES OF STOCK OUTSTANDING. THE MARKET PRICE PER SHARE IS $38.75. WHAT IS THE PRICE-EARNINGS RATIO?arrow_forwardNextera Corp has $842,700 in sales. The profit margin is 7.25 percent and the firm has 18,500 shares of stock outstanding. The market price per share is $52.50. What is the price-earnings ratio?arrow_forward

- What is the price earnings ratio? for this accounting questionarrow_forwardAldi has $823,000 in sales. The profit margin is 3.9 percent and the firm has 7,500 shares of stock outstanding. The market price per share is $15. What is the price- earnings ratio? 3.98 4.27 3.51 3.15 O 4.42arrow_forwardNeed only correct answerarrow_forward

- A firm has $5,800 in Sales. The profit margin is 4 percent. There are 5,000 shares outstanding with a price of $1.70 per share. What is the firm’s price-earnings (P/E) ratio?arrow_forwardToyto Corp. has net working capital of $1,370, current liabilities of $3,720 and inventory of $1,950. What is the current ratio? What is the quick ratio? Doria Inc. has sales of $29 million, total assets of $17.5 million and total debt of $6.3 million. If the profit margin is 8 percent, what it the net income? What is the ROA? What is the ROE? Orion Inc. has a total debt ratio of 0.63. What is the debt-equity ratio? What is the equity multiplier?arrow_forwardLassiter Industries has annual sales of $220,000 with 12,000 shares of stock outstanding. The firm has a profit margin of 6 percent and a price-sales ratio of 1.20. What is the firm's price-earnings ratio? e B omarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT