FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

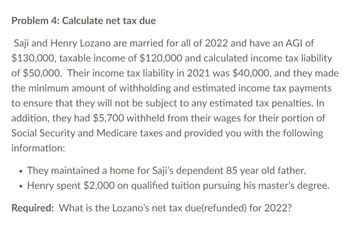

Transcribed Image Text:Problem 4: Calculate net tax due

Saji and Henry Lozano are married for all of 2022 and have an AGI of

$130,000, taxable income of $120,000 and calculated income tax liability

of $50,000. Their income tax liability in 2021 was $40,000, and they made

the minimum amount of withholding and estimated income tax payments

to ensure that they will not be subject to any estimated tax penalties. In

addition, they had $5,700 withheld from their wages for their portion of

Social Security and Medicare taxes and provided you with the following

information:

• They maintained a home for Saji's dependent 85 year old father.

Henry spent $2,000 on qualified tuition pursuing his master's degree.

Required: What is the Lozano's net tax due(refunded) for 2022?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Tax Formula for Individuals, A Brief Overview of Capital Gains and Losses (LO 1.3, 1.9) In 2020, Manon earns wages of $54,000. She also has dividend income of $2,800. Manon is single and has no dependents. During the year, Manon sold silver coins held as an investment for a $7,000 loss. Table for the standard deduction Filing Status Standard Deduction Single $12,400 Married, filing jointly 24,800 Married, filing separately 12,400 Head of household 18,650 Qualifying widow(er) 24,800 Calculate the following amounts for Manon: a. Adjusted gross income $fill in the blank b. Standard deduction $fill in the blank c. Taxable income $fill in the blankarrow_forwardHi can someone help me with this question?arrow_forwardi need the answer quicklyarrow_forward

- Vishnuarrow_forward! Required information [The following information applies to the questions displayed below.] In 2023, Juanita is married and files a joint tax return with her husband. What is her tentative minimum tax in each of the following alternative circumstances? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Input all values as positive. Leave no answer blank. Enter zero if applicable. d. Her AMT base is $422,500, which includes $13,000 of qualified dividends. Description (1) AMT base (2) Dividends taxed at preferential rate (3) Tax on dividends (4) AMT base taxed at regular AMT rates (5) Tax on AMT base taxed at 26% rate (6) Tax on AMT base taxed at 28% rate Tentative minimum tax Amountarrow_forward10.arrow_forward

- 2. Taxes paid for a given income level Deborah is getting ready to do her taxes. She is single and lives in Miami. Deborah earned $250,000 in taxable income in 2015. She reviews the following table, which shows the IRS tax rates for a single taxpayer in 2015. On Annual Taxable Income... Up to $9,225 From $9,225 to $37,450 From $37,450 to $90,750 From $90,750 to $189,300 From $189,300 to $411,500 From $411,500 to $413,200 Over $413,200 The Tax Rate Is... (Percent) 10.0 15.0 Deborah calculates that she owes 25.0 28.0 33.0 35.0 39.6 Based on the IRS table, Deborah calculates that her marginal tax rate is 33% when her annual taxable income is $250,000. Deborah then calculates that her average tax rate is in income taxes for 2015. , based on the annual income level and the amount of taxes she owes for 2015.arrow_forwardAnswer questions 3 and 4 correctly please. Calculate FICA Taxes Note: all calculations both intermediate and final should be rounded to two decimal places at each calculation.arrow_forwardMunabhaiarrow_forward

- 18. Rex and Dena are married and have two children, Michelle (age seven) and Nancy (age five). During 2022, Rex earned a salary of $27,500, received interest income of $300, and filed a joint income tax return with Dena. Dena had $0 gross income. Their earned income credit for the year is: a.$0. b.$5,840. c.$5,903. d.$6,164.arrow_forwardLiam has a gross income of $120,000 and takes the standard deduction. 1) What are his total taxes due? 2) What is his marginal tax rate? 3) What is his effective tax rate? Round to the neared hundredth of a percent.arrow_forwardData: In 2020, Elaine paid $2,160 of tuition and $900 for books for her dependent son to attend State University this past fall as a freshman. Elaine files a joint return with her husband - AGI $165,500. Question: What is the maximum American opportunity tax credit that Elaine can claim for the tuition payment and books ? Thx, Stephaniearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education