FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

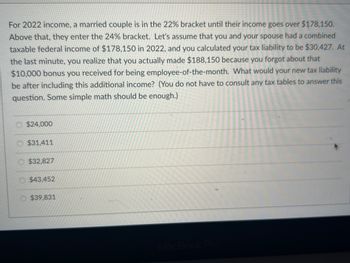

Transcribed Image Text:For 2022 income, a married couple is in the 22% bracket until their income goes over $178,150.

Above that, they enter the 24% bracket. Let's assume that you and your spouse had a combined

taxable federal income of $178,150 in 2022, and you calculated your tax liability to be $30,427. At

the last minute, you realize that you actually made $188,150 because you forgot about that

$10,000 bonus you received for being employee-of-the-month. What would your new tax liability

be after including this additional income? (You do not have to consult any tax tables to answer this

question. Some simple math should be enough.)

$24,000

$31,411

$32,827

$43,452

$39,831

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Ma4. Are these actions taxable? If yes, where would it go on tax return? (2020) Child Support Payment from Kevin Hamblin $12,000 Alimony Payment from Kevin Hamblin $16,000 Gift from her father to help with legal bills $8,500 Interest income on U.S. Treasury Bond $400 Interest income of Madison City Bond (municipal bond) $250 Interest income from First Bank of Madison $165 Life insurance proceeds on the death of her mother $45,000arrow_forwardDengerarrow_forwardplease explain in step to step on how to get this answer. answer is 95,259.00 Jason graduated in 2017 and landed a job after graduation in Orlando for Finance. If his taxable income for 2019 is $68000, how much federal income tax will he owe given the 2019 federal income tax brackets below? 15% on the first $47,630 of taxable income, plus 20.5% on the next $47,629 of taxable income (on the portion of taxable income over 47,630 up to $95,259), plus 26% on the next $52,408 of taxable income (on the portion of taxable income over $95,259 up to $147,667), plus 29% on the next $62,704 of taxable income (on the portion of taxable income over 147,667 up to $210,371), plus 33% of taxable income over $210,371arrow_forward

- In 2023, Jasmine and Thomas, a married couple, had taxable income of $162,000. If they were to file separate tax returns, Jasmine would have reported taxable income of $152,000 and Thomas would have reported taxable income of $10,000. Use Tax Rate Schedule for reference. What is the couple's marriage penalty or benefit? Note: Do not round intermediate calculations. Round your final answer to the nearest whole dollar. X Answer is complete but not entirely correct. Marriage benefit 23,615 Xarrow_forwardScenario: Emma (age 30) and Brad (age 32) are considering getting married before the end of 2022. The following summarizes their income and deductions: Brad Emma ABC Salary 112,000 94,000 Itemized Deductions 21,700 11,800 Requirements: Compute 2022 (1.) taxable income; (2.) income tax liability; and (3.) the average tax rate under the following scenarios. Provide the details of your computations and use formulas when appropriate. They get married on December 1, 2022 and they choose to file married joint. They get married on January 1, 2023. What is the tax consequence to Emma and Brad, if they get married on December 1, 2022?arrow_forwardi need the answer quicklyarrow_forward

- In 2022, Lisa and Fred, a married couple, had taxable income of $307,800. If they were to file separate tax returns, Lisa would have reported taxable income of $128,900 and Fred would have reported taxable income of $178,900. -what is the couples marriage benefit?arrow_forward! Required information [The following information applies to the questions displayed below.] In 2023, Juanita is married and files a joint tax return with her husband. What is her tentative minimum tax in each of the following alternative circumstances? Use Tax Rate Schedule, Dividends and Capital Gains Tax Rates for reference. Note: Input all values as positive. Leave no answer blank. Enter zero if applicable. d. Her AMT base is $422,500, which includes $13,000 of qualified dividends. Description (1) AMT base (2) Dividends taxed at preferential rate (3) Tax on dividends (4) AMT base taxed at regular AMT rates (5) Tax on AMT base taxed at 26% rate (6) Tax on AMT base taxed at 28% rate Tentative minimum tax Amountarrow_forward10.arrow_forward

- Hw.145. Francisco paid the following taxes in 2022: !"$6,000 property taxes on their personal residence !"$500 property taxes on their personal automobile !"$3,000 property taxes on business property !"$10,000 federal income taxes !"$5,000 state income taxes !"$6,000 employment (FICA) taxes !"$2,000 sales/use tax What amount of taxes can Francisco deduct as an itemized deduction in 2022? What amount of taxes could Francisco deduct as an itemized deduction if the taxes were paid in 2026?arrow_forwardi need the answer quicklyarrow_forwardJackie is a non-VAT self-employed individual. His forecast for 2022 shows non-operating income of P50,000 and allowable deductions of P1,250,000. In the default option for the income tax regime, his income tax due would be P385,000. How much is the income tax due assuming the use of the 8% optional tax and presence of a taxable compensation income amounting to P430,000? 245,500 269,500 265,500 249,500arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education