FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

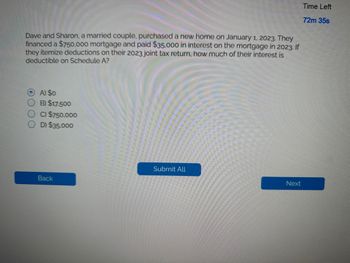

Transcribed Image Text:Dave and Sharon, a married couple, purchased a new home on January 1, 2023. They

financed a $750,000 mortgage and paid $35.000 in interest on the mortgage in 2023. If

they itemize deductions on their 2023 joint tax return, how much of their interest is

deductible on Schedule A?

OA) $0

B) $17.500

OC) $750,000

D) $35,000

Back

Submit All

Next

Time Left

72m 35s

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sally owns real property for which the annual property taxes are $9,000. She sells the property to Kate on March 9, 2021, for $550,000. Kate pays the real property taxes for the entire year on October 1, 2021. Assume a 365-day year. How much of the property taxes can be deducted by Sally and how much by Kate? a. Katie b. Sallyarrow_forwarddetermine the income tax owed by Jake and Anna Green. They are a married couple with 3 dependent children. They decided to file their taxes jointly this year and had a combined gross income of $55,000. They had an adjustment of $800 and tax credits of $4000. They give you an itemized list of their deductions that include mortgage interest of $7,500, charitable contributions of $1500, student loan interest of $2,500, and property taxes of $1450. 1.) What is Jake and Anna Green’s adjusted gross income? 2.) What is Jake and Anna Green’s taxable income?arrow_forwardLewis and Laurie are married and jointly own a home valued at $262,000. They recently paid off the mortgage on their home. The couple borrowed money from the local credit union in January of 2022. How much interest may the couple deduct in each of the following alternative situations? (Assume they itemize deductions no matter the amount of interest.) Note: Leave no answer blank. Enter zero if applicable. Required: The couple borrows $62,000, and the loan is secured by their home. The credit union calls the loan a "home equity loan." Lewis and Laurie use the loan proceeds for purposes unrelated to the home. The couple pays $3,800 interest on the loan during the year, and the couple files a joint return. The couple borrows $154,000, and the loan is secured by their home. The credit union calls the loan a "home equity loan." Lewis and Laurie use the loan proceeds to add a room to their home. The couple pays $6,300 interest on the loan during the year, and the couple files a joint…arrow_forward

- On January 1, 2019, Charles Jamison borrows $40,000 from his father to open a business. Charles is the beneficiary of a trust created by his aunt from which he will receive $25,000 on January 1, 2029. He signs an agreement to make this amount payable to his father and, further, to pay his father equal annual amounts from January 1, 2020, to January 1, 2028, inclusive, in retirement of the debt. Interest is 12% per year. What are the annual payments?arrow_forwardMr. and Mrs. David file a joint tax return. They have $169,300 taxable income in 2019, $120,300 of which is ordinary income and $49,000 of which is taxed at a 15% preferential rate. Compute their tax savings from the preferential rate. A) $7,032 B) $3,448 C) $10,798 D) None of the above.arrow_forwardJessica purchased a home on January 1, 2019, for $580,000 by making a down payment of $230,000 and financing the remaining $350,000 with a loan, secured by the residence, at 6 percent. During 2019 and 2020, Jessica made interest-only payments on this loan of $21,000 (each year). On July 1, 2019, when her home was worth $580,000, Jessica borrowed an additional $145,000 secured by the home at an interest rate of 8 percent. During 2019, she made interest-only payments on the second loan in the amount of $5800. During 2020, she made interest-only payments on the second loan in the amount of $11,600. What is the maximum amount of the $32,600 interest expense Jessica paid during 2020 that she may deduct as an itemized deduction if she used the proceeds of the second loan to finish the basement in her home and landscape her yard? (Assume not married filing separately.) (Enter only numbers with no dollar signs or other punctuation.)arrow_forward

- Barbara purchased a new Honda Clarity electric vehicle in 2019 for $36,000. Her federal tax credit will be:a. $0b. $2,500c. $5,000d. $7,500e. $10,000arrow_forwardDuring the year, Maxine pays the following amounts related to her residence: Mortgage interest $8,000 Real estate taxes 4,000 Painting of exterior 2,000 Utilities 3,400 New roof 10,000 She also paid the following for her daughter's house: Real estate taxes (owned and used by daughter) $1,500 a. Which expenses are deductible by Maxine if she is eligible to itemize her deductions? b. Calculate the total dollar amount. c. Are the deductions "For" or "From" AGI?arrow_forwardIn 2022, Tom and Alejandro Jackson (married filing jointly) have $232.000 of taxable income before considering the following events: (Use the dividends and capital gains tax rates and tax rate schedules.) a. On May 12, 2022, they sold a painting (art) for $114,000 that was inherited from Grandma on July 23, 2020. The fair market value on the date of Grandma's death was $92,000, and Grandma's adjusted basis of the painting was $25,800. b. They applied a long-term capital loss carryover from 2021 of $10,400. c. They recognized a $12,200 loss on the 11/1/2022 sale of bonds (acquired on 5/12/2012). d. They recognized a $4,240 gain on the 12/12/2022 sale of IBM stock (acquired on 2/5/2022). e. They recognized a $17,960 gain on the 10/17/2022 sale of rental property (the only 51231 transaction), of which $8,640 is reportable as gain subject to the 25 percent maximum rate and the remaining $9.320 is subject to the 0/15/20 percent maximum rates (the property was acquired on 8/2/2016). f. They…arrow_forward

- Tyler, a self-employed taxpayer, travels from Denver to Miami primarily on business. He spends five days conducting business and two days sightseeing. His expenses are $685 (airfare), $200 per day (meals at local restaurants), and $145 per night (lodging). If required, round your answers to the nearest dollar. What are Tyler's deductible expenses in the below year: 2023 2022arrow_forwardA9arrow_forwardKelsey (age 30) purchased an annuity for $120,00. The annuity will pay her $1,200 per month for life beginning when she turns age 60. At age 60, her life expectancy is 25 years. a. When Kelsey receives the first $1,200 monthly annuity payment, how much will be taxable and how much will be a nontaxable return of basis? b. Kelsey lives to age 92. What is the tax effect of each monthly annuity payment she receives after age 85? c. Instead, Kelsey dies after receiving all of her monthly payments for age 80. What is the amount of her unrecovered basis and how is it treated for tax purposes?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education