FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Prepare CORIS RA Statement of

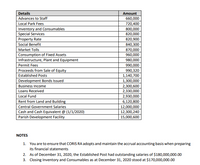

Transcribed Image Text:**Financial Breakdown for Educational Purposes**

Below is a detailed financial breakdown which outlines various transactions and financial positions for CORIS RA as of the indicated period.

| **Details** | **Amount** |

|------------------------------------------|-----------------|

| Advances to Staff | 660,000 |

| Local Park Fees | 720,400 |

| Inventory and Consumables | 800,000 |

| Special Services | 820,000 |

| Property Rate | 820,900 |

| Social Benefit | 840,300 |

| Market Tolls | 870,000 |

| Consumption of Fixed Assets | 960,000 |

| Infrastructure, Plant and Equipment | 980,000 |

| Permit Fees | 990,000 |

| Proceeds from Sale of Equity | 990,320 |

| Established Posts | 1,140,700 |

| Development Bonds Issued | 1,300,000 |

| Business Income | 2,300,600 |

| Loans Received | 2,330,000 |

| Local Fund | 2,930,000 |

| Rent from Land and Building | 6,120,800 |

| Central Government Salaries | 12,000,000 |

| Cash and Cash Equivalent (@ 1/1/2020) | 12,300,240 |

| Parish Development Facility | 15,000,600 |

---

### Notes:

1. **Accrual Accounting Basis**:

- Ensure that CORIS RA adopts and maintains the accrual accounting basis when preparing its financial statements.

2. **Outstanding Salaries**:

- As of December 31, 2020, the Established Post had outstanding salaries amounting to $180,000,000.00.

3. **Closing Inventory and Consumables**:

- The closing Inventory and Consumables as of December 31, 2020, stood at $170,000,000.00.

This table and accompanying notes provide a snapshot of the financial activities and position of CORIS RA, highlighting various income sources, expenditures, and significant financial obligations. The emphasis on accrual accounting basis is crucial for accurate financial reporting, ensuring all financial transactions are recorded when they occur, regardless of when the cash transactions happen.

Transcribed Image Text:**CORIS RA Financial Accounting Information for 2020**

---

CORIS RA is a government-owned enterprise mandated to generate its income, which it uses for capital and recurrent expenditures. The legislation also empowers the government to transfer parts or all of the income it generates to the consolidated fund as it deems fit. Besides its own generated income, the government provides CORIS RA with monthly subventions to cover its recurrent expenditures based on CORIS RA's budgetary demands and the legal allocations by the government.

For the fiscal years 2017 and 2018, CORIS RA employed the cash basis for preparing its financial statements; however, certain accounting transactions were recorded using the accrual basis. It is noteworthy that the government has instructed all its agencies to use an accrual basis, which is guided and recommended by IPSAS (International Public Sector Accounting Standards).

In 2020, you were commissioned by the government to assist CORIS RA with its accounting processes. This task included recording, generating, and preparing accounting transactions and final accounts as per IPSAS guidelines.

Together with a team of qualified and seasoned accountants, the following accounting information for CORIS RA was prepared for the fiscal year ending December 2020:

| **Details** | **Amount** |

|---------------------------------------|------------|

| Dividend Received | 93,250 |

| Loan payment | 143,000 |

| Amounts Recovered | 194,000 |

| Interest Expense | 200,000 |

| Court Administration Fees | 240,000 |

| Cost of Training | 275,000 |

| Bar License | 300,400 |

| Store Rent | 300,750 |

| Fines and Penalties | 330,000 |

| General Cleaning | 350,000 |

| Sanitation | 370,000 |

| Accumulated Fund (1/1/2020) | 370,600 |

| Basic Taxes and Rates | 370,900 |

| Allowances | 390,470 |

| Equity Investment Acquired | 420,000 |

| Royalties | 430,000 |

| Accountancy and Consultancies cost | 470,000 |

| Work-In-Progress | 490,000 |

| Herbalist License | 530,370 |

| Posts on Lot

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Boombayah has recorded the following transactions on its book for the year 2020. How much total Cash Inflow from financing activities that Boombayah should reflected on its Statement of Cash Flow:i. Payment for interest of the issued bonds on April 1, 2020, 90.ii. Cash dividend received on the short-term investment, 500iii. Depreciation on plant that manufactures goods for sale, 600.iv. Payment of income tax on gain on sale of treasury bills, 200.v. Issued 50 ordinary shares for 5,000.vi. Received cash from interest on the acquired treasury bonds of Sheshe, 240.vii. Payment for marketable securities, 1200.arrow_forwardReconstruct the company’s comparative balance sheet for 2020/2021 using the information in line with your first name initial and compute and show the missing figures to include the appropriate sign as a positive or negative figure. Prepare a complete statement of cash flows for 2021 using the indirect method using the information in line with your first name initialarrow_forwardWhat is Target’s balance of cash equivalents for the fiscal year ended January 30,2016?arrow_forward

- Given the financial data for New Electronic World, Inc. (NEW), compute the following measures of cash flows for the NEW for the year ended December 31, 2021 Required: Compute for the operating cash flow Compute for the free cash flowarrow_forwardCalculate working capital for the year 2019?arrow_forwardPreparing a Cash Flow Statement—Indirect Method Sketchers Corporation’s recent comparative balance sheet and income statement follow. Balance Sheets, December 31 2019 2020 Assets Cash and cash equivalents $12,800 $54,400 Accounts receivable (net) 16,000 28,800 Inventory 32,000 38,400 Investment, long-term 6,400 Plant assets 96,000 150,400 Accumulated depreciation (16,000) (22,400) Total assets $147,200 $249,600 Liabilities and Stockholders’ Equity Accounts payable $9,600 $16,000 Notes payable, short-term (nontrade) 12,800 9,600 Notes payable, long-term 32,000 57,600 Common stock, no-par 80,000 128,000 Retained earnings 12,800 38,400 Total liabilities andstockholders’ equity $147,200 $249,600 Income Statement,For Year Ended December 31 2020 Sales revenue $480,000 Cost of goods sold (288,000) Gross margin 192,000 Depreciation expense (6,400) Other operating expenses (104,400) Net income $83,200 Additional…arrow_forward

- This Information will be used for all questions: Selected Balance Sheet Information Year 2020 Year 2021 Cash 40,000 ? Accounts Receivable 10,000 14,000 Prepaid Rent 5,000 6,000 Inventory 35,000 30,000 Accounts Payable 3,000 2,000 Unearned Revenue 5,000 7,000 Income Taxes Payable 14,000 12,000 Other Relevant Information for 2021 Beginning Cash Balance 40,000 Net Income 65,000 Depreciation Expense 40,000 Cash Paid for Dividends 10,000 Cash Received for Loan 40,000 Cash Repaying Loan 10,000 Cash Payment to Purchase Land 12,000 Cash Received for Sale of Equipment 15,000 Gain on Sale of Equipment 5,000 Cash Received for Issuance of Stock…arrow_forwardDetermine External Funds Needed (EFN) and how it may be financed.arrow_forwardPlease help.arrow_forward

- Can you assess the company’s overall cash flow disposition for 2019, 2020 and 2021 in terms of the positive or negative cash flow patterns for the three categories of cash flows. *NEED ASAP*arrow_forwardCompare and explain the data presented ( Year 2019-2020) in the balance sheet.arrow_forwardPrepare the Cash Flow for the year 2021arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education