Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

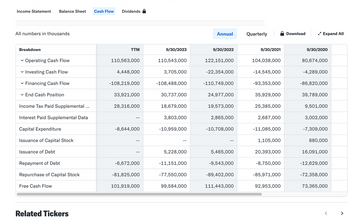

Take each statement Cash Flow statement and state the key parts in words. Tell a story / summary from the cash flow statement of the financial statement.

Transcribed Image Text:Income Statement

Balance Sheet Cash Flow

Dividends

All numbers in thousands

Annual

Quarterly

Download

✓ Expand All

Breakdown

TTM

9/30/2023

9/30/2022

9/30/2021

9/30/2020

✓ Operating Cash Flow

110,563,000

110,543,000

122,151,000

104,038,000

80,674,000

Investing Cash Flow

4,448,000

3,705,000

-22,354,000

-14,545,000

-4,289,000

✓ Financing Cash Flow

-108,219,000

-108,488,000

-110,749,000

-93,353,000

-86,820,000

✓ End Cash Position

33,921,000

30,737,000

24,977,000

35,929,000

39,789,000

Income Tax Paid Supplemental ...

28,316,000

18,679,000

19,573,000

25,385,000

9,501,000

Interest Paid Supplemental Data

3,803,000

2,865,000

2,687,000

3,002,000

Capital Expenditure

-8,644,000

-10,959,000

-10,708,000

-11,085,000

-7,309,000

Issuance of Capital Stock

1,105,000

880,000

Issuance of Debt

5,228,000

5,465,000

20,393,000

16,091,000

Repayment of Debt

-6,672,000

-11,151,000

-9,543,000

-8,750,000

-12,629,000

Repurchase of Capital Stock

-81,825,000

-77,550,000

-89,402,000

-85,971,000

-72,358,000

Free Cash Flow

101,919,000

99,584,000

111,443,000

92,953,000

73,365,000

Related Tickers

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- what are the two methods to prepare cash flow statement? Discuss in detail how cash from operating activities is determined in both the methods. Describe the entire processarrow_forwardWhat are the steps necessary to create a statement of cash flows in quickbooks.arrow_forwardContrast the aims of the income statement, the balance sheet, and the cash flow statement;arrow_forward

- What accounts on the balance sheet must be evaluated when completing the financing activities section of the statement of cash flows?arrow_forwardPlease explain how to prepare a statement of cash flows (indirect method) including analyzing tables? Please provide an example. Thank you,arrow_forwardCreate a cash-flow statement. Make sure all three areas (operating, investment, and Financing activities) are includedarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education