FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

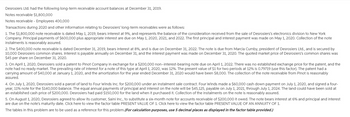

Transcribed Image Text:Desrosiers Ltd. had the following long-term receivable account balances at December 31, 2019.

Notes receivable $1,800,000

Notes receivable - Employees 400,000

Transactions during 2020 and other information relating to Desrosiers' long-term receivables were as follows:

1. The $1,800,000 note receivable is dated May 1, 2019, bears interest at 9%, and represents the balance of the consideration received from the sale of Desrosiers's electronics division to New York

Company. Principal payments of $600,000 plus appropriate interest are due on May 1, 2020, 2021, and 2022. The first principal and interest payment was made on May 1, 2020. Collection of the note

instalments is reasonably assured.

2. The $400,000 note receivable is dated December 31, 2019, bears interest at 8%, and is due on December 31, 2022. The note is due from Marcia Cumby, president of Desrosiers Ltd., and is secured by

10,000 Desrosiers common shares. Interest is payable annually on December 31, and the interest payment was made on December 31, 2020. The quoted market price of Desrosiers's common shares was

$45 per share on December 31, 2020.

3. On April 1, 2020, Desrosiers sold a patent to Pinot Company in exchange for a $200,000 non-interest-bearing note due on April 1, 2022. There was no established exchange price for the patent, and the

note had no ready market. The prevailing rate of interest for a note of this type at April 1, 2020, was 12%. The present value of $1 for two periods at 12% is 0.79719 (use this factor). The patent had a

carrying amount of $40,000 at January 1, 2020, and the amortization for the year ended December 31, 2020 would have been $8,000. The collection of the note receivable from Pinot is reasonably

assured.

4. On July 1, 2020, Desrosiers sold a parcel of land to Four Winds Inc. for $200,000 under an instalment sale contract. Four Winds made a $60,000 cash down payment on July 1, 2020, and signed a four-

year, 11% note for the $140,000 balance. The equal annual payments of principal and interest on the note will be $45,125, payable on July 1, 2021, through July 1, 2024. The land could have been sold at

an established cash price of $200,000. Desrosiers had paid $150,000 for the land when it purchased it. Collection of the instalments on the note is reasonably assured.

5. On August 1, 2020, Desrosiers agreed to allow its customer, Saini Inc., to substitute a six-month note for accounts receivable of $200,000 it owed. The note bears interest at 6% and principal and interest

are due on the note's maturity date. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1.

The tables in this problem are to be used as a reference for this problem. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

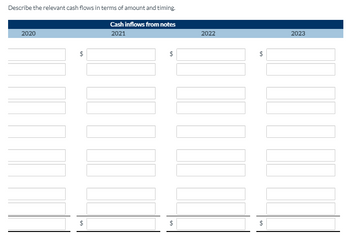

Transcribed Image Text:Describe the relevant cash flows in terms of amount and timing.

Cash inflows from notes

2020

$

2021

$

+A

2022

$

+A

$

2023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- C.S.Sunland Company had the following transactions involving notes payable. July 1, 2025 Nov. 1, 2025 Dec. 31, 2025 Feb. 1, 2026 Apr. 1, 2026 Borrows $55,950 from First National Bank by signing a 9-month, 8% note. Borrows $59,000 from Lyon County State Bank by signing a 3-month, 6% note. Prepares adjusting entries. Pays principal and interest to Lyon County State Bank. Pays principal and interest to First National Bank. Prepare journal entries for each of the transactions. (List all debit entries before credit entries. Credit accarrow_forwardSeifert Supply Company sold merchandise to a customer on December 1, 2020 for $100,000. The transaction resulted in recording a note receivable with a term of 6 months and an annual interest rate of 9%. The company's accounting period ends on December 31, 2020. What amount should Seifert Supply Company recognize as interest revenue on the note receivable on December 31, 2020? A. $1,500 B. $9,000 C. $750 D. $0arrow_forwardook int ences During 2020, Jesse Jericho Enterprises Corporation recorded credit sales of $786,000. At the beginning of the year, Accounts Receivable, Net of Allowance was $93,500. At the end of the year, after the Bad Debt Expense adjustment was recorded but before any bad debts had been written off, Accounts Receivable, Net of Allowance was $70,000. Required: 1. Assume that on December 31, 2020, accounts receivable totalling $10,000 for the year were determined to be uncollectible and written off. What was the receivables turnover ratio for 2020? (Round your answer to 1 decimal place.) Receivables turnover ratio 2. Assume instead that on December 31, 2020, $11,000 of accounts receivable was determined to be uncollectible and written off. What was the receivables turnover ratio for 2020? (Round your answer to 1 decimal place.) Receivables turnover ratioarrow_forward

- On May 31, Baker Co. issued an $35,679, 8%, 120-day note payable to Samunck Co. Assume Baker's fiscal year ends on June 30. Assume a 360- day year for your calculations. a) What is the interest EXPENSE recognized by Baker in the current fiscal year? b) What is the maturity value of the note? c) What is the maturity date of the note?arrow_forwardDecember 11, 2019, Hooper Inc. made a credit sale to Marshall Company and required Marshall to sign a $12,000, 60-day note. Prepare the journal entries necessary to record the receipt of the note by Hooper, the accrual of interest on December 31, 2019, and the customer’s repayment on February 9, 2020, assuming: 1. Interest of 12% was assessed in addition to the face value of the note. 2. The note was issued as a $12,000 non-interest-bearing note with a present value of $11,765. The implicit interest rate on the note receivable was 12%. Assume a 360-day year. (Round to the nearest dollar.)arrow_forwardCulver Company shows a balance of $237,880 in the Accounts Receivable account on December 31, 2020. The balance consists of the following. Installment accounts due in 2021 $23,900 Installment accounts due after 2021 38,300 Overpayments to vendors 3,540 Due from regular customers, of which $39,570 represents accounts pledged as security for a bank loan 87,500 Advances to employees 1,740 Advance to subsidiary company (due in 2021) 82,900 Illustrate how the information above should be shown on the balance sheet of Culver Company on December 31, 2020. Assume that installment accounts collectible due after December 31, 2018 (Customers) are collectible within the operating cycle of the business. The company’s operating cycle is such that all installment receivables are classified as current. CULVER COMPANYBalance Sheet (Partial)arrow_forward

- On July 1, 2020 Walker Inc. signed a $600,000, 15 month, 10% note payable. At due date, the principal and interest will be paid. Calculate the amount of interest expense that Walker Inc. should report on its income statement for the year ended December 31, 2021. (round to the nearest dollar)arrow_forwardSayed Company borrowed $40,000 on August 31, 2020, by issuing an 9-month, 9% interest-bearing note. The company prepares its financial statement annually at the end of December. Maturity date is: April 1, 2020 May 1, 2020 June 1, 2020 July 1, 2020 None of the above The adjusting entry to record the accrued interest on December 31, 2020 is: * Debit Interest Expense and Credit Interest Payable for $1,200 Debit Interest Expense and Credit Interest Payable for $1,500 Debit Interest Expense and Credit Cash for $3,600 Debit Interest Expense and Credit Interest Payable for $2,700 None of the above O Oarrow_forwardOn December 31, 2023, Sandy Company has a Note Receivable of $6,000. The note will be collected in installments. $1,200 is due on December 31, 2024 and $1,200 is due every year after December 31, 2024. The classification of the note on Sandy Company's balance sheet at December 31, 2023 is : A) $4,800 is a current asset and $1,200 is a long-term asset. B) all $6,000 is a long-term asset. C) all $6,000 is a current asset. D) $1,200 is a current asset and $4,800 is a long-term asset.arrow_forward

- Consider the following liabilities of Future Brands, Inc., at December 31, 2016, the company’s fiscal year-end. Should they be reported as current liabilities or long-term liabilities? 1. $77 million of 8% notes are due on May 31, 2020. The notes are callable by the company’s bank, beginning March 1, 2017. 2. $102 million of 8% notes are due on May 31, 2021. A debt covenant requires Future to maintain a current ratio (ratio of current assets to current liabilities) of at least 2 to 1. Future is in violation of this requirement but has obtained a waiver from the bank until May 2017, since both companies feel Future will correct the situation during the first half of 2017.arrow_forwardWaterway Company has the following two notes receivable at May 31, 2024, its fiscal year end: 1. 2. $32,400 six-month, 6% note issued January 1, 2024. $12,000 three-month, 4% note issued April 30, 2024. Interest is payable at maturity for both notes. (a) Calculate the accrued interest on both notes at May 31, 2024. (Round answers to the nearest whole dollar, e.g. 5,275.) Note 1: Note 2: Total accrued interest $arrow_forwardOn September 1,2020, Sunland Company issued a note payable to Fidelity Bank in the amount of $2691000, bearing interest at 9%, and payable in three equal annual principal payments of $897000. On this date, the bank's prime rate was 10%. The first payment for interest and principal was made on September 1, 2021. At December 31, 2021, Sunland should record accrued interest payable of O $89700. O $80730. O $179400, O $53820.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education