FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

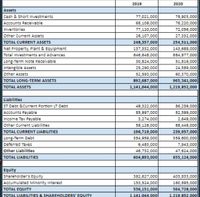

Compare and explain the data presented ( Year 2019-2020) in the balance sheet .

Transcribed Image Text:2019

2020

Assets

77,021,000

68,109,000

77,120,000

26,107,000

248,357,000

137,332,000

646,648,000

30,824,000

25,290,000

52,593,000

892,687,000

1,141,044,000|

Cash & Short Investments

78,903,000

76,220,000

72,056,000

Accounts Receivable

Inventories

Other Current Assets

27,332,000

254,511,000

143,689,000

000 ,ר87 684

51,816,000

24,589,000

60,370,000

965,341,000

1,219,852,000

TOTAL CURRENT ASSETS

Net Property, Plant & Equipment

Total Investments and Advances

Long-Term Note Receivable

Intangible Assets

Other AssetS

TOTAL LONG-TERM ASSETS

TOTAL ASSETS

Liabilities

49,322,000

85,997,000

3,274,000

58,126,000

196,719,000

354,959,000

6,483,000

46,732,000

604,893,000

ST Debt &Current Portion LT Debt

86,259,000

82,599,000

Accounts Payable

Income Tax Payable

2,649,000

Other Current Liabilities

68,449,000

239,957,000

TOTAL CURRENT LIABILITIES

Long-Term Debt

Deferred Taxes

359,600,000

7,943,000

47,624,000

655,124,000

other Liabilities

TOTAL LIABILITIES

Equity

Shareholder's Equity

Accumulated Minority Interest

382,627,000

153,524,000|

536,151,000

1.141.044.000

403,833,000

160,895,000

564,728,000

1.219.852.000

TOTAL EQUITY

TOTAL LIABILITIES & SHAREHOLDERS' EQUITY

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On the balance sheets, what is the most recent fiscal year reported? Fiscal year 2020, ending on February 1, 2020 Fiscal year 2020, ending on January 30, 2021 Fiscal year 2021, ending on February 1, 2020 Fiscal year 2021, ending on January 30, 2021arrow_forwardIndicate where each of the following items is reported on financial statements. Choose from the followingcategories: (a) current assets, (b) long-term investments, (c) current liabilities, (d) long-term liabilities,(e) other revenues and gains, ( f ) other expenses and losses, and (g) equity. Fair value adjustment—Tradingarrow_forwardBlyth Traders are a well-established wholesale business operating in the north of England and south Scotland. Their trial balance for year ended 31st December 2021 is presented below: Dr [£] Cr [£] Non-current assets (cost): Plant and machinery 150,000 Vehicles 100,000 Premises 600,000 Accumulated depreciation (1-1-21): Plant and equipment 90,000 Vehicles 50,000 Premises 96,000 Sales 829,000 Sales returns 2,000 Purchases 335,000 Carriage in Wages and salaries Discounts allowed 15,000 114,000 4,500 Electricity costs Vehicle maintenance 37,500 2,500 8,000 Advertising and marketing 14,000 Irrecoverable debts 3,000 Allowance for receivables 1,500 Bank 19,200 Accounts payable 31,600 Accounts receivable 60,000 Inventory (1-1-21) Drawings Bank loan [10%] Capital (1-1-21) 91,700 60,000 150.000 324,900 1,594,700 1,594,700 Additional notes: 1) Inventory at 31st December 2021 was valued at £94,000. However, on 4th January 2022 additional lines of inventory were uncovered that had not been…arrow_forward

- Count the average of these weights for all three years. Please note that you are to assign weights of 3, 2 and 1 to the financial ratios for FISCAL YEAR 2019, FISCAL YEAR 2018 and FISCAL YEAR 2017 and then compute the weighted average. Current Ratlo Particulars FY'19 L&T BHEL NBCC 1.3 1.59 1.08 Slemens 191 FY'18 FY'17 132 1.44 1.83 1.96 1.18 1.26 1.82 ▷arrow_forwardReview the Republic Financial Holdings Limited 2022 annual report. What recommendations can be made for the preparation of the financial statements ?arrow_forwardWhat would be a classified balance sheet as of December 31, 2021 for this problem?arrow_forward

- Using the following Balance Sheet summary information, for the two years presented calculate the working capital for 2018 and 2019 respectively: Current Assets 12/31/2018 is $101,600/ 12/31/2019 is $97,350 current liabilities 12/31/2018 is $33,650/ 12/31/2019 is $32,800arrow_forwardHow are open encumbrances at year-end reported in the financial statements?arrow_forwardCalculate Wiper's debt ratio and debt/equity ratio at December 31, 2020 and 2019.arrow_forward

- Prepare the following financial reports for the month of January 2020: a) Income Statement b) Balance Sheet c) Statement of Financial Position d) Statement of Cash Flows See the tabulation table.arrow_forwardInstructions: (Assume all transactions during the year were for cash.) a. Prepare the journal entry to record the sale of the available-for-sale debt securities in 2020. b. Prepare the journal entry to record the Unrealized Holding Gain or Loss for 2020. c. Prepare a statement of comprehensive income for 2020. d. Prepare a balance sheet as of December 31, 2020arrow_forwardPTD adopts the calendar year as reporting period and publishes interim financial report for the quarter-ended June 30, 2021. Which among the following reports bears correct date/period?I. Statement of Financial Position as of June 30, 2021 and as at December 31, 2020II. Statement of Financial Position as of June 20, 2021 and as at June 30, 2020III. Statement of Comprehensive Income for quarter-ended June 30, 2021, and six months ended June 30, 2021 plus Statement of Comprehensive Income for the period-ended December 31, 2020 and six-months ended June 30, 2020IV. Statement of Changes in Equity for six months ended June 30, 2021 and period-ended December 31, 2020V. Statement of Cash Flows for the six months ended June 30, 2021 and six months ended June 30, 2020.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education