FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Create a common-size statement of

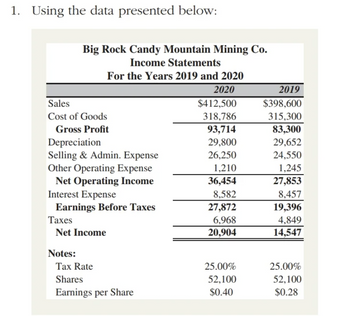

Transcribed Image Text:1. Using the data presented below:

Sales

Cost of Goods

Gross Profit

Big Rock Candy Mountain Mining Co.

Income Statements

For the Years 2019 and 2020

2020

$412,500

318,786

93,714

29,800

26,250

1,210

36,454

8,582

27,872

6,968

20,904

Depreciation

Selling & Admin. Expense

Other Operating Expense

Net Operating Income

Interest Expense

Earnings Before Taxes

Taxes

Net Income

Notes:

Tax Rate

Shares

Earnings per Share

25.00%

52,100

$0.40

2019

$398,600

315,300

83,300

29,652

24,550

1,245

27,853

8,457

19,396

4,849

14,547

25.00%

52,100

$0.28

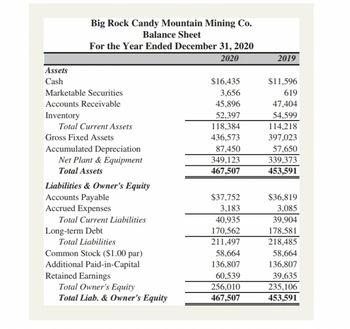

Transcribed Image Text:Assets

Cash

Big Rock Candy Mountain Mining Co.

Balance Sheet

For the Year Ended December 31, 2020

2020

Marketable Securities

Accounts Receivable

Inventory

Total Current Assets

Gross Fixed Assets

Accumulated Depreciation

Net Plant & Equipment

Total Assets

Liabilities & Owner's Equity

Accounts Payable

Accrued Expenses

Total Current Liabilities

Long-term Debt

Total Liabilities

Common Stock ($1.00 par)

Additional Paid-in-Capital

Retained Earnings

Total Owner's Equity

Total Liab. & Owner's Equity

$16,435

3,656

45,896

52,397

118,384

436,573

87,450

349,123

467,507

$37,752

3,183

40,935

170,562

211,497

58,664

136,807

60,539

256,010

467,507

2019

$11,596

619

47,404

54,599

114,218

397,023

57,650

339,373

453,591

$36,819

3,085

39,904

178,581

218,485

58,664

136,807

39,635

235,106

453,591

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Use the following information from Dubuque Company’s financial statements to prepare the operating activities section of the statement of cash flows (indirect method) for the year 2018.arrow_forwardWhat adjustment is made to FCFE when calculating the terminal value in a Discounted Cash Flow (DCF) analysis?arrow_forwardPrepare a complete statement of cash flows for 2014 using the indirect method using the information given.arrow_forward

- How would I input the formulas into excel to get those numbers for the statement of cash flowsarrow_forwardList the six steps to be followed when preparing a statement of cash flows. Be sure to include all aspects of the statement's preparation.arrow_forwardReconstruct the company’s comparative balance sheet for 2020/2021 using the information in line with your first name initial and compute and show the missing figures to include the appropriate sign as a positive or negative figure. Prepare a complete statement of cash flows for 2021 using the indirect method using the information in line with your first name initialarrow_forward

- Which is an appropriate method of preparing a common-size cash fl ow statement? B . Show each line item on the cash fl ow statement as a percentage of net revenue.arrow_forwardWhich is an appropriate method of preparing a common-size cash fl ow statement? A . Show each item of revenue and expense as a percentage of net revenue.arrow_forwardWhat accounts on the balance sheet must be evaluated when completing the financing activities section of the statement of cash flows?arrow_forward

- In addition to the three basic financial statements, which of the following is also a required financial statement? (C17L01) Select one a the Statement of Cash Flows Ob. the "Cash Reconciliation" the "Cash Budget" d. the Statement of Cash eflows and Outflowsarrow_forwardCompute the cost of goods sold and ending inventory, assuming (1) FIFO cost flow, (2) LIFO cost flow, and (3) weighted-average cost flow. Then, compute the income tax expense for each method. Use a vertical model to show the 2018 income statement, balance sheet, and statement of cash flows under FIFO, LIFO, and weighted average. (Hint: Record the events under an accounting equation before preparing the statements.)arrow_forwardPlease explain how to prepare a statement of cash flows (indirect method) including analyzing tables for a two year period such as : Statement of Cash Flows As of December 31, 2022 and 2021 Please provide an example. Thank you,arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education