Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

please solve the question with calculation

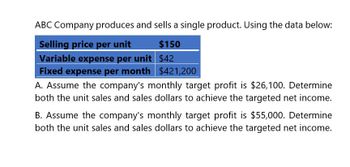

Transcribed Image Text:ABC Company produces and sells a single product. Using the data below:

Selling price per unit

Variable expense per unit

$150

$42

Fixed expense per month $421,200

A. Assume the company's monthly target profit is $26,100. Determine

both the unit sales and sales dollars to achieve the targeted net income.

B. Assume the company's monthly target profit is $55,000. Determine

both the unit sales and sales dollars to achieve the targeted net income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Using the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forwardOlivian Company wants to earn 420,000 in net (after-tax) income next year. Its product is priced at 275 per unit. Product costs include: Variable selling expense is 14 per unit; fixed selling and administrative expense totals 290,000. Olivian has a tax rate of 40 percent. Required: 1. Calculate the before-tax profit needed to achieve an after-tax target of 420,000. 2. Calculate the number of units that will yield operating income calculated in Requirement 1 above. (Round to the nearest unit.) 3. Prepare an income statement for Olivian Company for the coming year based on the number of units computed in Requirement 2. 4. What if Olivian had a 35 percent tax rate? Would the units sold to reach a 420,000 target net income be higher or lower than the units calculated in Requirement 3? Calculate the number of units needed at the new tax rate. (Round dollar amounts to the nearest dollar and unit amounts to the nearest unit.)arrow_forwardThe following information is available for Cooke Company for the current year: The gross margin is 40% of net sales. What is the cost of goods available for sale? a. 5840,000 b. 960,000 c. 1,200,000 d. 1,220,000arrow_forward

- Starling Co. manufactures one product with a selling price of 18 and variable cost of 12. Starlings total annual fixed costs are 38,400. If operating income last year was 28,800, what was the number of units Starling sold? a. 4,800 b. 6,400 c. 5,600 d. 11,200arrow_forwardFaldo Company produces a single product. The projected income statement for the coming year, based on sales of 200,000 units, is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. Suppose that 30,000 units are sold above the break-even point. What is the profit? 2. Compute the contribution margin ratio and the break-even point in dollars. Suppose that revenues are 200,000 greater than expected. What would the total profit be? 3. Compute the margin of safety in sales revenue. 4. Compute the operating leverage. Compute the new profit level if sales are 20 percent higher than expected. 5. How many units must be sold to earn a profit equal to 10 percent of sales? 6. Assume the income tax rate is 40 percent. How many units must be sold to earn an after-tax profit of 180,000?arrow_forwardLotts Company produces and sells one product. The selling price is 10, and the unit variable cost is 6. Total fixed cost is 10,000. Required: 1. Prepare a CVP graph with Units Sold as the horizontal axis and Dollars as the vertical axis. Label the break-even point on the horizontal axis. 2. Prepare CVP graphs for each of the following independent scenarios: (a) Fixed cost increases by 5,000, (b) Unit variable cost increases to 7, (c) Unit selling price increases to 12, and (d) Fixed cost increases by 5,000 and unit variable cost is 7.arrow_forward

- Income Statements under Absorption and Variable Costing In the coming year, Kalling Company expects to sell 28,700 units at 32 each. Kallings controller provided the following information for the coming year: Required: 1. Calculate the cost of one unit of product under absorption costing. 2. Calculate the cost of one unit of product under variable costing. 3. Calculate operating income under absorption costing for next year. 4. Calculate operating income under variable costing for next year.arrow_forwardKlamath Company produces a single product. The projected income statement for the coming year is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. 2. Suppose 10,000 units are sold above break-even. What is the operating income? 3. Compute the contribution margin ratio. Use the contribution margin ratio to compute the break-even point in sales revenue. (Note: Round the contribution margin ratio to four decimal places, and round the sales revenue to the nearest dollar.) Suppose that revenues are 200,000 more than expected for the coming year. What would the total operating income be?arrow_forwardPedaci Corporation produces and sells a single product. Data concerning that product appear below: Assume the company's monthly target profit is $15,000. The unit sales to attain that target profit is closest to: 3,212B. 5,265C. 8,235D. 5,571 Assume the company's monthly target profit is $17,000. The dollar sales to attain that target profit is closest to: $387,392B. $635,069C. $671,925D. $993,313arrow_forward

- Frymire Corporation produces and sells a single product. Data concerning that product appear below: Selling price per unit $240.00 Variable expense per unit $79.20 Fixed expense per month $1,019,472 Assume the company's monthly target profit is $46,000. The dollar sales to attain that target profit is closest to: a. $3,228,703 b. $1,961,477 c. $1,590,257 d. $1,065,472arrow_forwardSpectrum Corp. makes two products: C and D. The following data have been summarized: (Click the icon to view the data.) Spectrum Corp. desires a 25% target gross profit after covering all product costs. Considering the total product costs assigned to the Products C and D, what would Spectrum have to charge the customer to achieve that gross profit? Round to two decimal places. Begin by selecting the formula to compute the amount that the company should charge for each product. Required sales price per unit Data table Direct materials cost per unit Direct labor cost per unit Indirect manufacturing cost per unit Total costs assigned Print $ $ Product C 600.00 $ 300.00 270.00 1,170.00 S Done - X Product D 2,400.00 200.00 604.00 3,204.00arrow_forwardThe Abigail Company produces and sell two products, X and Y. Cost and revenue data on the products follow: Product X Product Y P24 Selling price per unit Variable cost per unit Contribution margin per unit P20 12 6. P8 P18 In the most recent month, the company sold 400 units of Product X and 800 units of Product Y. Fixed expenses are P10,000 per month. REQUIRED: 1. Prepare a comparative income statement for both products on the most recent monthly projections. 2. Compute the company's overall monthly break-even point in peso sales.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,