Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Provide solution for this question

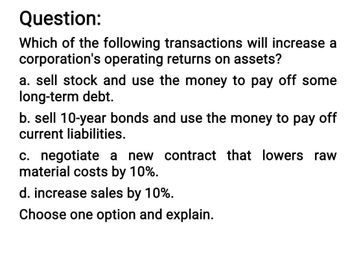

Transcribed Image Text:Question:

Which of the following transactions will increase a

corporation's operating returns on assets?

a. sell stock and use the money to pay off some

long-term debt.

b. sell 10-year bonds and use the money to pay off

current liabilities.

c. negotiate a new contract that lowers raw

material costs by 10%.

d. increase sales by 10%.

Choose one option and explain.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company borrows $4 to finance a project. It has two choices when beginning the project. The first option has potential payoff of either $2 or $8 (both equally likely). The second option has potential payoffs of $0 or $16 (both equally likely). The lender would prefer the _____ option because the expected value of the first option is option is and the expected value of the second first; $3; $2 first; $8; $5 second; $5; $8 second; $16; $4arrow_forwardAssume that a company is considering purchasing a machine for $50,500 that will have a five-year useful life and no salvage value. The machine will lower operating costs by $17,000 per year. The company's required rate of return is 18%. The profitability index for this investment is closest to: Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice C O 0.95. 1.01. 1.05. 1.11.arrow_forwardSuppose the following two independent investment opportunities are available to a company. The appropriate discount rate is 8 percent. Year O 1 2 3 Project Alpha -$4,500 b. 2,300 2,200 1,450 a. Compute the profitability index for each of the two projects. (Do not round intermediate calculations and round your answers to 3 decimal places, e.g., 32.161.) Project Alpha Project Beta Project Beta -$ 6,100 1,350 4,500 4,000 Profitability Index Which project(s), if either, should the company accept based on the profitability index rule? Project Alpha O Project Beta Neither project O Both projectsarrow_forward

- Assume that a company is considering purchasing a machine for $50,500 that will have a five-year useful life and no salvage value. The machine will lower operating costs by $17,000 per year. The company's required rate of return is 18%. The profitability index for this investment is closest to: Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using the tables provided. Multiple Choice O 0.95. 1.01. 1.05. 1.11.arrow_forwardPlease only answer PART F d) Suppose the Internal Rate of Return (IRR) of this investment opportunity is 15%. Based on this information alone, should Limitless Ltd. make the investment? Why?Would this decision be consistent with that from B? Explain your reasoning.e) Suppose that, instead of paying the initial £500,000 now, Limitless Ltd. decides to pay it in equal instalments over the next 10 years. How much would the companyneed to pay each year to make all these payments equivalent to £500,000 today? f) Now assume that an alternative project would generate immediate (time zero) net profits of £500,000 upfront, but after that, it would result in annual losses of£120,000 over the next five years, and then the annual losses of £60,000 over the following five years. The cost of capital is 12% and the IRR is 15%. Should you start this project? Explain your reasoning. Would you make the same decision based on NPV and IRR? Why?arrow_forwardConsider the following two independent investment opportunities that are available to Lion, Inc. The appropriate discount rate is 11.7%. Project X Project Y Year 0 1 2 3 $-1,272 544 941 860 $-2.162 909 2,194 1,302 What is the Profitability Index of project Y? (Round answer to 2 decimal places. Do not round intermediate calculations)arrow_forward

- I need answer of this question solution general financearrow_forwardA. Estimate the free cash flow to the firm for each of the 4 years. B. Compute the payback (using free cash flows) period for investors in the firm. C. Compute the net present value and internal rate of return to investors in the firm.Would you accept the project? Why or why not? D. How will you incorporate this information in your existing analysis? Compute the newFCF side costs and benefits. Calculate the new NPV and IRR. Would you accept the project? Using A, B C with the first picture.arrow_forwardLipsion Ltd company is thinking about investing in one of two potential new productsfor sale. The projections are as follows: year revenue/ product s revenue/ product v0 (150,000) outlay (150000) outlay1 14000 150002 24000 253333 44000 520004 84000 63333 Calculate NPV of both products (to 1 d.p.) assuming a discount rate of 7%. Then decide which product should be selected and why ?arrow_forward

- 9. Which of the following strategy enables a manager to report a higher current ratio? Select one: a. Pay off accounts payable prior to year-end b. Purchase more fixed assets c. Purchase more fixed income securities d. Invest more in long term debtarrow_forwardThe Weiland Computer Corporation is trying to choose between the following mutually exclusive design projects, P1 and P2: Year 0 1 2 3 Cash flows (P1) -$53,000 27,000 27,000 27,000 Cash flow (P2) -$16,000 9,100 9,100 9,100 If the discount rate is 10 percent and the company applies the profitability index (PI) decision rule, which project should the firm accept? If the firm applies the Net Present Value (NPV) decision rule, which project should it take? Are your answers in (a) and (b) different? Explain why?arrow_forwardA company is thinking of investing in one of two potential new products for sale. The projections are as follows: Year Revenue/cost £ (Product A) Revenue/cost £ (Product B)0 (150,000) outlay (150,000) outlay 1 24,000 12,0002 24,000 25,3333 44,000 52,0004 84,000 63,333 1.Calculate the payback period for both products in years and months, not as a decimal. Please present answer to nearest half a month.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning