FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

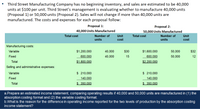

Transcribed Image Text:Third Street Manufacturing Company has no beginning inventory, and sales are estimated to be 40,000

units at $100 per unit. Third Street's management is evaluating whether to manufacture 40,000 units

(Proposal 1) or 50,000 units (Proposal 2). Sales will not change if more than 40,000 units are

manufactured. The costs and expenses for each proposal follow:

Proposal 1:

Proposal 2:

40,000 Units Manufactured

50,000 Units Manufactured

Total cost

Number of

Unit

cost

Total cost

Number of

Unit

units

units

cost

Manufacturing costs:

Variable

$1,200,000

40,000

$30

$1,600,000

50,000

$32

Fixed

600,000

40,000

15

600,000

50,000

12

Total

$1.800.000

$2.200.000

Selling and administrative expenses:

Variable

$ 210,000

$ 210,000

Fixed

140,000

140,000

Total

$ 350.000

$ 350.000

a.Prepare an estimated income statement, comparing operating results if 40,000 and 50,000 units are manufactured in (1) the

absorption costing format and (2) the variable costing format.

b.What is the reason for the difference in operating income reported for the two levels of production by the absorption costing

income statement?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Baxtell Company manufactures and sells a single product. The following costs were incurred during the company's first year of operations: Variable costs per unit: Manufacturing: Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative Fixed costs per year: Fixed manufacturing overhead Fixed selling and administrative expense $ 27 7 4 9 370,800 183,200 During the year, the company produced 30,900 units and sold 22,900 units. The selling price of the company's product is $73 per unit. Required: 1. Assume that the company uses absorption costing. a. Compute the unit product cost. Unit product cost b. Prepare an income statement for the year. (Do not leave any empty spaces; Input a O wherever it is required.) Absorption Costing Income Statement Cost of goods sold:arrow_forwarda. 1. Prepare an estimated income statement, comparing operating results if 29,600 and 32,800 units are manufactured in the absorption costing format. If an amount box does not require an entry leave it blank. a. 2. Prepare an estimated income statement, comparing operating results if 29,600 and 32,800 units are manufactured in the variable costing format. If an amount box does not require an entry leave it blank. b. What is the reason for the difference in operating income reported for the two levels of production by the absorption costing income statement? The increase in income from operations under absorption costing is caused by the allocation of overhead cost over a number of units. Thus, the cost of goods sold is . The difference can also be explained by the amount of overhead cost included in the inventory.arrow_forwardIncome Statements under Absorption Costing and Variable Costing Fresno Industries Inc. manufactures and sells high-quality camping tents. The company began operations on January 1 and operated at 100% of capacity (70,400 units) during the first month, creating an ending inventory of 6,400 units. During February, the company produced 64,000 units during the month but sold 70,400 units at $90 per unit. The February manufacturing costs and selling and administrative expenses were as follows: Manufacturing costs in February 1 beginning inventory: Variable Fixed Total Manufacturing costs in February: Variable Fixed Total Selling and administrative expenses in February: Variable Fixed Total Number of Units Cost of goods sold: 6,400 $36.00 6,400 14.00 64,000 64,000 Unit Cost 70,400 70,400 Total Cost $230,400 89,600 $50.00 $320,000 $36.00 $2,304,000 15.40 985,600 $51.40 $3,289,600 $18.20 $1,281,280 7.00 492,800 $25.20 $1,774,080 a. Prepare an income statement according to the absorption…arrow_forward

- need last three requirement , answer in text form please (without image)arrow_forwardSunland Products manufactures and sells a variety of camping products. Recently the company opened a new factory to manufacture a deluxe portable cooking unit. Cost and sales data for the first month of operation are shown below: Beginning inventory Units produced Units sold Manufacturing costs Fixed overhead Variable overhead Direct labour Direct material Selling and administrative costs Fixed Variable 0 units 11,200 10,100 $100,800 $3 $12 $28 $207,100 per unit. per unit per unit $3 per unit sold The portable cooking unit sells for $110. Management is interested in the opening month's results and has asked for an income statement.arrow_forwardGreat Outdoze Company manufactures sleeping bags, which sell for $66.10 each. The variable costs of production are as follows: Direct material Direct labor Variable manufacturing overhead $19.10 10.30 7.40 k Budgeted fixed overhead in 20x1 was $157,500 and budgeted production was 25,000 sleeping bags. The year's actual production was 25,000 units, of which 21,300 were sold. Variable selling and administrative costs were $1.30 per unit sold; fixed selling and administrative costs were $22,000. atarrow_forward

- Required: 1. Determine the unit product cost under: a. Absorption costing. b. Variable costing. 2. Prepare variable costing income statements for July and August. 3. Reconcile the variable costing and absorption costing net operating incomes.arrow_forwardYour company management wants you to compare the list of materials for HML and ABC analysis. For ABC classification they set the following criteria; Items below SR 100000 annual consumption shall be considered as C-items, items between SR 100000 and SR 150000 shall be considered as B-items, and items above SR 150000 shall be considered as A- items For HML classification they set the following criteria; Items below unit price SR 50 shall be considered as L-items, items between SR 50 and SR 100 unit price shall be considered as M-items, and items above SR 100 unit price shall be considered as H-items. Based upon your analysis suggest which classification shall be better for the company so that inventory can be optimized. Justify your answer. Item Consumption (Units) Annual Price/unit SR H/M/L Consumption (SR) Annual A/B/C A 2000 40 B 3000 65 C 2500 90…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education