College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

General Accounting

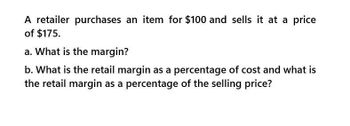

Transcribed Image Text:A retailer purchases an item for $100 and sells it at a price

of $175.

a. What is the margin?

b. What is the retail margin as a percentage of cost and what is

the retail margin as a percentage of the selling price?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- If a retailer bought n numbers of goods at P price each, he sold each good at a rate r marked up on the selling price. Describe how to find the selling price and the gross margin for each good. How is the gross margin used in sales?arrow_forwardWhat is the wholesale price of an item, if the retail price is $104.37 and the amount of markup is $33.37? The wholesale price is $arrow_forwardK Which of the following is true of net sales revenue? OA It is calculated by adding sales discounts and sales retums and allowances to sales OB. It is calculated by deducting sales discounts and sales retums and allowances from sales OC. It is calculated by adding sales discounts to sales OD. It is calculated by subtracting cost of goods sold from sales MacBook Proarrow_forward

- o determine the sales tax (in $) and calculate the total purchase price (in $) for the item. (Round your answers to the nearest cent.) Use Selling Sales Total Item Price Таx Purchase Price Candy bar $0.69 $4 2$arrow_forwardCost of goods sold is given by: Select one: a. Net Purchases + beginning inventory - ending inventory. b. Net purchases + ending inventory - beginning inventory. c. Beginning inventory + accounts payable - net purchases. d. Beginning inventory - net purchases + ending inventory.arrow_forwardCompute cost of goods sold using the following information. Merchandise inventory, beginning Cost of merchandise purchased Merchandise inventory, ending $12,200 45.200 18,200 Cost of Goods Sold is Computed an Cost of goods sold $ Heip have t Subitarrow_forward

- 3. If a retailer bought n numbers of goods at P price each, he sold each good at a rater marked up on the selling price. Describe how to find the selling price and the gross margin for each good. How is the gross margin used in sales? 1S 4. After learning the concept of mark up, how would you assess your market value in terms of abilities? What can you do to increase your market value?arrow_forwardThe gross margin estimation method estimates the cost of goods sold by multiplying the costs to sales ratio by purchases. O multiplying the sales revenue by the inventory turnover ratio. multiplying the cost of goods available by the gross margin percentage. O multiplying the sales revenue by cost-to-sales ratio.arrow_forwardSub. Accountarrow_forward

- 6. The formula for calculating the selling price (or retail price) of an item when the Total Purchase Price is known is as follows. Selling Price = Total Purchase Price 100% − Sales Tax Rate True or False?arrow_forwardMar. Stellar Stores purchases $8,500 of merchandise for resale from Blossom Wholesalers, terms 2/10, n/30, FOB shipping point. The correct company pays $135 for the shipping charges. Stellar returns $1,000 of the merchandise purchased on March 1 because it was the wrong colour. Blossom gives Stellar a 3 $1,000 credit on its account. Stellar Stores purchases an additional $11,500 of merchandise for resale from Blossom Wholesalers, terms 2/10, n/30, 21 FOB destination. 22 The correct company pays $155 for freight charges. Stellar returns $300 of the merchandise purchased on March 21 because it was damaged. Blossom gives Stellar a $300 23 credit on its account. 30 Stellar paid Blossom the amount owing for the merchandise purchased on March 1. 31 Stellar paid Blossom the amount owing for the merchandise purchased on March 21. Additional information: Mar. Blossom's cost of the merchandise sold to Stellar was $3,800. 1 Blossom's cost of the merchandise returned by Stellar was $447. As the…arrow_forwardRetailer X buys a product at $1.75 per unit and plans to sell the item for $3.29 per unit. Calculate the Margin on an (A) COST Basis or (B) RETAIL basisarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,