Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

provide solution

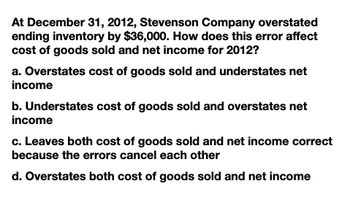

Transcribed Image Text:At December 31, 2012, Stevenson Company overstated

ending inventory by $36,000. How does this error affect

cost of goods sold and net income for 2012?

a. Overstates cost of goods sold and understates net

income

b. Understates cost of goods sold and overstates net

income

c. Leaves both cost of goods sold and net income correct

because the errors cancel each other

d. Overstates both cost of goods sold and net income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Company Edgar reported the following cost of goods sold but later realized that an error had been made in ending inventory for year 2021. The correct inventory amount for 2021 was 12,000. Once the error is corrected, (a) how much is the restated cost of goods sold for 2021? and (b) how much is the restated cost of goods sold for 2022?arrow_forwardAssuming a companys year-end inventory were overstated by $5,000, indicate the effect (overstated/understated/no effect) of the error on the following balance sheet and income statement accounts. A. Income Statement: Cost of Goods Sold B. Income Statement: Net Income C. Balance Sheet: Assets D. Balance Sheet: Liabilities E. Balance Sheet: Equityarrow_forwardIf a group of inventory items costing $3,200 had been double counted during the year-end inventory count, what impact would the error have on the following inventory calculations? Indicate the effect (and amount) as either (a) none, (b) understated $______, or (c) overstated $______. Table 10.2arrow_forward

- If Barcelona Companys ending inventory was actually $122,000, but the cost of consigned goods, with a cost value of $20,000 were accidentally included with the company assets, when making the year-end inventory adjustment, what would be the impact on the presentation of the balance sheet and income statement for the year that the error occurred, if any?arrow_forwardIf a group of inventory items costing $15,000 had been omitted from the year-end inventory count, what impact would the error have on the following inventory calculations? Indicate the effect (and amount) as either (a) none, (b) understated $______, or (c) overstated $______. Table 10.1arrow_forwardIdentify the errors in the following schedule of the cost of merchandise sold for the year ended May 31, 2018:arrow_forward

- Indicate the effect of each of the following errors on the following balance sheet and income statement items for the current and succeeding years: beginning inventory, ending inventory, accounts payable, retained earnings, purchases, cost of goods sold, net income, and earnings per share. a. The ending inventory is overstated. b. Merchandise purchased on account and received was not recorded in the purchases account until the succeeding year although the item was included in inventory of the current year. c. Merchandise purchased on account and shipped FOB shipping point was not recorded in either the purchases account or the ending inventory. d. The ending inventory was understated as a result of the exclusion of goods sent out on consignment.arrow_forwardBhushan Company has been using LIFO for inventory purposes because it would prefer to keep gross profits low for tax purposes. In its second year of operation (20-2), the controller pointed out that this strategy did not appear to work and suggested that FIFO cost of goods sold would have been higher than LIFO cost of goods sold for 20-2. Is this possible? REQUIRED Using the information provided, compute the cost of goods sold for 20-1 and 20-2 comparing the LIFO and FIFO methods.arrow_forwardGet Answer please without AI toolarrow_forward

- Suppose Ajax Corporation overstates its ending inventory amount. What effect will this have on the reported amount of cost of goods sold in the year of the error? a. Overstate cost of goods sold.b. Understate cost of goods sold.c. Have no effect on cost of goods sold.d. Not possible to determine with information given.arrow_forwardMerchandise inventory at the end of the year was understated. Which of the following statements correctly states the effect of the error? Oa. Net income is understated. Ob. Net income is overstated. Dc. Merchandise inventory reported on the balance sheet is overstated. d. Cost of merchandise sold is understated.arrow_forwardAyayai Hardware Limited reported the following amounts for its cost of goods sold and Inventory: Cost of goods sold Ending inventory 2018 Ending inventory $169,200 Cost of goods sold 37,400 2017 Ayayai made two errors: (1) ending inventory for 2018 was overstated by $2,000 and (2) ending inventory for 2017 was understated by $4,100. Assume that neither error has been found or corrected. $152,900 Calculate the correct ending inventory and cost of goods sold amounts for each year. $ 29,400 2018 tA $ LA 2017arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning