Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

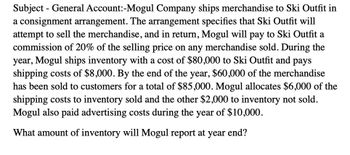

Transcribed Image Text:Subject - General Account:-Mogul Company ships merchandise to Ski Outfit in

a consignment arrangement. The arrangement specifies that Ski Outfit will

attempt to sell the merchandise, and in return, Mogul will pay to Ski Outfit a

commission of 20% of the selling price on any merchandise sold. During the

year, Mogul ships inventory with a cost of $80,000 to Ski Outfit and pays

shipping costs of $8,000. By the end of the year, $60,000 of the merchandise

has been sold to customers for a total of $85,000. Mogul allocates $6,000 of the

shipping costs to inventory sold and the other $2,000 to inventory not sold.

Mogul also paid advertising costs during the year of $10,000.

What amount of inventory will Mogul report at year end?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Blossom Corporation shipped $21,900 of merchandise on consignment to Cullumber Company. Blossom paid freight costs of $2,100. Cullumber Company paid $550 for local advertising, which is reimbursable from Blossom. By year-end, 65% of the merchandise had been sold for $21,900. Cullumber notified Blossom, retained a 10% commission, and remitted the cash due to Blossom. Prepare Blossom's journal entry when the cash is received. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Account Titles and Explanation (To record the cash remitted to Blossom.) (To record the cost of inventory sold on consignment.) Debit 11 Credit 1arrow_forwardIndigo Corporation shipped $25,000 of merchandise on consignment to Sandhill Company. Indigo paid freight costs of $1,900. Sandhill Company paid $400 for local advertising, which is reimbursable from Indigo. By year end, 60% of the merchandise had been sold for $20,500. Sandhill notified Indigo, retained a 10% commission, and remitted the cash due to Indigo. Prepare Indigo’s journal entry when cash is received. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit enter an account title to record revenue enter a debit amount enter a credit amount enter an account title to record revenue enter a debit amount enter a credit amount enter an account title to record revenue enter a debit amount enter a credit amount enter an account title to record revenue enter a…arrow_forwardCarla Vista Corporation shipped $20,100 of merchandise on consignment to Wildhorse Company. Carla Vista paid freight costs of $2,000. Wildhorse Company paid $510 for local advertising, which is reimbursable from Carla Vista. By year-end, 58% of the merchandise had been sold for $20,100. Wildhorse notified Carla Vista, retained a 10% commission, and remitted the cash due to Carla Vista. Prepare Carla Vista's journal entry when the cash is received. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)arrow_forward

- JBL undertook the following transactions for the month of Nov Purchased merchandise or $80,000 less 5-5 on terms 3/10 n/30. The entity paid freight for $2,500 and returned defective goods worth $7,000. JBL paid this account in full within the discount period. How much was the purchase discount?arrow_forwardOn May 11, 2022, Babolat Purchasing purchased $23,000 of merchandise from Polystring Pro; terms 2/10, n/90, FOB Shipping point. The cost of the goods to Polystring was $16,000. Babolat paid $1,300 to Express Shipping Service for the delivery charges on the merchandise on May 11. On May 12, Babolat returned $3,500 of goods to Polystring Pro, which restored them to inventory. On May 15, Babolat sent its payment to Polystring. Present the journal entries that Babolat Purchasing should record for these transactionarrow_forwardOn June 3, 2020, Nash Company sold to Ann Mount merchandise having a sales price of $7,200 (cost $4,320) with terms of n/60, f.o.b. shipping point. Nash estimates that merchandise with a sales value of $720 will be returned. An invoice totaling $140 was received by Mount on June 8 from Olympic Transport Service for the freight cost. Upon receipt of the goods, on June 8, Mount returned to Nash $300 of merchandise containing flaws. Nash estimates the returned items are expected to be resold at a profit. The freight on the returned merchandise was $23, paid by Nash on June 8. On July 16, the company received a check for the balance due from Mount.Prepare journal entries for Nash Company to record all the events in June and July. The journal entries required are: To record sales To record cost of goods sold To record sales returns To record cost of goods returned To record the freight costarrow_forward

- YG COMPANY enters into a consignment arrangement with SM Company Under the arrangement, YG COMPANY transfers goods to SM Company which SM Company undertakes to sell on behalf of YG COMPANY In exchange, SM Company is entitled to a 20% commission based on sales. The following are the transactions: April 1- SMCompany accepts delivery of consigned goods with total sales value of P 390,000. The costs of those goods to YG COMPANY is P 220,000. April 3 - SM Company sells consigned goods costing P 55,000 for P 100,000. YG COMPANY. is not notified of the sale. April 7 - SM Company makes the weekly remittance of sale proceeds, net of commission, to YG COMPANY Prepare the journal entry on April 1 on the books of YG COMPANY.arrow_forwardOn June 10, Pharoah Company purchased $8,500 of merchandise on account from Flounder Company, FOB shipping point, terms 2/10, n/30. Pharoah pays the freight costs of $520 on June 11. Damaged goods totaling $500 are returned to Flounder for credit on June 12. The fair value of these goods is $70. On June 19, Pharoah pays Flounder Company in full, less the purchase discount. Both companies use a perpetual inventory system. (a) Your answer is partially correct. Prepare separate entries for each transaction on the books of Pharoah Company. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit June 10 v Inventory 8,500 Accounts Payable 8,500 June 11 v Inventory 520 Cash 520 June 12 v Accounts Payable 500 Inventory 500 June 19 v Accounts Payable Inventory Cash MacBook Proarrow_forwardOn June 10, Pharoah Company purchased $ 8,500 of merchandise on account from Flounder Company, FOB shipping point, terms 2/10, n/30. Pharoah pays the freight costs of $ 520 on June 11. Damaged goods totaling $ 500 are returned to Flounder for credit on June 12. The fair value of these goods is $ 70. On June 19, Pharoah pays Flounder Company in full, less the purchase discount. Both companies use a perpetual inventory system.arrow_forward

- On January 1, 20x1 Plaka Co. acquired goods for sale in the ordinary course of business for P250,000, excluding P5,000 refundable purchase taxes. The supplier usually sells goods on 30 days' interest-free credit. However, as a special promotion, the purchase agreement for these goods provided for payment to be made in full on December 31, 20x1. Transport charges of P2,000 were paid on January 1, 20x1. An appropriate discount rate is 10 per cent per year. 12. How much is the initial cost of the inventories?arrow_forwardE5-4 On June 10, Diaz Company purchased $8,000 of merchandise from Taylor Company, FOB shipping point, terms 2/10, n/30. Diaz pays the freight costs of $400 on June 11. Dam- aged goods totaling $300 are returned to Taylor for credit on June 12. The fair value of these goods is $70. On June 19, Diaz pays Taylor Company in full, less the purchase dis- count. Both companies use a perpetual inventory system. Instructions (a) Prepare separate entries for each transaction on the books of Diaz Company. (b) Prepare separate entries for each transaction for Taylor Company. The merchandise purchased by Diaz on June 10 had cost Taylor $4,800.arrow_forwardE5-4 On June 10, Diaz Company purchased $8,000 of merchandise from Taylor Company, FOB shipping point, terms 2/10, n/30. Diaz pays the freight costs of $400 on June 11. Dam- aged goods totaling $300 are returned to Taylor for credit on June 12. The fair value of these goods is $70. On June 19, Diaz pays Taylor Company in full, less the purchase dis- count. Both companies use a perpetual inventory system. Instructions (a) Prepare separate entries for each transaction on the books of Diaz Company. (b) Prepare separate entries for each transaction for Taylor Company. The merchandise purchased by Diaz on June 10 had cost Taylor $4,800. E5-5 Presented below are transactions related to R. Humphrey Company. 1. On December 3, R. Humphrey Company sold $570,000 of merchandise to Frazier Co., terms 1/10, n/30, FOB destination. R. Humphrey paid $400 for freight charges. The cost of the merchandise sold was $350,000. 2. On December 8, Frazier Co. was granted an allowance of $20,000 for merchandise…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning  Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning