Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Please make sure you have the right answer! I have asked this question too many times and all the answers were wrong!!!

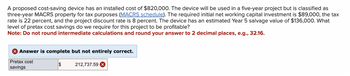

Transcribed Image Text:A proposed cost-saving device has an installed cost of $820,000. The device will be used in a five-year project but is classified as

three-year MACRS property for tax purposes (MACRS schedule). The required initial net working capital investment is $89,000, the tax

rate is 22 percent, and the project discount rate is 8 percent. The device has an estimated Year 5 salvage value of $136,000. What

level of pretax cost savings do we require for this project to be profitable?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

Answer is complete but not entirely correct.

Pretax cost

savings

$

212,737.59

Expert Solution

arrow_forward

Step 1

The Company manufacture and sells goods after bearing lots of costs such as material labor, machinery, expenses, etc. The company should invest in those machines which control the company's cost so the Burdon of the cost will be low.

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forwardthe answer is wrong and i still couldnt get past the question.arrow_forwardthey didnot answer it completely,arrow_forward

- Hello, the second half of this problem was not solved. Can you please provide explanation for part 4 and part 5 like you did for the other parts. Thanks so much.arrow_forwardEmployees are more likely to apply their personal values to their behaviour when: those values conflict with the organization's values. the values are abstract. someone reminds them of those values. All of the answers are correct. None of the answers apply.arrow_forwardKaren finds that many claim forms were rejected because important information was omitted. How might Karen suggest corrections for these omissions?arrow_forward

- Consider a project with an initial investment of $300,000, which must befinanced at an interest rate of l2% per year. Assuming that the required repayment period is six years, determine the repayment schedule by identifying the principal as well as the interest payments for each of the following repayment methods:(a) Equal repayment of the principal: $50,000 principal payment each year(b) Equal repayment of the interest: $36,000 interest payment each year(c) Equal annual installments: $72,968 each yeararrow_forwardExplain the steps that apply your own sense of right and wrong to ethical dilemmas.arrow_forwardQuite often, people may face situations that put them in an ethical conflict. The best way to cope with this is ________. Question 22 options: A) to develop a personal code of ethical conduct about what is right and wrong B) to use the "golden rule" C) to do what makes the largest number of people happy in the situation D) to do nothing and ignore the situation E) to act the same way you have seen others act in similar situationsarrow_forward

- I have problems in understanding the concept of "risk aversion" Which of the following is correct? i. A more risk averse person would require less return to face the face same risk as a less risk averse person i. No, he would require more return because his aversion is higher ii. They both would require the same return, because in the final analysis, risk aversion, does not matter. iv. Risk aversion is morally wrong, so forget about the concept, nothing to understand!arrow_forwardI still don't understand and the answer to project X, Y and Z isn't correct. I got a different answer.arrow_forwardIt keeps coming back incorrect and I can not figure out whYarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education