Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

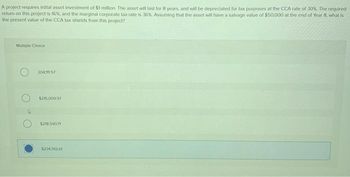

Transcribed Image Text:A project requires initial asset investment of $1 million. The asset will last for 8 years, and will be depreciated for tax purposes at the CCA rate of 30%. The required

return on this project is 16%, and the marginal corporate tax rate is 36%. Assuming that the asset will have a salvage value of $50,000 at the end of Year 8. what is

the present value of the CCA tax shields from this project?

Multiple Choice

204111.57

$215.009.97

$218.59071

$234.782.61

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Ignore income taxes in this problem.) Your Company is considering a project with an 8-year life. Your required rate of return is 10%. What is the net present value of the project? Project Cost of equipment needed now $80,000 Working capital investment needed now 115,000 Annual cash operating inflows 27,000 Salvage value of equipment in 6 years 0 Group of answer choices ($ 270). $ 2,750. $73,375. ($26,625).arrow_forwardHh.27.arrow_forwardq4d-Project A requires an initial outlay of $10000 and will last for 5 years. The investment will be depreciated using straight‐line depreciation to a book value of 0 over the life of the project. The corporate tax rate is 30% and the required rate of return is 8%. What is the present value of Project A’s depreciation tax shields?arrow_forward

- 19.Sunshine Love Company is considering two mutually exclusive project, one with a 4-year life and the other 6-year life. The after-tax cash flows from the two project are as follows: Project A (RM) |(400,000) Project B (RM) (400,000) Year 1 162,000 120,000 162,000 162,000 120,000 120,000 4 120,000 120,000 Assuming a 15 % required rate of return on both project, calculate each project'sarrow_forwardABC is considering investing in a project that has an initial cost of $560,000. The project will earn unlevered free cash flows (FCFF) of $96, 000 per year in perpetuity. The unlevered cost of capital is 20% and the tax rate is 40%. What is the NPV of the unlevered project? Group of answer choices $400,000 $80, 000 $480,000 $80, 000arrow_forwardPlease answer very fast then i ll upvote. XYZ Limited is considering two projects. Each requires an immediate cash outlay: $10,000 for A, $9,000 for B. Project A has a life of four years, project B five years; neither will have any salvage value at the end of its life. For tax purposes, each would be depreciated by the straight-line method, project A at 30 percent, project B at 24 percent. The company’s tax rate is 40 percent, and its required rate of return after tax is 11 percent. Net cash flows before taxes have been projected as follows. Year 1 2 3 4 5 Project A 3200 3200 4000 4100 Project B 4000 4000 1900 1800 1800 a)calculate the net cash flows after tax for each project. (Assume that XYZ Limited has a substantial taxable income so that,where a project has a negative taxable income in a particular year, this will give rise to a tax saving by the firm.) b) Compute the payback for each investment. c) Compute the average rate of return for each investment. d) Compute…arrow_forward

- A 7-year project is expected to provide annual sales of $221,000 with costs of $97,500. The equipment necessary for the project will cost $360,000 and will be depreciated on a straight-line method over the life of the project. You feel that both sales and costs are accurate to +/-15 percent. The tax rate is 21 percent. What is the annual operating cash flow for the worst-case scenario? es Multiple Choice $77,946 $44,504 0 $70,623 $129,329 $49.221arrow_forwardNeed help with entire problem.arrow_forwardA capital project requires a $50,000 increase in working capital. It also requires equipment at a price of $200,000. It takes $20,000 to install the equipment and $15,000 to ship the equipment to the desired location. The income tax rate is 35% and equipment is depreciated for income tax purposes on a straight line basis.What is the project's initial cash flow?Group of answer choices A.200,000 B.120,000 C.285,000 D.235,000 E. 250,000arrow_forward

- A project requires an increase of $2100 in Net Working Capital at the beginning of the project, which will be fully recovered after the completion of the project. Equipment with a book value of $11,000 will be sold at the end of the project for a salvage value of $6,000. The tax rate is 20%. What is the incremental free cash flow in the year following the end of the project? Question 3Answer a. $9100 b. $7100 c. $4900 d. $2900arrow_forwardPlease make sure you have the right answer! I have asked this question too many times and all the answers were wrong!!!arrow_forward4. Mulroney Corp. is considering two mutually exclusive projects. Both require an initial investment of S9,000 at t = 0. Project X has an expected life of 2 years with after-tax cash inflows of $6,200 and $7,100 at the end of Years 1 and 2, respectively. In addition, Project X can be repeated at the end of Year 2 with no changes in its cash flows. Project Y has an expected life of 4 years with after-tax cash inflows of $4,600 at the end of each of the next 4 years. Each project has a WACC of 8%. Using the replacement chain approach, what is the NPV of the most profitable project? Do not round the intermediate calculations and round the final answer to the nearest whole number. a. 5,113 b. 4,989 c. 5,425 d. 5,924arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education