choose from the following accounts:

Accumulated Other Comprehensive Income

Allowance for Investment Impairment

Bond Investment at Amortized Cost

Cash

Commission Expense

Dividends Receivable

Dividend Revenue

FV-NI Investments

FV-OC|Investments

Gain on Disposal of Investments - FV-NI

Gain on Disposal of Investments - FV-OCI

Gain on Sale of Investments

GST Receivable

Interest Expense

Interest Income

Interest Payable

Interest Receivable

Investment in Associate

Investment Income or Loss

Loss on Discontinued Operations

Loss on Disposal of Investments FV-NI

Loss on Disposal of Investments FV-OCI

Loss on Impairment

Loss on Sale of Investments

No Entry

Note Investment at Amortized Cost

Other Investments

Recovery of Loss from Impairment

Unrealized Gain or Loss

Unrealized Gain or Loss - OCI

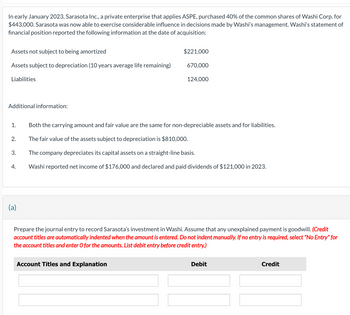

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- Compute and Analyze Measures for DuPont Disaggregation Analysis The 2018 balance sheets and income statement for Netflix Inc. follow. Refer to these financial statements to answer the requirements. NETFLIX INC. Consolidated Statements of Earnings For Year Ended December 31, $ thousands 2018 Revenues $9,318,661 Cost of revenues 5,880,847 1,397,987 720,870 630,294 688,663 Marketing Technology and development General and administrative Operating income Other income (expense) Interest expense Interest and other income Income before income taxes Provision for income taxes Net income NETFLIX INC. Consolidated Balance Sheets in thousands, except par value 2018 Current assets Cash and cash equivalents Current content assets, net Other current assets Total current assets Noncurrent content assets, net Property and equipment, net Other noncurrent assets Total assets Current liabilities Current content liabilities Accounts payable Accrued expenses Deferred revenue (248,091) 41,725 482,297 8,977…arrow_forwardDec. 31, 2020 Dec. 31, 2019 Assets Current assets: Cash and cash equivalents $248,005 $419,465 Accounts receivable 38,283 34,839 Inventory 15.043 15,332 Prepaid expenses and other current assets 39,965 34,795 Income tax receivable 58,152 16,488 Investments 415,199 338,592 Total current assets 814.647 859,511 Property, plant, & equipment, net 1,217.220 1,106,984 Long-term investments 622,939 496.106 Other assets 70,260 64,716 Total assets $2,725,066 $2,527,317 Liabilities and Shareholders' Equity Current liabilities: Accounts payable $85,709 $69,613 Accrued payroll and benefits 64,958 73,894 Accrued liabilities 129,275 102,203 Total current liabilities 279,942 245,710 Deferred liabilities 284.267 240,975 Other liabilities 32.883 28,263 Total liabilities 597,092 514,948 Shareholders' equity: Common stock 358 354 Additional paid-in capital 954,988 861.843 Retained earnings 1,172.628 1,150,172 Total shareholders' equity 2,127,974 2,012.369 Total liabilities and shareholders' equity…arrow_forwardThe Equity Method of accounting for investments: a) Requires the investment asset to increase proportionally with the affiliates net income b) Requires the investment asset to decrease proportionally with the affiliates net loss c) Requires the investment asset to decrease proportionally with dividends received d) All of the abovearrow_forward

- What is Return to Equity? Interest paid on debt Revenue minus Costs Only Retained Earnings All of the Abovearrow_forwardchoose the right answer The debts which are to be repaid within a short period (a year or less) are referred to as, Contingent liabilities All the above Fixed liabilities Current Liabilities O choose the right answer Gross profit is Sales - Purchases O Cost of goods sold + Opening stock Sales - cost of goods sold Net profit - expensesarrow_forwardDiscuss, using practical why capital ratio is used to share a loss on realizationarrow_forward

- Why do we report gains and losses of fixed assets on the income statement when we sell our fixed assets?arrow_forwardCurrent Attempt in Progress Equity investments that are accounted for under the cost model will result in O recognition of dividend income only when actually received. expensing transaction costs when incurred. O recognition of a gain or loss in other comprehensive income at disposal. O recognition of a gain or loss in net income at disposal.arrow_forwardIs the balance column for profit and loss (capital equity) a CR or DR?arrow_forward

- 1. Assuming the investment is appropriately recognized as a financial asset intended to collect contractual cash flows and also to sell the bonds in open market: How much unrealized gain (loss) is to be reflected in the statement of changes in equity and statement of comprehensive income at yearend 2020? 2. Assuming the investment is appropriately recognized as a financial asset intended to collect contractual cash flows and also to sell the bonds in open market: What is the carrying value of the investment on December 31, 2020? 3. Assuming the investment is appropriately recognized as a financial asset intended to collect contractual cash flows and also to sell the bonds in open market: Determine the gain or (loss) to be recorded upon the sale of the investment.arrow_forward11. Which type of financial assets are purchased only with the intent of selling them in the near future? DAFVTPL financial assets ⒸBFVTOCI Financial assets C. Amortized Cost financial assets OD. Investment accounted for using the equity methodarrow_forwardDetermine the formula for EVA. (WACC = Weighted-average cost of capital) After tax operating inc. Current liabilities Market value of debt Market value of equity Operating income Revenues Total assets WACC x ( )) = EVAarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education