FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

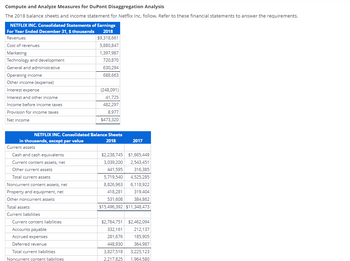

Transcribed Image Text:Compute and Analyze Measures for DuPont Disaggregation Analysis

The 2018 balance sheets and income statement for Netflix Inc. follow. Refer to these financial statements to answer the requirements.

NETFLIX INC. Consolidated Statements of Earnings

For Year Ended December 31, $ thousands

2018

Revenues

$9,318,661

Cost of revenues

5,880,847

1,397,987

720,870

630,294

688,663

Marketing

Technology and development

General and administrative

Operating income

Other income (expense)

Interest expense

Interest and other income

Income before income taxes

Provision for income taxes

Net income

NETFLIX INC. Consolidated Balance Sheets

in thousands, except par value

2018

Current assets

Cash and cash equivalents

Current content assets, net

Other current assets

Total current assets

Noncurrent content assets, net

Property and equipment, net

Other noncurrent assets

Total assets

Current liabilities

Current content liabilities

Accounts payable

Accrued expenses

Deferred revenue

(248,091)

41,725

482,297

8,977

$473,320

Total current liabilities.

Noncurrent content liabilities

2017

$2,238,745 $1,665,449

3,039,200 2,543,451

441,595

316,385

5,719,540 4,525,285

8,826,963 6,118,922

418,281

319,404

531,608

384,862

$15,496,392 $11,348,473

$2,764,751 $2,462,094

332,161

212,137

281,676

185,905

448,930

364,987

3,827,518 3,225,123

2,217,825 1.964,580

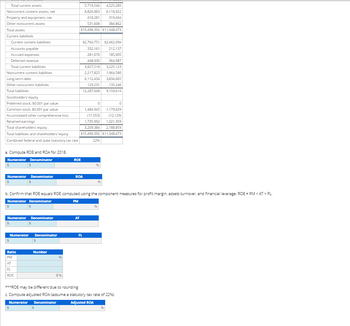

Transcribed Image Text:Total current assets

Noncurrent content assets, net

Property and equipment, net

Other noncurrent assets

Total assets

Current liabilities

Current content liabilities

Accounts payable

Accrued expenses

Deferred revenue

Total current liabilities

Noncurrent content liabilities

Long-term debt

Other noncurrent liabilities

Total liabilities

Stockholders' equity

Preferred stock, $0.001 par value

Common stock, $0.001 par value

Accumulated other comprehensive loss

Retained earnings

Total shareholders' equity

Total liabilities and shareholders' equity

Combined federal and state statutory tax rate

a. Compute ROE and ROA for 2018,

Numerator Denominator

Numerator Denominator

Numerator Denominator

Numerator Denominator

Ratio

PM

AT

FL

ROE

Number

%

5,719,540 4,525,285

8,826,963

6,118,922

418,281

319,404

531,608

384,862

$15,496,392 $11,348,473

ROE

AT

$2,764,751 $2,462,094

332,161 212,137

185,905

ROA

b. Confirm that ROE equals ROE computed using the component measures for profit margin, assets turnover, and financial leverage: ROE = PM * AT * FL.

Numerator Denominator

PM

281,676

448,930 364,987

3,827,518 3,225,123

2,217,825 1,964,580

6,112,434 3,834,665

129,231 135,246

9,159,614

12,287,008

FL

1,484,945

1,179,629

(11,553) (12,129)

1,735,992 1,021,359

3,209,384 2,188,859

$15,496,392 $11,348,473

22%

0

9%

0

***ROE may be different due to rounding

c. Compute adjusted ROA (assume a statutory tax rate of 22%).

Numerator Denominator

Adjusted ROA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Forecast an Income Statement Following is the income statement for Medtronic PLC. Consolidated Statement of Income ($ millions) For Fiscal Year Ended April 26, 2019 Net sales $27,807 Costs and expenses Cost of products sold 8,331 Research and development expense 2,330 Selling, general, and administrative expense 9,480 Amortization of intangible assets 1,605 Restructuring charges, net 198 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit 5,439 Other nonoperating income, net (373) Interest expense 1,314 Income before income taxes 4,498 Income tax provision 547 Net income 3,951 Net income loss attributable to noncontrolling interests (19) Net income attributable to Medtronic $3,932 Use the following assumptions to prepare a forecast of the company’s income statement for FY2020. Note: Complete the entire question in Excel using the following template: Excel Template. Format each answer to two decimal…arrow_forwardCompute NOPATThe income statement for TJX Companies follows. THE TJX COMPANIES, INC.Consolidated Statements of Income Fiscal Year Ended ($ thousands) February 2, 2019 Net sales $38,972,934 Cost of sales, including buying and occupancy costs 27,831,177 Selling, general and administrative expenses 6,923,564 Pension settlement charge 36,122 Interest expense, net 8,860 Income before provision for income taxes 4,173,211 Provision for income taxes 1,113,413 Net income $ 3,059,798 Assume that the combined federal and state statutory tax rate is 22%. a. Compute NOPAT using the formula: NOPAT = Net income + NNE. Round to the nearest whole number. b. Compute NOPAT using the formula: NOPAT = NOPBT − Tax on operating profit. Round to the nearest whole number.arrow_forwardProblem: Remesh Corporation prepared the following income statement and statement of retained earnings for the year ended December 31, 2021. Remesh Corporation December 31, 2021 Expense and Profit Statement Dollars in thousands Sales (net) $206,000 Less: Selling Expenses (20,600) Net Sales $185,400 Add: Interest Revenue 2,400 Add: Gain on sale of equipment 3,600 Gross Sales Revenue $191,400 Less: Cost of operations: Cost of Goods Sold $126,100 Correction of overstatement in last years income because of error $5,500 (net of tax credit) $3850 Dividend cost ($0.50 per share for 8k common shares) $4000 Unusual loss due to a hurricane, $6,400 (net of tax credit) $1,920 ($135,870) Taxable Revenues $55,530 Less: Income tax on income from continuing operations $16,659 Net income $38871 Miscellaneous Deductions Loss from operations of…arrow_forward

- Please helparrow_forwardForecast Income Statement and Balance Sheet Following are the income statement and balance sheet for Medtronic PLC. Note: Complete the entire question using the following Excel template: Excel Template. Then enter the answers into the provided spaces below with two decimal places. Medtronic PLC Consolidated Statement of Income $ millions, For Fiscal Year Ended April 26, 2019 Net sales $30,557 Costs and expenses Cost of products sold 9,155 Research and development expense 979 Selling, general, and administrative expense 10,418 Amortization of intangible assets 1,764 Restructuring charges, net 83 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit 7,734 Other nonoperating income, net (157) Interest expense 1,444 Income before income taxes 6,447 Income tax provision 547 Net income 5,900 Net income loss attributable to noncontrolling interests (19) Net income attributable to Medtronic $5,881…arrow_forwardReturn on Assets Ratio and Asset Turnover Ratio Northern Systems reported the following financlal data (in millions) In its annual report: 2018 2019 Net Income $9,050 $7.500 Net Sales 52,350 37,200 Total Assets 58,734 68,128 If the company's total assets are $55,676 in 2017, calculate the company's: (a) return on assets (round answers to one decimal place - ex: 10.79%6) (b) asset turnover for 2018 and 2019 (round answers to two decimal places) 2018 2019 a. Return on Assets Ratio 96 96 b. Asset Turnover Ratio Check O Prevlous Save Answersarrow_forward

- Lansing Company’s 2018 income statement and selected balance sheet data (for current assets and current liabilities) at December 31, 2017 and 2018, follow. LANSING COMPANYIncome StatementFor Year Ended December 31, 2018 Sales revenue $ 100,200 Expenses Cost of goods sold 43,000 Depreciation expense 12,500 Salaries expense 19,000 Rent expense 9,100 Insurance expense 3,900 Interest expense 3,700 Utilities expense 2,900 Net income $ 6,100 LANSING COMPANYSelected Balance Sheet Accounts At December 31 2018 2017 Accounts receivable $ 5,700 $ 6,000 Inventory 2,080 1,590 Accounts payable 4,500 4,800 Salaries payable 900 710 Utilities payable 240 170 Prepaid insurance 270 300 Prepaid rent 240 190 Required:Prepare the cash flows from operating activities section only of the company’s 2018 statement of cash flows using the direct method. (Amounts to be…arrow_forwardPERFORM A LIQUIDITY AND PROFITABILITY ANALYSIS ON THE FOLLOWING COMPANY UTILIZING THE RATIOS LISTED: PAYABLES TURNOVER DAYS PAYABLE statement of operations 12 Months Ended Jul. 31, 2020 Jul. 31, 2019 Revenues: Revenues $ 1,497,826,000 $ 1,684,392,000 Costs and expenses: Operating expense - personnel, vehicle, plant and other 493,055,000 468,868,000 Operating expense - equipment lease expense 33,017,000 Equipment lease expense, preadoption 33,073,000 Depreciation and amortization expense 80,481,000 78,846,000 General and administrative expense 45,752,000 59,994,000 Non-cash employee stock ownership plan compensation charge 2,871,000 5,693,000 Asset impairments 0 0 Loss on asset sales and disposals 7,924,000 10,968,000 Operating income 148,670,000 113,028,000 Interest expense (192,962,000) (177,619,000) Loss on extinguishment of debt (37,399,000) Other income (expense), net (460,000) 369,000 Loss before income taxes (82,151,000)…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education