FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

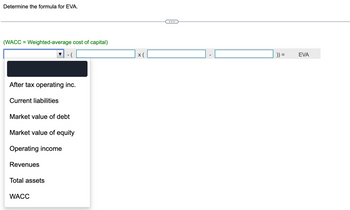

Transcribed Image Text:Determine the formula for EVA.

(WACC = Weighted-average cost of capital)

After tax operating inc.

Current liabilities

Market value of debt

Market value of equity

Operating income

Revenues

Total assets

WACC

x (

)) =

EVA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- H1.arrow_forwardI need the answer as soon as possiblearrow_forwardSome recent financial statements for Smolira Golf, Incorporated, follow. Assets Current assets Cash Accounts receivable Inventory Total Fixed assets Net plant and equipment Total assets Sales Cost of goods sold Depreciation EBIT Interest paid Taxable income Taxes SMOLIRA GOLF, INCORPORATED 2022 Income Statement Net income Dividends Retained earnings 2021 Short-term solvency ratios a. Current ratio b. Quick ratio c. Cash ratio Asset utilization ratios d. Total asset turnover e. Inventory turnover f. Receivables turnover Long-term solvency ratios g. Total debt ratio h. Debt-equity ratio i. Equity multiplier j. Times interest earned ratio k. Cash coverage ratio Profitability ratios I. Profit margin m. Return on assets n. Return on equity $3,061 4,742 12,578 $ 20,381 SMOLIRA GOLF, INCORPORATED Balance Sheets as of December 31, 2021 and 2022 2022 Liabilities and Owners' Equity Current liabilities Accounts payable Notes payable Other $ 52,746 $ 73,127 2021 $ 188,370 126, 703 5,283 $ 56,384…arrow_forward

- Assets Cash Receivables (net) Inventory PP & E (net) Patents&Licenses Goodwill Total assets Liabilities & Equity Accounts payable Short term debt Long term debt Preferred stock Common Equity Total Liabilities + Equity New Chip Corp Balance Sheet at 12/31/22 ($ in Millions) 31 45 64 215 28 19 402 53 19 179 23 128 402arrow_forwardWhat is Return to Equity? Interest paid on debt Revenue minus Costs Only Retained Earnings All of the Abovearrow_forwardMatch each ratio that follows to its use. Items may be used more than once.arrow_forward

- Calculate the following profitability ratios for 2018 and 2019. a. Gross profit ratio b. Return on assets c. Profit margin d. assets turnoverarrow_forwardA-Rod Manufacturing Company is trying to calculate its cost of capital for use in making a capital budgeting decision. Mr. Jeter, the vice-president of finance, has given you the following information and has asked you to compute the weighted average cost of capital. The company currently has outstanding a bond with a 10.2 percent coupon rate and another bond with an 7.8 percent rate. The firm has been informed by its investment banker that bonds of equal risk and credit rating are now selling to yield 11.1 percent. The common stock has a price of $56 and an expected dividend (D₁) of $1.76 per share. The historical growth pattern (g) for dividends is as follows: $ 1.31 T 1.45 1.60 1.76 The preferred stock is selling at $76 per share and pays a dividend of $7.20 per share. The corporate tax rate is 30 percent. The flotation cost is 2.0 percent of the selling price for preferred stock. The optimum capital structure for the firm is 25 percent debt, 20 percent preferred stock, and 55…arrow_forwardWhich of the below are the correct adjustments we make to a company's EBIT to arrive at its FCFF? Select all that apply. Select All That Apply A B D E F Take out taxes Subtract depreciation and amortization Subtract capital expenditures Add back acquisition expenses Subtract changes in net working capital Add back R&D expenses ?arrow_forward

- Define each of the following terms:a. Annual report; balance sheet; income statement; statement of cash flows; statement ofstockholders’ equityb. Stockholders’ equity; retained earnings; working capital; net working capital; net operatingworking capital (NOWC); total debtc. Depreciation; amortization; operating income; EBITDA; free cash flow (FCF)d. Net operating profit after taxes (NOPAT)e. Market value added (MVA); economic value added (EVA)f. Progressive tax; marginal tax rate; average tax rateg. Tax loss carryback; carryforward; alternative minimum tax (AMT)h. Traditional IRAs; Roth IRAsi. Capital gain (loss)j. S corporationarrow_forwardNeed help please provide Solutions with explanationarrow_forwardIs the balance column for profit and loss (capital equity) a CR or DR?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education