FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

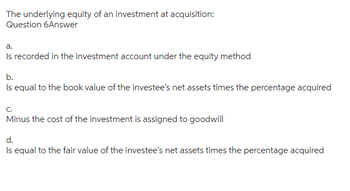

Transcribed Image Text:The underlying equity of an investment at acquisition:

Question 6Answer

a.

Is recorded in the investment account under the equity method

b.

Is equal to the book value of the investee's net assets times the percentage acquired

C.

Minus the cost of the investment is assigned to goodwill

d.

Is equal to the fair value of the investee's net assets times the percentage acquired

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In an accretion/dilution analysis of an acquisition, if the purchase price exceeds the book value of the target’s assets, discuss the key components of the balance sheet that will be adjusted on the pro forma financial statements.arrow_forwardIn an accretion/dilution analysis of an acquisition, if the purchase price exceeds the book value of the target’s assets, discuss the key components of the balance sheet that will be adjusted on the pro forma financials.arrow_forwardchoose from the following accounts: Accumulated Other Comprehensive Income Allowance for Investment Impairment Bond Investment at Amortized Cost Cash Commission Expense Dividends Receivable Dividend Revenue FV-NI Investments FV-OC|Investments Gain on Disposal of Investments - FV-NI Gain on Disposal of Investments - FV-OCI Gain on Sale of Investments GST Receivable Interest Expense Interest Income Interest Payable Interest Receivable Investment in Associate Investment Income or Loss Loss on Discontinued Operations Loss on Disposal of Investments FV-NI Loss on Disposal of Investments FV-OCI Loss on Impairment Loss on Sale of Investments No Entry Note Investment at Amortized Cost Other Investments Recovery of Loss from Impairment Retained Earnings Unrealized Gain or Loss Unrealized Gain or Loss - OCIarrow_forward

- The Equity Method of accounting for investments: a) Requires the investment asset to increase proportionally with the affiliates net income b) Requires the investment asset to decrease proportionally with the affiliates net loss c) Requires the investment asset to decrease proportionally with dividends received d) All of the abovearrow_forwardUnrealized gains/losses of trading securities and available-for-sale securities investment are reported on the Balance sheet as part of Investment. Income statement and accumulated other comprehensive Income respectively. Income statement. Accumulated other comprehensive Income.arrow_forwardQuestion 3. Classify each of the following accounts as (a) asset, (b) liability, or (c) equity. a.→Defined benefit obligation b.→Plan asset c.→Right-of-use asset d.→Contract asset e.→ Unearned revenue f.→ Deferred tax asset g.→Accumulated other comprehensive lossearrow_forward

- Which of the following results in an increase in the Equity in the Investee Income acct. when applying the equity method? Amortizations of purchase price over book value on date of purchase Amortization since date of purchase of purchase price over book value on date of purchase Sale of portion of the investment at a gain to the investor Investors share of gross profit from intra-entity inventory sale for the prior year Sale of a portion of the investment at a lossarrow_forwardWhich of the following are Assets, Liabilities, EquityAccounts PayableCommon StockBonds PayableFurniture and FixturesInventoryInterest PayableDividentsAdditional paid-in-capitalPatents and copyrightsShort-term investmentsarrow_forward25. A parent company’s investment account would include an element which is representative of : Multiple Choice the unrecorded difference between fair value and book value of the investee’s assets. the unrecorded book value of the investor’s assets. the goodwill accrued since the purchase of the investee. the recorded current value of the investee’s assets.arrow_forward

- Demonstrate how to identify and account for equity investments classified forreporting purposes as fair value through net incomearrow_forwardWhat is Correct optionarrow_forwardshares on January 1. Promise paid $300,000 and issued $200,000 in long-term liabilities and paid Promise also agreed to pay $80,000 to the former owners of SaidSo contingent on meeting certain revenue goals during the following year. Promise estimated the present value of its probability adjusted expected payment for the contingency or contingent obligation at $30,000 in legal fees. $23,000 Precombination book values for SaidSo, Inc. are as follows: 80,000 90,000 175,000 Current assets 24 Equipment Buildings Goodwill 33,000 $378,000 Total $ (45,000) (180,000) (115,000) (138,000) 100,000 $(378,000) Current liabilities 2$ Common stock Retained earnings Revenues Expenses Total Promise's appraisal of SaidSo found two balance sheet accounts that differed from fair value. Equipment was undervalued by $15,000 and Buildings by $5,000. Promise noted that SaidSo has unrecorded client contracts worth $60,000 and résearch and development activity in process with an appraised fair value of $90,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education