Concept explainers

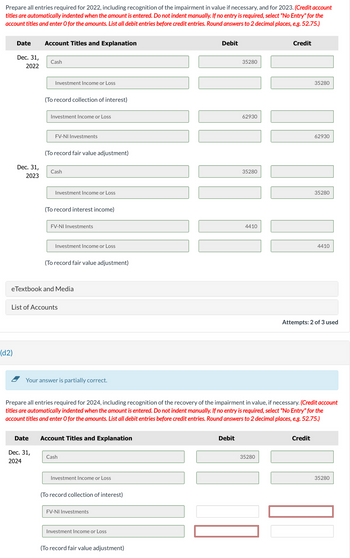

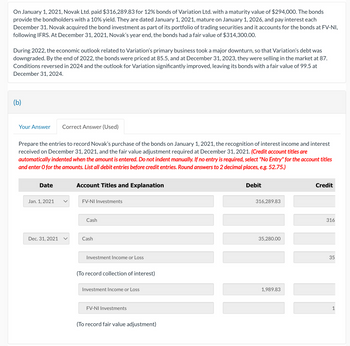

15, please answer last part. thanks

Accumulated Other Comprehensive Income

Allowance for Investment Impairment

Bond Investment at Amortized Cost

Cash

Commission Expense

Dividends Receivable

Dividend Revenue

FV-NI Investments

FV-OCI Investments

Gain on Disposal of Investments - FV-NI

Gain on Disposal of Investments - FV-OCI

Gain on Sale of Investments

GST Receivable

Interest Expense

Interest Income

Interest Payable

Interest Receivable

Investment in Associate

Investment Income or Loss

Loss on Discontinued Operations

Loss on Disposal of Investments FV-NI

Loss on Disposal of Investments FV-OCI

Loss on Impairment

Loss on Sale of Investments

No Entry

Note Investment at Amortized Cost

Other Investments

Recovery of Loss from Impairment

Unrealized Gain or Loss

Unrealized Gain or Loss - OCI

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

- True (t) or False (f) _____ The accounting for short-term debt investments and for long-term debt investments is similararrow_forwardPresented below are two independent cases related to available-for-sale debt investments. Amortized cost Fair value Expected credit losses Case 2 Case 1 Case 2 $37,230 $91,300 26,680 100,350 82,740 For each case, determine the amount of impairment loss, if any. Of no loss, please enter O. Do not leave any fields blank) Case 1 Impairment Loss $ Impairment Loss $ 21,640arrow_forwardam. 62.arrow_forward

- The Equity Method of accounting for investments: a) Requires the investment asset to increase proportionally with the affiliates net income b) Requires the investment asset to decrease proportionally with the affiliates net loss c) Requires the investment asset to decrease proportionally with dividends received d) All of the abovearrow_forwardAmong the following five types of investments: Held-to-maturity, debt investment Trading, debt investment Available-for-sale, debt investment Trading, equity investment Available-for-sale, equity investment unrealized holding gains or losses are recognized in income for securities classified as (Enter 1, 2, 3, or 4 that represents the correct answer): c, e a, b, c b, d b, c, d, earrow_forwardView Policies Current Attempt in Progress For each of the following transactions, classify it as an operating, investing, financing, or significant noncash investing and financing activity or "none of the above" and assuming the company follows ASPE. (a) Repayment of mortgage payable (b) Payment of interest on mortgage (c) Purchase of land in exchange for common shares (d) Issue of preferred shares for cash (e) Payment for the purchase of a trading investment (f) Collection of accounts receivable (g) Declaration of cash dividend (h) Payment of cash dividend (i) Cash purchase of inventory (i) Recording of depreciation expense (k) Purchase and cancellation of common sharesarrow_forward

- Which of the following results in an increase in the Equity in the Investee Income acct. when applying the equity method? Amortizations of purchase price over book value on date of purchase Amortization since date of purchase of purchase price over book value on date of purchase Sale of portion of the investment at a gain to the investor Investors share of gross profit from intra-entity inventory sale for the prior year Sale of a portion of the investment at a lossarrow_forwardWhich of the following are Assets, Liabilities, EquityAccounts PayableCommon StockBonds PayableFurniture and FixturesInventoryInterest PayableDividentsAdditional paid-in-capitalPatents and copyrightsShort-term investmentsarrow_forwardIn investment in debt securities accounted for at fair value through other comprehensive income, the difference between the fair value and the accumulated unrealized gain or loss - OCI presented in the statement of financial position would normally equal to: * A. The unrealized gain or loss - OCI presented as part of other comprehensive income B. The amortized cost of the debt securities C. The interest income for the period D. The fair value of the debt securities in the previous periodarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education